As India's financial market rapidly expands on the back of fast economic growth and a young demographic structure, experts advise that domestic financial firms need to support their entry with thorough market research, localization strategies, and systematic approaches such as leveraging partnerships.

On June 16, PwC Consulting released a report titled "Strategic Recommendations for Entering the Indian Securities and Asset Management Market," outlining these insights. The report analyzes major trends and challenges in India's financial market and presents strategic considerations that Korean financial firms should keep in mind when entering the local market.

According to the report, while India's financial market in the past was characterized by a preference for physical assets and a prevalence of informal transactions, recent years have seen a rapid formalization of financial assets driven by the expansion of financial infrastructure and the spread of investment culture. With a massive domestic market of 1.4 billion people, low penetration of financial services, and government policies supporting the sector, India's financial market has emerged as an attractive market with high growth potential.

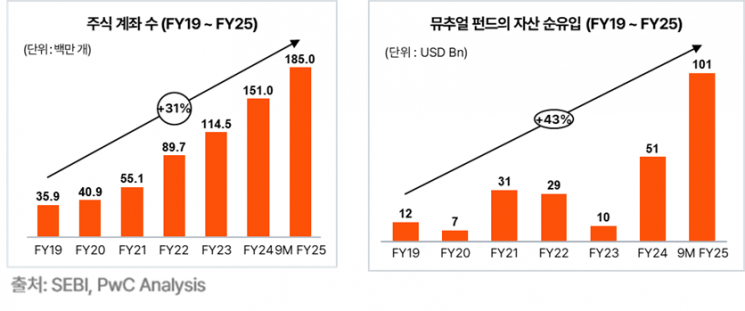

In particular, India's stock market is expected to continue its rapid growth, driven by increased participation from individual investors and improved corporate performance. The country's asset management market is also anticipated to grow significantly, especially in bond products, retail systematic investment plans, and the expansion of digital infrastructure.

The report identifies several risk factors that foreign financial firms may face when entering the Indian financial market, including stringent licensing regulations, the overwhelming market dominance of local banks and asset managers, lack of brand credibility, and cultural and institutional complexity. In practice, providing capital market-related services in India requires approval from the Securities and Exchange Board of India (SEBI), and firms wishing to directly engage in asset management must also establish a local entity.

For Korean financial firms to succeed in the Indian market, more sophisticated strategies are required. The report highlights thorough market research, localization strategies, partnership collaboration, and differentiated value propositions as key competitive advantages. Entry methods suggested include mergers and acquisitions, establishing joint ventures with local companies, setting up independent local entities, and forming partnerships or alliances.

Jo Kyusang, a partner at PwC Consulting, stated that entering the Indian financial market is "both a challenge and an opportunity for Korean financial firms," adding, "If they achieve a soft landing in the Indian market through continuous learning and adaptation, it could serve as a catalyst for securing new growth engines within the Asian financial belt." More details of the report are available on the PwC Consulting website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)