Micron Begins Supplying Samples to Customers

SK hynix Aims for Mass Production in Second Half of Year

Samsung Electronics' Pursuit Adds Market Uncertainty

Evolution to 1c Design and Hybrid Bonding

Prelude to Securing Leadership in HBM4E

Following SK hynix, Micron has begun supplying its next-generation high bandwidth memory (HBM), known as 'HBM4', to customers, marking the start of full-fledged competition over technological leadership and market dominance. Samsung Electronics is also reportedly preparing to counterattack.

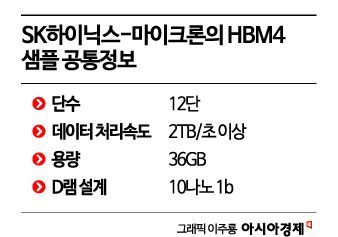

According to industry sources on June 12, SK hynix is working to enhance product completeness based on its 12-layer HBM4 samples, which feature a data processing speed of over 2 terabytes (TB) per second and a capacity of 36GB, with the goal of mass production in the second half of this year. Earlier this month, Micron also unveiled samples with the same specifications, announcing that compared to its own HBM3E products, performance has improved by 60% and power efficiency by more than 20%. The industry believes that Samsung Electronics is also developing products targeting a similar level of performance.

Industry observers view this HBM4 competition as a prelude to the upcoming 'HBM4E', which is expected to launch next year. Both SK hynix and Micron are producing HBM4 using existing methods, while newly researched design and process technologies will be applied starting with HBM4E. As a result, it is expected that after the full-scale mass production of HBM4 next year, the technological competition will immediately shift to HBM4E.

From HBM4E onward, significant changes in design and bonding methods are anticipated. Both companies have built HBM4 products by stacking 12 layers of DRAM based on a 10nm-class (1nm = one billionth of a meter) 1b design, but they plan to apply an advanced 1c design to HBM4E. The bonding method is also set to shift to the 'hybrid bonding' technique, which is currently being adopted in place of previous methods. While MR-MUF offers the advantage of bonding multiple chips at once, which is favorable for heat dissipation and reducing process time, it is noted to have limitations for the highly integrated structures required by HBM4E.

Hybrid bonding, which connects chips directly without bumps, increases connection density and enables faster data transmission speeds, making it a key technology in the next-generation HBM competition. Both companies are accelerating demonstrations and development to apply this technology to HBM4E.

With SK hynix maintaining its market lead and Micron rapidly catching up, Samsung Electronics' next moves are emerging as another variable. Although Samsung Electronics has yet to unveil its HBM4 samples, industry sources say the company is strategizing to disrupt the competitive landscape by simultaneously applying the 1c design and hybrid bonding from HBM4 onward. Currently, Samsung Electronics faces some constraints with its HBM3E due to the quality verification (qualification test) schedule of its major customer, Nvidia, but it is reportedly continuing to focus on HBM4 development regardless.

Kim Junghoe, Vice President of the Korea Semiconductor Industry Association, stated, "Following the supply of HBM4 samples and the construction of a large-scale plant in Idaho, Micron's recent moves have been aggressive. Its influence is growing across various indicators, and as a U.S. company, it holds an advantageous position in terms of trade." He added, "SK hynix and Samsung Electronics will need to respond with even more sophisticated technology and supply strategies to maintain their leadership."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.