Chinese Import Share Drops Over the Past Decade

Southeast Asia, Taiwan, and Europe Fill the Gap

China Expands Influence as Key Export Supply Chain Hub

"Korea Has Significant Potential for Expanded Cooperation with the EU"

Since the first Trump administration, competition between the United States and China has intensified, particularly in advanced industries, resulting in a decline of approximately 30 percentage points in the share of Chinese advanced technology products (ATP) in the U.S. import market. It has been analyzed that this decline in Chinese imports is being offset by increased shares from Southeast Asia, Taiwan, and Europe, indicating ongoing structural changes in global trade supply chains.

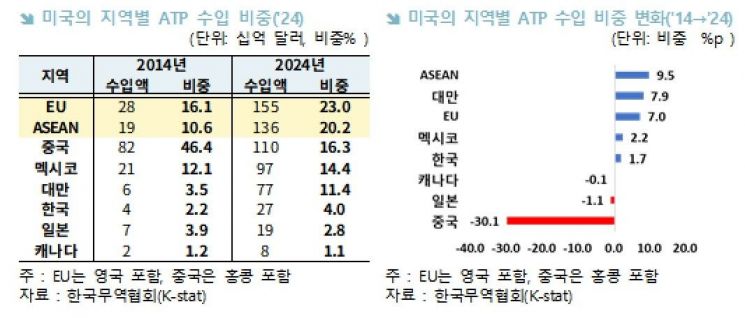

According to the report "Changes in the Structure of Global Advanced Technology Product (ATP) Supply Chains and Implications" published by the Korea International Trade Association's Institute for International Trade and Commerce on June 12, the share of Chinese ATPs in the U.S. import market fell from 46.4% to 16.3% over the past ten years, from 2014 to 2024?a decrease of 30.1 percentage points. This analysis focused on five key sectors?information and communications, bio, electronics, life sciences, and optics?which are similar to Korea's new growth industry classifications, based on the advanced industry HS code classification (covering 10 sectors and 665 codes in total).

During the same period, the share of ATP imports to the U.S. from the Association of Southeast Asian Nations (ASEAN) increased by 9.5 percentage points, from Taiwan by 7.9 percentage points, and from the European Union (EU) by 7.0 percentage points, rapidly filling the gap left by China. This is attributed to several factors: continued U.S. restrictions on Chinese semiconductors since the first Trump administration, which led to a shift in import sources to ASEAN and Taiwan where semiconductor manufacturing plants are concentrated, and increased imports of pharmaceuticals from the EU following the COVID-19 pandemic.

In contrast, Korea's share in the U.S. ATP import market increased by only 1.7 percentage points to reach 4.0% during the same period. This limited growth is due to the fact that, aside from electronics?which accounts for a 9.4% share?Korea's market share in the other four sectors remains low.

Regional Import Share and Share Change Trend of Advanced Technology Products (ATP) in the United States. Korea International Trade Association.

Regional Import Share and Share Change Trend of Advanced Technology Products (ATP) in the United States. Korea International Trade Association.

According to the report's social network analysis (SNA) of the influence and connectivity of global ATP supply chains among 20 major countries, China has rapidly risen, narrowing the gap with the United States. The U.S. maintained the greatest influence in the global supply chains of the five major industries from 2014 to 2022, but China has notably expanded its influence, especially in export supply chains, increasing its presence.

In terms of supply chain connectivity (betweenness) among countries, the U.S. still ranked first in four key sectors. However, China has overtaken the U.S. in betweenness for the electronics sector?including semiconductors and electric vehicles?thus narrowing the gap. This indicates that China now has more trading partners than the U.S. in these fields, making it increasingly important within the supply chain network.

Decoupling between the U.S. and China was also prominent in ATP supply chain clusters. The U.S. and China were found to form separate supply chain clusters across all five key sectors. In response to decoupling from the U.S., China has strengthened its ties with the European cluster in the information and communications and bio sectors, and with the Asian cluster in the electronics, life sciences, and optics sectors.

For Korea, the information and communications and bio sectors are part of the U.S. cluster, while the electronics, life sciences, and optics sectors are aligned with the Chinese cluster, resulting in different partner countries depending on the sector. The report suggests that, since Korea and the EU belong to different clusters across the five key sectors, there is significant potential for expanding trade and cooperation in the future.

Ok Woongki, Senior Researcher at the Korea International Trade Association, emphasized, "Korea is at a critical juncture for strategic positioning amid U.S.-China technological competition and supply chain restructuring. Domestically, it is essential to continuously improve the business environment to strengthen core processes and manufacturing capabilities in future advanced industries. Internationally, a comprehensive trade strategy is needed to build a foundation for strategic supply chain cooperation with leading countries in advanced industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.