Among Social Contribution Activities,

Combined Support for Low-Income Individuals, Marginalized Groups, Small Business Owners, and Livelihood Finance

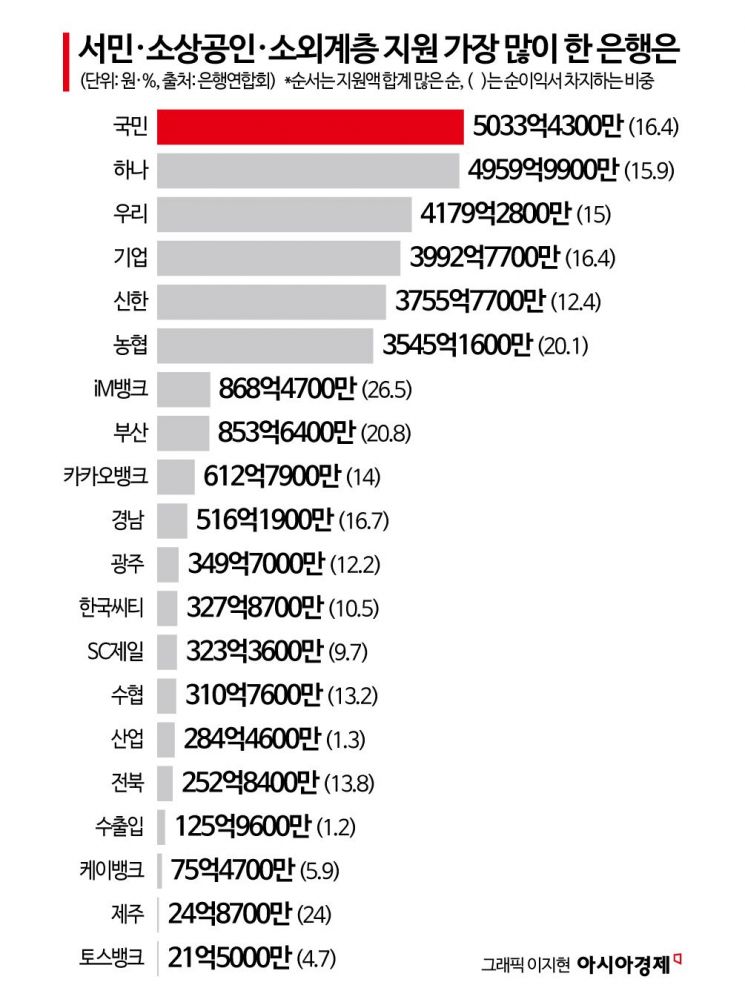

KB Kookmin Bank Leads in Total Amount at 503.3 Billion Won

iM Bank Has the Highest Proportion Relative to Net Profit at 26%

Last year, KB Kookmin Bank provided the largest amount of support to low-income individuals, small business owners, and marginalized groups among all banks. However, when looking at the proportion of such support relative to net profit, iM Bank, which transitioned to a commercial bank, made the greatest effort.

According to the Korea Federation of Banks' "2024 Social Contribution Activities Report" released on June 12, the total amount of support provided by 20 banks to low-income individuals, marginalized groups, and small business owners last year was 3.041428 trillion won. These 20 banks are members of the Korea Federation of Banks, and the amount includes the sum of support for inclusive finance, marginalized groups and small business owners, and livelihood finance within their social contribution activities.

The majority of the support amount was allocated to livelihood finance (2.0154 trillion won). The livelihood finance support was a temporary measure introduced by the banking sector in December 2023 to ease interest burdens for self-employed individuals and small business owners. Excluding this, the support amount was 1.026028 trillion won, which is approximately a 21% increase compared to 850.140 billion won in 2023.

By bank, KB Kookmin Bank provided the largest amount of support at 503.343 billion won to low-income individuals, small business owners, and marginalized groups. This was followed by Hana Bank (495.999 billion won), Woori Bank (417.928 billion won), IBK Industrial Bank of Korea (399.277 billion won), Shinhan Bank (375.577 billion won), and NongHyup Bank (354.516 billion won). The bank that provided the least support was Toss Bank, with 2.15 billion won. The top six banks (KB Kookmin, Shinhan, Hana, Woori, NongHyup, and IBK) dominated the upper ranks because the largest portion of support?livelihood finance?was distributed according to the scale of net profit. As a result, banks with larger assets or net profits inevitably provided the most support.

When examining how much of their profits banks returned to low-income individuals, small business owners, and marginalized groups, iM Bank made the largest contribution. The proportion of support provided by iM Bank relative to its net profit reached 26.5%. iM Bank has been strengthening its public responsibility since transitioning from a regional bank to a commercial bank last year. The amount of support, which stood at 22.482 billion won in 2023, increased by about 92% to 43.047 billion won last year (excluding livelihood finance). Banks operating mainly in regions with higher concentrations of low-income individuals, small business owners, and marginalized groups tended to provide more support. Following iM Bank, Jeju Bank (24%), Busan Bank (20.8%), NongHyup Bank (20.1%), Kyongnam Bank (16.7%), and IBK Industrial Bank of Korea (16.4%) provided the highest support relative to their own net profits.

By support category, IBK Industrial Bank of Korea provided the highest amount in the inclusive finance sector. The inclusive finance sector includes contributions to the Korea Inclusive Finance Agency or Smile Microcredit Foundation, as well as support for credit recovery programs. Although the report also includes dormant deposits and checks contributed for related business support, financial authorities have raised concerns about the appropriateness of using unclaimed funds for such contributions. Excluding these, IBK Industrial Bank of Korea provided 43.042 billion won for inclusive finance. In the area of support for marginalized groups, Hana Bank stood out, allocating 27.094 billion won for this purpose. Support for marginalized groups includes reducing debt burdens for low-income or low-credit individuals, providing customized financial products, and participating in sharing and volunteer activities. Even in the temporary but largest-scale livelihood finance category, Hana Bank provided the highest amount at 346.604 billion won. In the small business owner support category, which involves special contributions to the Korea Credit Guarantee Fund or Korea Technology Finance Corporation, KB Kookmin Bank ranked first with 118.421 billion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)