"Korean AI Startups Lag Far Behind the US in Research Capabilities"

Will Large-Scale Funding Become a 'Game Changer' for AI Venture Investment?

A 'Long-Term Patient' Investment Approach Is Essential

As the Lee Jaemyung administration unveils its vision to become one of the world's top three artificial intelligence (AI) powerhouses and announces plans for large-scale investments, the role of venture capital (VC) as "patient capital" is gaining attention for the long-term development of the AI industry. With policies such as allowing retirement pensions to invest in venture funds and expanding the Korea Fund of Funds expected to be rolled out in succession, private venture investment is set to become even more important in the ecosystem for developing foundational AI technologies.

"Korean AI Startups Lag Significantly Behind the US in Research Capabilities"

Kim Jinyoung, a research fellow at the Korea Capital Market Institute, stated in a recent report, "AI, classified as deep tech, has a much greater social impact than general technologies, but it faces high uncertainty and requires a long time to commercialize. Since initial investment costs are high and it takes a considerable period to verify the technology and form a market, the role of VCs with the characteristics of patient capital is crucial for deep tech startups."

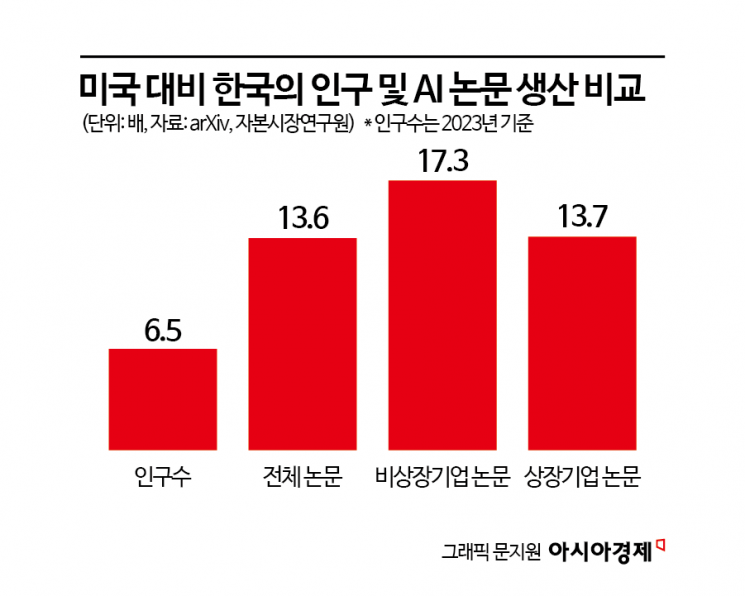

He added, "According to an analysis of the academic paper repository arXiv, from 2021 to March of this year, the United States published about 13 times more AI research papers than Korea. In particular, the number of papers registered by unlisted US companies was 17.3 times higher than that of Korea. This shows that US startups are actively leading the development of foundational AI technologies, whereas Korean startups are not."

Looking at the entities publishing AI papers, in the US, private sector companies such as listed companies (13.2%) and unlisted companies (6.3%) accounted for a significant proportion. In contrast, in Korea, most AI research was conducted by universities and research institutes, with the contribution of private sector entities such as startups being relatively low.

Kim pointed out, "In the US, patient capital is actively supplied for the long-term R&D of startups, allowing AI startups to focus on research and development without short-term profit pressures. In contrast, the scale of private venture investment in Korean AI startups is very small." He described this as "a typical market failure where funds do not flow into highly uncertain technology sectors," and stressed that "to overcome this, a strategic design of policy funds to support foundational technology startups is necessary."

Will Large-Scale Funding Become a 'Game Changer' for AI Venture Investment?

Large-scale investment is also an essential task for the advancement of Korea's AI industry. As seen in the recent case where AI semiconductor company FuriosaAI turned down a 1.2 trillion won acquisition offer from US-based Meta after much consideration, there are virtually no VCs in Korea capable of providing such large-scale funding to a single AI startup. A representative of a mid-sized domestic VC commented, "In reality, only major conglomerates could make investments worth several trillion won, but so far, none have actively stepped in. If the government takes the initiative, whether by securing GPUs or by promoting AI venture investment, the situation will improve in earnest."

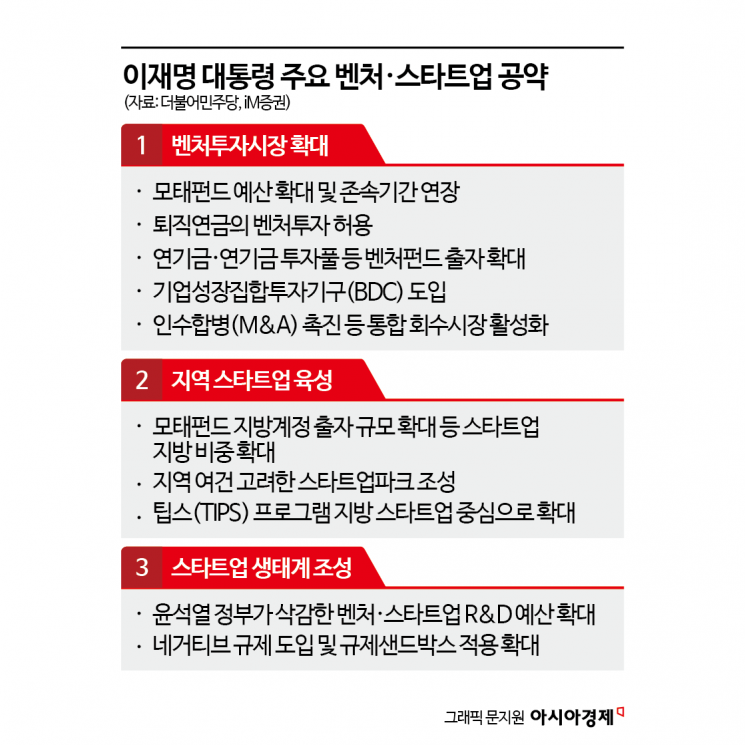

The government has already set out policy tasks to induce large-scale public and private investment, aiming to join the ranks of the world's top three AI powerhouses. Securing more than 50,000 GPUs, building AI data centers, and establishing a national AI data cluster are cited as key infrastructure projects. During his presidential campaign, President Lee Jaemyung stated, "The government will act as a catalyst for private investment and increase the AI-related budget to levels surpassing advanced countries." At his inauguration, he also pledged, "Through massive investment and support for advanced technology industries such as AI and semiconductors, we will become an industrial powerhouse leading the future."

In particular, if the 431.7 trillion won in retirement pensions as of the end of last year is allowed to be invested in venture capital, it is expected that large-scale funds will flow into the startup investment market. Expanding the budget for the Korea Fund of Funds, allowing retirement pensions to invest in venture capital, and increasing venture investment involving pension funds are also being actively considered. The introduction of Business Development Companies (BDC) is also being pursued. BDCs are listed closed-end funds that raise investment capital through public offerings and invest in unlisted venture companies, distributing profits as dividends when the investee companies generate returns.

Lee Sangheon, a researcher at iM Securities, stated, "If retirement pensions are allowed to invest in venture capital, large-scale funds could be invested in venture companies. Large VCs with strong financial resources will have significant opportunities for capital inflow." He added, "AI will serve as a growth engine for ventures and startups, and to build a foundation for AI growth, not only will various government-led AI funds be established, but major institutional investors will also participate as limited partners (LPs) in AI-related investment projects."

"A 'Long-Term Patient' Investment Approach Is Essential"

Ensuring that investors adopt a "long-term investment" approach is also crucial for the stable growth of startups. Kim emphasized, "The more a fund supports deep tech startups, the more strategic consideration is needed regarding the composition of LPs. For VC management companies, LPs providing large-scale capital are important clients, and the risk appetite and investment orientation of LPs are factors that cannot be ignored."

He further explained, "In the US, family offices, corporate venture capital (CVC), university endowments, foundations, and defined contribution pension plans actively participate in early-stage startup investments based on an investment orientation that tolerates high risk for high returns. These LPs are well-suited investors for deep tech sectors that require a long time to commercialize technologies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.