Attention on Whether Pressure to Lower Payment Fees Will Extend Beyond Brokerage Commissions

Financial Services Commission Hints at Stronger Disclosure Regulations in First Half of Year... "Blanket Regulation Inappropriate"

With the inauguration of the Lee Jaemyung administration, discussions on introducing a ceiling on delivery application (app) commission fees are expected to accelerate, prompting the simple payment industry to closely monitor whether regulations on payment fees will be expanded.

According to the financial sector on June 12, the simple payment and electronic payment gateway (PG) industries are paying close attention to the possibility that the new administration's announced platform commission regulation policy may include measures to reduce payment commission rates. The new administration has pledged to ban discriminatory brokerage commissions on delivery apps and to introduce a ceiling on such commissions.

The main point of interest is whether the regulation will extend beyond the brokerage commissions paid by franchise owners to delivery apps to also include the payment commission rates of simple payment providers. If included, a key issue will be whether the regulation will target only delivery apps such as Woowa Brothers (Baedal Minjok), or whether it will apply to all 11 companies with an average monthly transaction volume of 100 billion won or more, which are subject to mandatory disclosure of commission rates.

An official from the fintech (finance + technology) industry stated, "The new administration's commission policy appears to focus on brokerage commissions for delivery apps," but added, "We are also examining whether a blanket policy to lower payment commission rates could be applied to simple payment providers other than delivery apps."

The simple payment and PG industries have expressed concern that, in the medium to long term, a cost-based calculation system, similar to the preferential commission rate policy for credit and debit card companies, could be introduced. Until now, aside from signaling a strengthening of disclosure regulations for simple payment provider commission rates, the government has not been particularly involved in the process of setting industry commission rates. On the contrary, it has minimized intervention and encouraged voluntary adjustments within the industry.

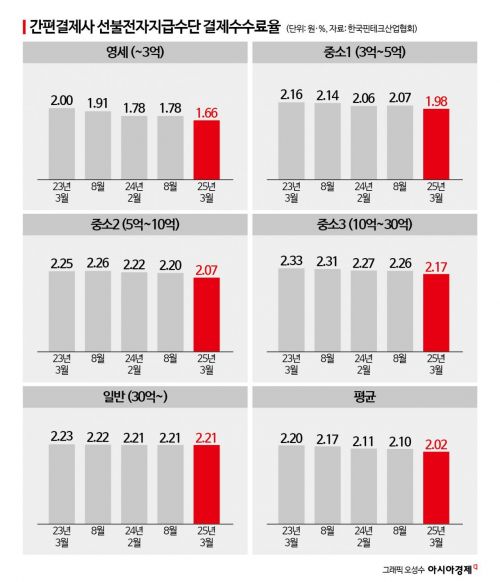

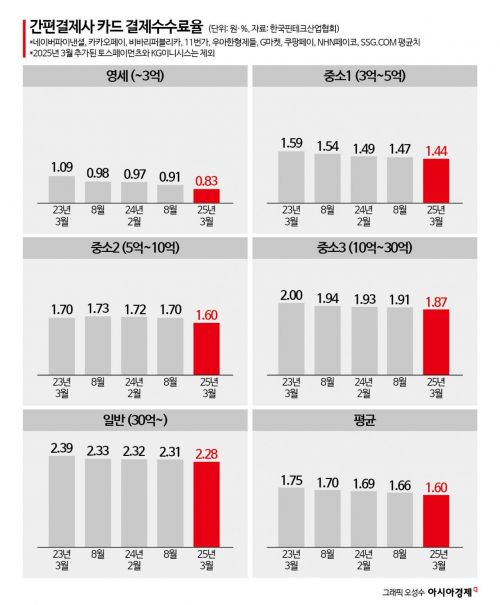

In response, the industry argues that it has voluntarily lowered commission rates every six months to address complaints from franchise owners and customers. According to the Korea Fintech Industry Association, the average card payment commission rate and prepaid electronic payment instrument (prepaid) commission rate for nine simple payment companies (excluding Toss Payments and KG Inicis, which were added to the disclosure list in March) serving small and medium-sized merchants with low annual sales were 1.60% and 2.02%, respectively. The card commission rate decreased from 1.75% in March 2023, to 1.70% in August 2023, 1.69% in February last year, 1.66% in August last year, and 1.60% in March. The prepaid commission rate fell from 2.20%, 2.17%, 2.11%, 2.10%, to 2.02% over the same period. The prepaid commission rate applies to payment methods where cash is preloaded and used via simple payment company apps, while the card commission rate applies to payments withdrawn from accounts linked to credit or debit cards registered in the app.

The simple payment and PG industries argue that the preferential commission rate system for card companies should not be equated with the commission rate system for simple payment providers. The preferential commission rate for card companies, which is adjusted every three years by the Financial Services Commission, applies to offline merchants, whereas the commission rates for simple payment providers apply to online merchants, making direct comparison inappropriate. The Financial Services Commission has applied a principle of gradually reducing preferential commission rates for card companies based on cost recalculation, but the industry contends that applying the same rationale to lower commission rates for simple payment providers is unjustified.

A simple payment industry official stated, "The brokerage commission for delivery apps, which the Democratic Party is seeking to regulate, and the online simple payment commission for simple payment providers are clearly different systems, and since the commission levels are also different, a tailored policy approach for each sector is needed. It is erroneous to group together universal pay commissions (such as Naver, Kakao, Toss, etc.), which can be used anywhere, with closed pay systems (such as Baedal Minjok) that are only usable on their own sites, and conclude that the overall commission rate for the simple payment industry is high."

A PG industry official also expressed concern, stating, "Even among the companies subject to disclosure of simple payment commission rates, there are significant differences in business operations and merchant partnership scale between delivery apps like Baedal Minjok and fintech companies like Naver, Kakao, and Toss. There is concern that pressure to lower commission rates across the entire industry may arise without fully considering these differences. Rather than blanket regulation, it is necessary to prioritize the introduction of self-regulation."

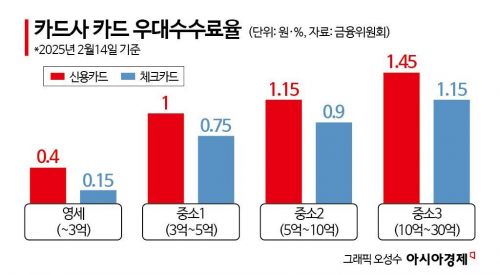

In contrast, the credit finance industry argues that since the payment commission rates of simple payment providers are higher than the preferential commission rates of card companies, this disparity should be rectified. They point out that while the commission rates for simple payment providers are left to industry discretion, the preferential commission rates for card companies continue to decrease due to government intervention, which they view as unfair. There is also a sense of welcome within the industry, as strengthening regulations on simple payment provider commission rates could have a positive impact on the credit card sales (installment sales) business of card companies. In March, the average prepaid commission rate for nine simple payment companies disclosed by the Korea Fintech Industry Association was 2.02%, about twice as high as the average preferential credit card commission rate of 1.00% for card companies.

A credit finance industry official stated, "From the perspective of 'same business, same regulation,' it is reasonable to consider applying the same regulations to simple payment providers that perform similar functions as card companies." A card industry official commented, "I agree with the simple payment and PG industries that the application of caps on brokerage and payment commissions should be discussed separately," but also noted, "It is true that simple payment providers have more freedom than the card industry in setting their commission rates."

The financial authorities have announced plans to strengthen disclosure regulations for the simple payment sector, separate from the new administration's delivery commission ceiling, to encourage a reduction in payment commission rates. Rather than intervening directly in the process of adjusting commission rates, the authorities plan to increase the number of mandatory disclosure items to induce voluntary reductions within the industry. On January 8, the Financial Services Commission stated in this year's business plan, "We will push for improvements to the simple payment commission disclosure system," adding, "Our goal is to announce the improvement plan within the first half of the year." The plan is to add soundness and profitability indicators to the existing disclosure items, such as prepaid and card payment commission rates. However, there are indications that the announcement may be delayed somewhat beyond the end of the first half (June 30). It is also uncertain whether this plan will be included in the new administration's policy briefing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.