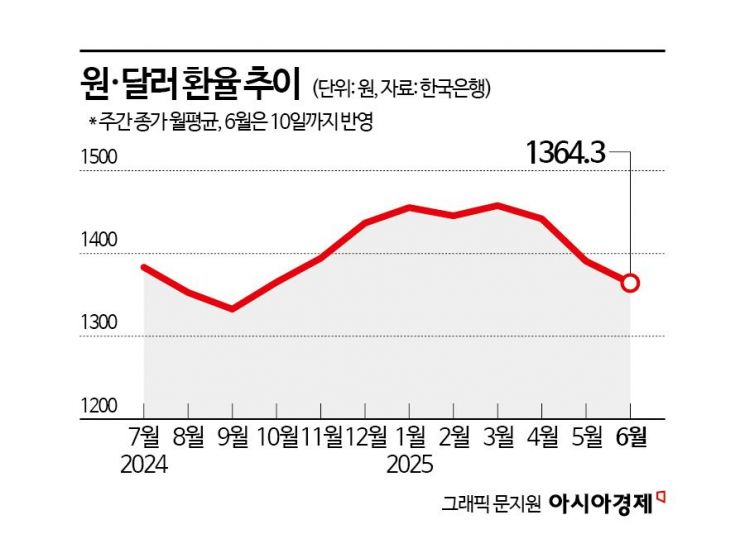

Average Won-Dollar Exchange Rate in June Returns to Last October's Level at 1,364.3

Gradual Decline Expected Amid Focus on US Tariffs, Currency Talks, Fiscal Concerns, and Rate Cuts

With the monthly average won-dollar exchange rate dropping by nearly 100 won in three months, there is growing interest in whether, how quickly, and by how much it may fall further. Experts predict that a "gradually declining trend with limited speed" will continue for the time being. The extent of any further decline is expected to depend on several factors: the outcome of negotiations between the United States and major countries before the expiration of the 90-day mutual tariff suspension next month, the progress of currency talks, and the degree to which global capital, which has been heavily concentrated in the United States, is reallocated.

According to the Bank of Korea's Economic Statistics System (ECOS) on June 11, the won-dollar exchange rate from the beginning of this month through the 10th remained in the 1,350-1,370 won range on a weekly closing basis, averaging 1,364.3 won. The monthly average has dropped by nearly 100 won in three months, returning to the level of October last year (1,365.4 won). After surging following the election of Donald Trump as U.S. President and the domestic 12·3 emergency martial law situation late last year, the average won-dollar exchange rate surpassed the 1,400 won mark in December (1,436.8 won), and continued to climb above 1,450 won in January (1,455.5 won), February (1,445.6 won), and March (1,457.9 won) of this year. In April, as domestic political uncertainty eased and the U.S.-driven tariff shock unfolded, the rate dipped slightly to 1,441.9 won. Last month, expectations of U.S. pressure for won appreciation following currency consultations pushed the rate down to 1,390.7 won. The so-called "honeymoon rally" in the stock market following this month's presidential election further contributed to the drop, bringing the average down to the 1,360 won range. As of this morning, the won-dollar exchange rate opened at 1,365 won and is fluctuating near that level.

Market participants generally expect the won-dollar exchange rate to continue its gradual downward trend. For the end of the first half of the year, the lower bound is seen around 1,350 won, while for the year as a whole, the lower bound is expected to reach as low as 1,300 won.

Experts anticipate continued upward pressure on the won through the tariff negotiations, which are suspended until July 8. Recently, the United States designated South Korea as a currency monitoring country and included in its report a pledge to closely examine market interventions through the National Pension Service and the sovereign wealth fund. This supports the outlook for continued pressure. However, since these factors have already been anticipated and partially priced into the market, the scope for further decline is seen as limited. Kwon Amin, a researcher at NH Investment & Securities, said, "From the U.S. perspective, Korea's intervention intentions and systems are acceptable, but unlike Germany and Japan, Korea continues to run a trade surplus and faces structural downward pressure on its currency value due to large-scale dollar demand. Therefore, it is likely that the U.S. will continue to make currency-related demands during the remaining tariff negotiation period."

In South Korea, expectations for economic stimulus under the Lee Jaemyung administration are also attracting foreign capital into the stock market, further driving down the won-dollar exchange rate. Lee Juwon, an economist at Daishin Securities, noted, "Since the 2000s, except during the financial crisis in 2007, the won-dollar exchange rate has tended to fall temporarily after presidential elections," adding, "This time as well, with the interest rate cut cycle underway and a second supplementary budget of about 30 trillion won expected, fiscal policies are expected to boost domestic demand and support continued capital inflows on expectations of economic recovery."

In the second half of the year, as "U.S. exceptionalism" fades and the Federal Reserve cuts its policy rate, the weak dollar trend is expected to continue. Baek Seokhyun, an economist at Shinhan Bank, said, "The market is watching to see to what extent the U.S. tax cuts, which would worsen the fiscal deficit, are passed next month. While U.S. authorities are considering complementary policies to sustain demand for Treasuries, the fiscal deficit problem remains unresolved," he said. "Although the dollar's weakness is unlikely to reverse in the second half, given that the euro and yen have been overvalued relative to the dollar and the dollar's decline has been rapid, we may see some moderation in the pace of depreciation." This economist also pointed out, "While U.S. Treasury yields remain high, doubts persist about fiscal capacity, and with the recent slowdown in the U.S. economic expansion, expectations for a strong recovery are also limited." There is also analysis that the Trump administration may maintain its preference for a weak dollar.

The Federal Reserve's currently cautious stance could also support a weaker dollar if it shifts its position going forward. Wi Jaehyun, an economist at NH Futures, said, "For the dollar's weakness to become a trend, Fed rate cuts are necessary. Based on inflation and employment, two rate cuts this year (in September and December) appear possible," adding, "In the second half of this year, the won is expected to enter a phase of undervaluation correction in a cyclical sense, driven by U.S. rate cuts, a weaker dollar, and resulting foreign capital inflows."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.