Five Instances of Quarterly Negative Growth in the Past Five Years... Frequency on the Rise

Slowing Potential Growth Rate and Export Concentration... Structural Factors at Play

"Structural Reforms Needed Alongside Short-Term Economic Measures"

In the first quarter of this year, South Korea's economic growth rate recorded a negative figure, and according to an analysis by the Bank of Korea, the probability of negative growth has roughly tripled over the past decade. The Bank of Korea attributes this increased volatility to persistently declining average growth rates, high external dependence, and a concentrated industrial structure. Experts point out that, in order to boost the economic growth rate, structural reforms are just as important as short-term counter-cyclical measures.

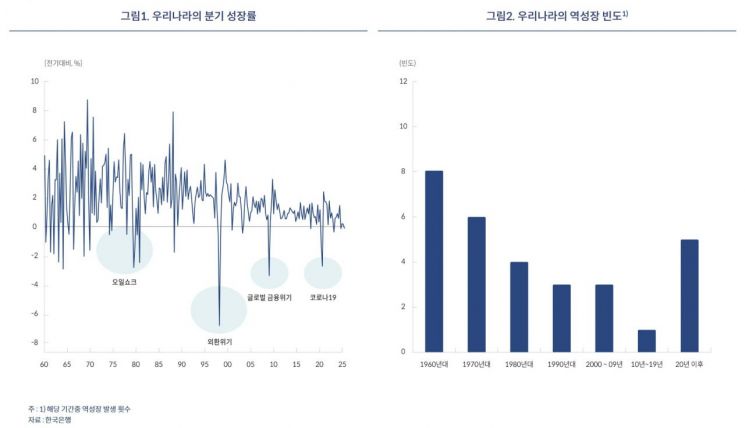

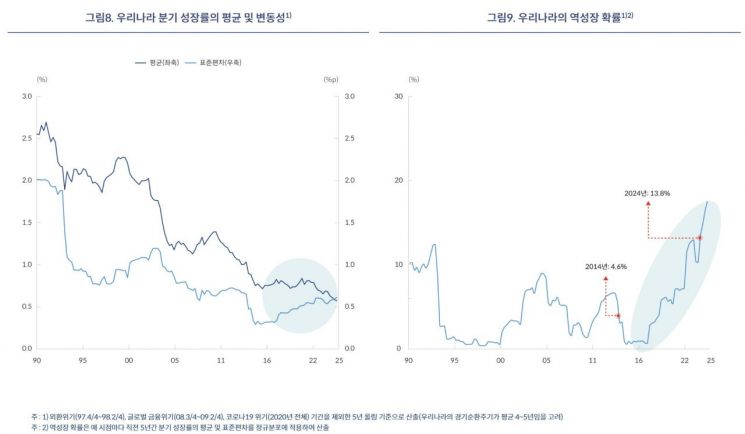

On June 10, Park Geunhyung, manager of the Policy Research Team at the Bank of Korea's Monetary Policy Department, and Shin Donghee, researcher, stated on the Bank's blog, "The frequency of negative growth in South Korea decreased through the 1990s and 2000s, but has begun to rise again in the 2020s." They added, "The probability of negative growth, calculated using data from the previous five years, is estimated to have increased about threefold, from an average of 4.6% in 2014 to 13.8% last year."

The Bank of Korea examined cases of negative growth in 20 major advanced and emerging economies, finding that negative growth is more likely to occur when the average growth rate is low and volatility is high.

For example, the United States, where quarterly growth rates have remained at 0.5-0.6% or higher, has not seen a trend of rising negative growth frequency and remains relatively stable. In contrast, Japan, where the average growth rate has dropped significantly to 0.2-0.3%, has seen a trend of increasing negative growth frequency to a high level. The Bank of Korea explained, "This reflects the fact that when the growth rate approaches 0%, there is a higher likelihood that even small- or medium-scale economic shocks, not just crises, will result in negative quarterly growth."

Along with the average growth rate, high volatility was also found to increase the frequency of negative growth. An analysis of major advanced economies since 2000 showed that the higher the external dependence, the more pronounced the frequency of negative growth. This suggests that when the share of exports and imports is high, external shocks can amplify economic fluctuations through trade channels.

In the case of South Korea, during the 1960s and 1970s, the small size of the economy and a vulnerable industrial structure meant that even minor shocks caused large economic fluctuations, resulting in frequent negative growth. However, as the economy grew and core industries diversified through the 1990s and 2000s, negative growth became rare except during major crises such as the foreign exchange crisis.

However, the Bank of Korea analyzed that since the late 2010s, as the average growth rate has continued to decline and volatility has increased, the frequency of negative growth has risen again. In the 2010s, negative growth occurred only once, in the fourth quarter of 2017. In contrast, in the 2020s, there have already been five instances of negative growth in five years, not only due to economic crises like COVID-19 but also various domestic and external shocks.

The Bank of Korea stated, "The recent increase in the occurrence of negative growth in South Korea suggests that, in addition to cyclical factors, structural factors such as declining domestic growth potential and vulnerability to external shocks are having a significant impact." The Bank added, "As the average growth rate has been trending downward, economic volatility has increased."

In fact, South Korea's potential growth rate has fallen from 5% in the early 2000s to below 2% recently, due to factors such as a declining working-age population and weakening industrial competitiveness. This rate of decline is very rapid compared to other major countries. A slowdown in the potential growth rate leads to a drop in the average growth rate, increasing the likelihood of quarterly negative growth.

Meanwhile, the Bank of Korea pointed out that high external dependence and a concentrated export structure in certain industries are increasing the volatility of growth. External dependence rose from 75% in 2015 to 83% since 2021, and export item concentration increased from 0.148 to 0.184. The Bank of Korea noted, "Such an economic structure could amplify the impact of external shocks, especially given the recent significant changes in the global trade environment."

In its report, the Bank of Korea warned that if the decline in the average growth rate continues, it cannot rule out the possibility of a higher frequency of negative growth. Since negative growth stems from structural problems, the Bank recommended that structural reforms should be pursued in the medium and long term, in addition to policy responses aimed at economic recovery. The Bank emphasized, "Efforts to raise the potential growth rate and reduce economic volatility through structural reforms must go hand in hand," and added, "It is necessary to build a more resilient economic structure against external shocks by fostering new growth engines, strengthening efforts to address low birth rates and population aging, revitalizing domestic demand, and diversifying exports."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)