Selective Order Strategies Adopted Amid Rising Construction Costs

Stabilization of Soaring Raw Material Prices Also Has Positive Impact

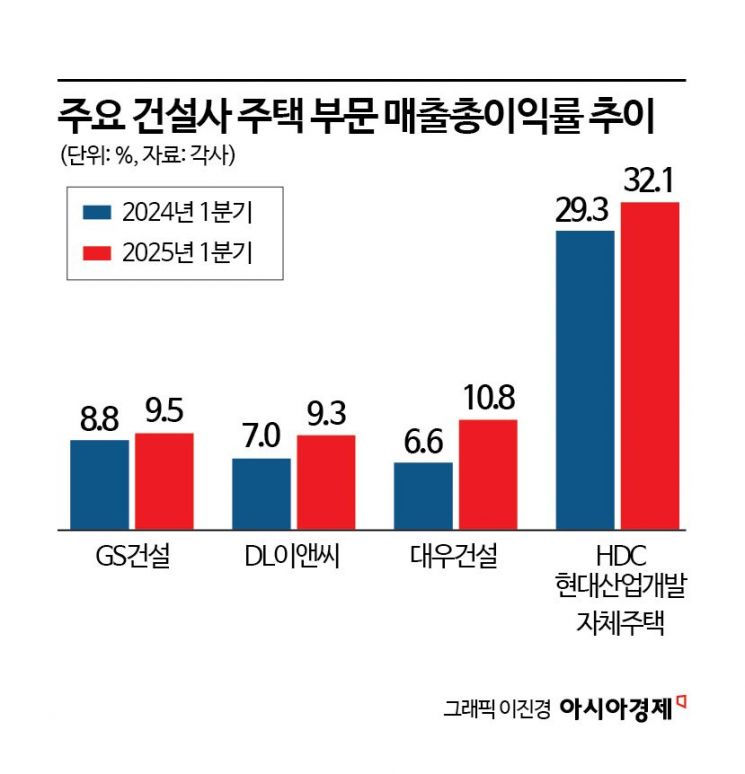

The gross profit margin (GPM) of the housing divisions of major domestic construction companies, including GS Engineering & Construction, is gradually improving. This increase in profitability is attributed to a strategy of focusing order capabilities on projects with high business potential, as well as the stabilization of material prices.

According to the industry on June 11, the gross profit margin for the architecture and housing division of GS Engineering & Construction in the first quarter of this year was recorded at 9.5%. This represents a 0.7 percentage point increase compared to the same period last year, which was 8.8%. The gross profit margin refers to the proportion of profit remaining after subtracting costs from total revenue. An increase in gross profit margin generally indicates a decrease in costs. In other words, the construction costs required for building housing such as apartments have decreased.

The gross profit margin for the housing division of DL E&C during the same period was 9.3%, up 2.3 percentage points from the same period last year. Daewoo Engineering & Construction also saw its gross profit margin rise from 6.6% to 10.8% over the same period. In the case of the self-developed housing division of HDC Hyundai Development Company, the gross profit margin increased by 2.8 percentage points, from 29.3% to 32.1%. Over the past few years, gross profit margins had been declining due to rising raw material and labor costs caused by the war between Ukraine and Russia and the COVID-19 pandemic, but this year, a recovery trend has emerged.

Construction companies have improved their profit margins through a selective order strategy. As construction costs have risen significantly, making it difficult to generate profits, companies are now focusing only on projects with high business potential. For example, in recent redevelopment sites in Seoul, construction companies are avoiding cutthroat competition and showing a preference for projects where they can secure orders independently. This trend is reflected in GS Engineering & Construction's sole participation in the bidding for the Jamsil Woosung 1·2·3 reconstruction project in Songpa-gu, Seoul, which is considered a major redevelopment project with a total construction cost of 1.7 trillion won. Initially, it was expected that Samsung C&T would participate, but as this did not materialize, a private contract is now likely.

The stabilization of raw material prices, which had played a significant role in driving up construction costs, also contributed to the increase in gross profit margins. According to GS Engineering & Construction's first quarter report, the price of rebar per ton fell from 911,000 won last year to 894,000 won in the first quarter. Over the same period, the price of ready-mixed concrete also dropped from 93,700 won per cubic meter to 92,930 won.

An industry official explained, "Compared to the past, the quality of orders has improved. While construction orders used to be secured at 5 million won per pyeong, now, even at 8 to 9 million won reflecting higher construction costs, profit margins are recovering." The official added, "As the business potential of the housing division, which contributes significantly to revenue, increases, expectations for future performance improvement are also rising."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)