Won-Dollar Exchange Rate Drops 120 Won in Two Months, Boosting Bank Earnings Outlook

Banks Could See Billions of Won in Foreign Exchange Gains on Overseas Assets

Improved CET1 Ratios Expected to Strengthen Value-Up Policies

With the sharp decline in the won-dollar exchange rate in the second quarter, expectations are rising for improved bank earnings and the strengthening of shareholder value enhancement (value-up) policies.

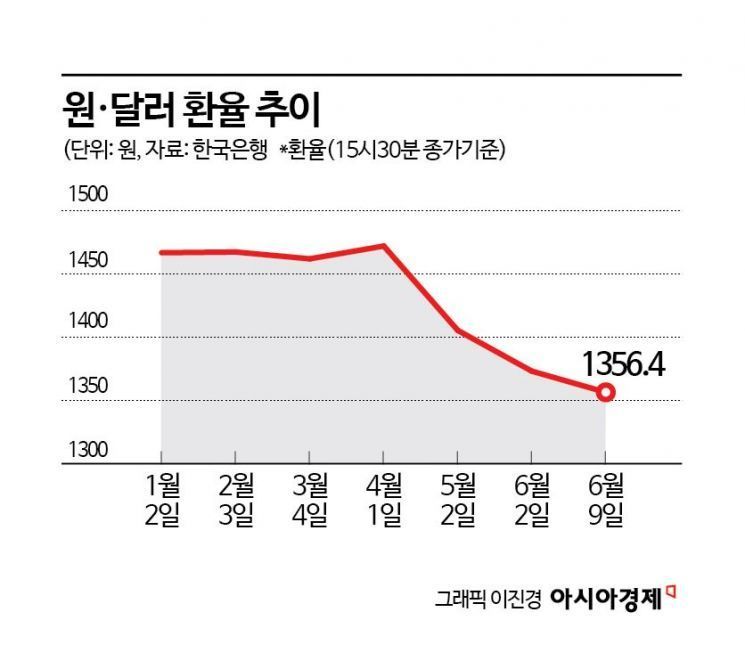

On June 10, the won-dollar exchange rate closed at 1,364.3 won in the Seoul foreign exchange market. After soaring to the mid-1,480 won range in early April, the exchange rate has stabilized, falling by about 120 won over the past two months.

Market participants cite improvements in the domestic political situation and the weakening of the dollar due to the U.S. tariff war as the main reasons for the decline in the won-dollar exchange rate. In particular, the sharp drop in the exchange rate followed the removal of political uncertainty after the Constitutional Court’s ruling to dismiss former President Yoon Suk-yeol in early April.

The drop in the exchange rate has also boosted expectations for improved earnings at domestic banks. At the end of last year, the sharp rise in the won-dollar exchange rate caused banks to incur significant foreign exchange losses (losses due to exchange rate fluctuations) on their foreign currency assets. For example, KB Kookmin Bank’s profits from securities and foreign exchange and derivatives fell by more than 200 billion won compared to 2023, most of which was attributed to foreign exchange losses from the exchange rate spike at the end of last year. Other major banks, such as Shinhan Bank, Hana Bank, and Woori Bank, are also known to have suffered foreign exchange losses of over 100 billion won each last year.

However, now that the exchange rate has normalized, banks are in a position to expect foreign exchange gains instead. The market estimates that for every 10-won drop in the won-dollar exchange rate, banks with large foreign currency assets, such as Hana Financial Group and Industrial Bank of Korea, could see as much as 9 billion won in foreign exchange gains. Other major banks are also expected to see several billion won in gains for every 10-won drop. Since the exchange rate has fallen by more than 120 won in the second quarter, there are projections that domestic banks could see foreign exchange gains and derivative profits amounting to several hundred billion won.

The sharp drop in the exchange rate has also raised expectations for stronger value-up policies at banks. A lower exchange rate reduces banks’ risk-weighted assets (RWA) denominated in dollars, thereby improving their common equity tier 1 (CET1) ratio, which is the key benchmark for value-up policies. Choi Jungwook, a researcher at Hana Securities, explained, “If the exchange rate remains at its current level, commercial banks with about 10% of their assets in foreign currencies could see their CET1 ratio improve by up to 0.2 percentage points.” Major banks such as KB Kookmin Bank allocate any CET1 above 13% to shareholder returns.

On the same day, global investment bank Goldman Sachs also raised its investment rating on Korean banks, noting that the reversal of the weak won is having a positive impact on banks’ CET1 ratios. The bank also raised its forecast for this year’s average total shareholder return (TSR) for banks from 42% to 45%. Goldman Sachs stated, “We are raising our target prices for banks to reflect the easing of political uncertainty in Korea and the government’s commitment to resolving the Korea discount.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.