Securities Companies' Net Profit in Q1 2025 Remains Steady at 2.4 Trillion Won

Bond and FX Gains Offset Losses in Derivatives and Funds

Large Firms Lead IB and Bond Profits; Small and Mid-Sized Companies Improve on Overseas Stock Commissions

The total net profit of all securities companies in the first quarter of this year reached 2.4 trillion won, showing a performance similar to that of the first quarter of last year.

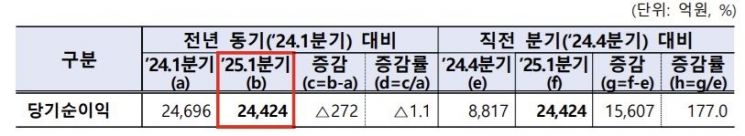

According to the "Business Performance of Securities and Futures Companies for the First Quarter of 2025 (Provisional)" released by the Financial Supervisory Service on June 11, the net profit of 60 securities companies in the first quarter of this year was 2.4424 trillion won, a decrease of 1.1% compared to the same period last year.

By major category, net commission income was 3.3646 trillion won, an improvement of 4.9% from a year earlier. In detail, custody commissions amounted to 1.6185 trillion won, a decrease of 0.2% year-on-year. Although commissions related to overseas stocks and others surged by 84.2% to 498.9 billion won, the overall custody commission decreased due to a decline in Kosdaq market trading volume.

Investment banking (IB) division commissions reached 943.7 billion won, an increase of 11.2%. This was due to increased refinancing demand resulting from interest rate cuts. In addition, asset management division commissions improved by 16.7% to 354.8 billion won, influenced by an increase in discretionary investment and advisory fees.

Proprietary trading profit of securities companies in the first quarter was 3.1343 trillion won, a decrease of 6.5% from the same period last year. Specifically, bond-related profits recorded 3.8855 trillion won, an increase of 51.7%. This was due to an increase in valuation gains resulting from a decline in market interest rates.

However, in derivatives-related profit and loss, a loss of 1.0422 trillion won was recorded, turning to a deficit compared to the same period last year. This was affected by increased valuation losses on sold equity-linked securities. Fund-related profit and loss also dropped by 82.1% to 198.7 billion won, impacted by a contraction in short-term money market funds due to overseas stock market adjustments and falling interest rates.

Other asset profit and loss reached 1.2335 trillion won, an increase of 87% year-on-year. Of this, foreign currency-related profit and loss turned to a surplus of 310.6 billion won compared to a year earlier, due to a base effect from losses related to foreign currency liabilities recognized as a result of a rise in the exchange rate.

Sales and administrative expenses in the first quarter were 3.1749 trillion won, up 4.2% from the same period last year.

The total assets of the 60 securities companies in the first quarter of this year stood at 797.4 trillion won, up 5.7% from the end of last year. This was due to an increase in receivables such as other assets and an increase in investor credit lending. However, liabilities also increased. Total liabilities amounted to 704.7 trillion won, up 6.3%. This was due to an increase in other liabilities such as accounts payable, as well as an increase in sold equity-linked securities and issued notes.

Equity capital was 92.7 trillion won, up 1.2% from the end of last year. The net capital ratio also improved by 17.3 percentage points to 818.5%. In detail, the 19 large companies recorded 1,227.6%, the 16 mid-sized companies 383.9%, and the 25 small companies 320.7%. All securities companies exceeded the regulatory ratio of 100%.

The leverage ratio was 667.4%, an increase of 11.0 percentage points from the end of last year. Specifically, the 19 large companies recorded 695.9%, the 16 mid-sized companies 547.9%, and the 25 small companies 305.3%, all meeting the regulatory limit of 1,100%.

The net profit for the first quarter of the three futures companies was 20.53 billion won, a decrease of 8.8% from the same period last year. Return on equity was 2.9%, down 0.7 percentage points year-on-year, but up 0.6 percentage points from the previous quarter.

Total assets stood at 5.769 trillion won, a decrease of 1.7% from the end of last year. Total liabilities were 5.0536 trillion won, down 2.3% over the same period. Equity capital increased by 3.1% to 532.2 billion won, and the net capital ratio rose by 50.0 percentage points to 1,488.4%.

The Financial Supervisory Service stated, "The net profit of securities companies in the first quarter showed a performance similar to that of the same period last year," adding, "Large securities companies, including investment brokerage firms, saw improved results in the IB division, bonds, and foreign exchange-related profit and loss due to interest rate cuts, while small and medium-sized securities companies also saw slight improvements in performance due to increased overseas stock commissions and the reversal of provisions set last year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.