Top 5 Small-Sum Unsecured Loans Under 3 Million Won

Higher Interest Rates for Lower Credit Scores

Borrowers Below 700 Points Face Exclusion if Rate is Cut to 15%

As the Lee Jaemyung administration is reportedly considering lowering the legal maximum interest rate from the current 20% to 15%, savings banks that mainly serve mid- and low-credit borrowers are becoming increasingly concerned. In particular, large savings banks with a high proportion of small-amount unsecured loans?specifically those under 3 million won?worry that stricter interest rate regulations will lead to tighter loan screening, a contraction in loan demand, and a decline in profitability.

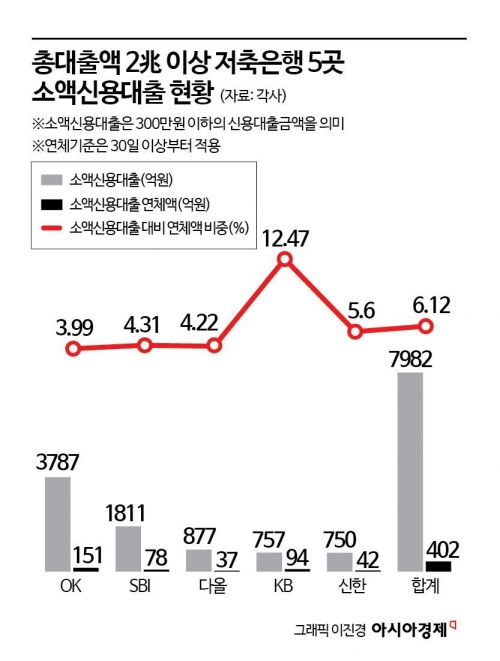

According to the financial sector as of June 10, among savings banks with total loans exceeding 2 trillion won at the end of the first quarter, the top five in terms of small-amount unsecured loan balances were OK Savings Bank (378.7 billion won), SBI Savings Bank (181.1 billion won), Daol Savings Bank (87.7 billion won), KB Savings Bank (75.7 billion won), and Shinhan Savings Bank (75.0 billion won). In terms of overdue small-amount unsecured loans, OK Savings Bank led with 15.1 billion won, followed by KB Savings Bank (9.4 billion won), SBI Savings Bank (7.8 billion won), Shinhan Savings Bank (4.2 billion won), and Daol Savings Bank (3.7 billion won).

The combined total of small-amount unsecured loans from these five savings banks was 798.2 billion won, accounting for 84.3% of the total 946.6 billion won across all 11 major savings banks. The total overdue amount was 40.2 billion won, which represented 78.7% of the total, and the average delinquency rate compared to total loans reached 6.12%. Small-amount unsecured loans refer to credit loans of 3 million won or less?essentially, emergency funds for people in urgent need. In the savings bank sector, loans are considered delinquent if overdue for 30 days or more. In summary, more than 6% of people who borrow less than 3 million won from savings banks are unable to repay their loans for over a month.

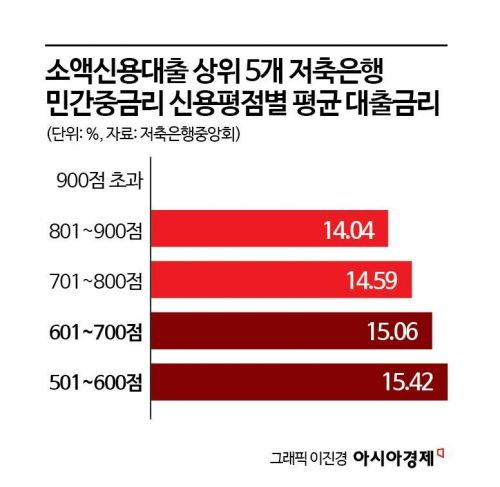

The core issue is that the lower a borrower's credit score, the higher the interest rate they are charged. According to the Korea Federation of Savings Banks, as of the end of the first quarter, the average private mid-rate loan interest rates at these five savings banks by credit score were: '801?900 points' at 14.04%, '701?800 points' at 14.59%, '601?700 points' at 15.06%, and '501?600 points' at 15.42%. Currently, customers with credit scores below 700 are already facing average interest rates exceeding 15%. In this context, if the maximum interest rate is lowered to 15%, mid- and low-credit borrowers with scores below 700 will effectively be excluded from the loan market. This is because when the maximum interest rate ceiling is lowered, savings banks are forced to reduce their average interest rates, which inevitably leads to even stricter screening standards for low-credit customers.

The political motivation behind considering a rate cut is believed to be the desire to ease the loan burden on the middle class, such as regular employees (including those on contracts of one year or more, permanent, and full-time workers). According to the Ministry of Employment and Labor, as of April, there were 17,054,000 regular employees, accounting for 84.1% of all employees at businesses with at least one worker. These borrowers, who generally have access to both first-tier and second-tier financial institutions, are considered relatively high-quality and would directly benefit from lower interest rates.

However, the financial industry is urging caution, warning that lowering the maximum interest rate could lead to the exclusion of financially vulnerable groups. In particular, there are concerns in the secondary financial sector that customers with low credit scores could be shut out not only from savings banks but also from card company cash advances and card loans. Some warn that certain vulnerable groups may ultimately be driven into illegal private lending. In such a scenario, profitability from household loans would be hit not only in the savings bank sector but also across card companies and other credit finance businesses.

An official at a major savings bank in the Seoul metropolitan area said, "Even under the current system, with a maximum interest rate of 20% and a mid-rate loan cap of 17% for savings banks, lending requirements for customers with credit scores below 700, as well as for self-employed and freelance workers, are already being applied very strictly. If the maximum rate is lowered to 15%, about 60 out of 79 savings banks could be pushed to the brink of bankruptcy."

Another financial sector official stated, "Lowering the maximum rate by 5 percentage points to 15% is tantamount to a death sentence for the entire secondary financial sector. Cash advances from card companies will become impossible, and more than half of card loan customers will disappear."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)