Expectations for Policy Changes Such as Amendments to the Commercial Act and Mandatory Cancellation of Treasury Shares

Sharp Rally Driven by Optimism, Market Expected to Stabilize

Winners and Losers to Be Distinguished After the Broad Surge

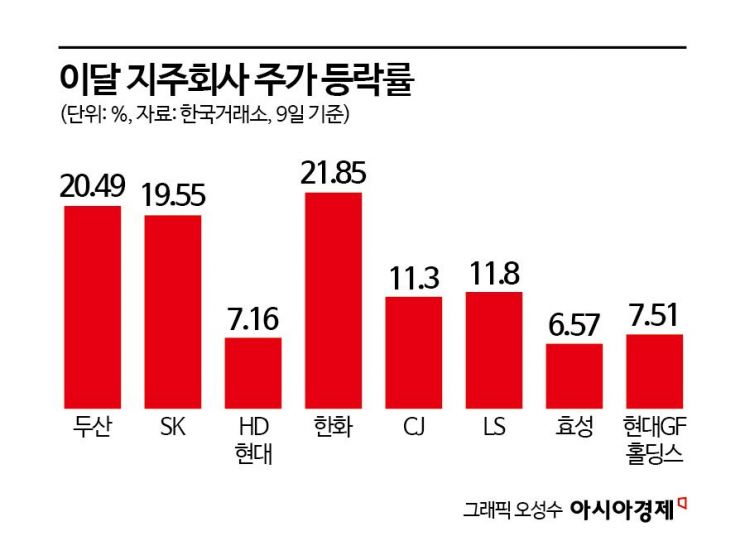

Holding companies have been hitting record highs for consecutive days, driven by expectations for new government policies. However, as the sharp rally has been fueled by short-term optimism, some analysts predict the market will gradually stabilize and a process of distinguishing winners from losers will take place.

According to the Korea Exchange on June 10, holding companies set new 52-week highs one after another the previous day. Doosan climbed as high as 605,000 won during the session, reaching a 52-week high, and closed at 588,000 won, up 7.1%. This marked three consecutive days of significant gains. SK also maintained a strong upward trend for three straight days, rising to 204,500 won during trading and setting a new 52-week high. It closed at 195,700 won, up 4.65% for the day. Hanwha also hit a 52-week high of 97,400 won during the session, ending the day at 92,000 won, up 1.43%. Hanwha's share price, which was in the 50,000 won range in mid-May, has now surged into the 90,000 won range.

In addition, CJ, Hyosung, LS, LX Holdings, HD Hyundai, Hyundai GF Holdings, and Lotte Holdings also set new 52-week highs during the session.

This strong performance by holding companies is attributed to expectations for new government policies. Yang Ji-hwan, a researcher at Daishin Securities, said, "The rally in holding company stocks is driven by expectations following the election of President Lee Jaemyung, including the potential passage of amendments to the Commercial Act, mandatory cancellation of treasury shares, restructuring of corporate governance, and the revaluation of low price-to-book ratio (PBR) stocks as the Korea Discount (undervaluation of the Korean stock market) is addressed."

Because holding companies are the top controlling entities in large conglomerates, they typically have high ownership by founding families, which is believed to result in a tendency to prioritize the interests of major shareholders over those of general shareholders in key management decisions. Yang explained, "The market expects that if the amendments to the Commercial Act are passed, such practices will decrease, leading to enhanced shareholder value and a reduction in discount rates." He added, "Mandatory cancellation of treasury shares is also expected to serve as a re-rating factor for holding company stocks. Lotte Holdings, SK, Doosan, and HD Hyundai each hold more than 10% of their own shares."

Holding companies are also expected to benefit from measures to boost the stock market. Choi Kwansoon, a researcher at SK Securities, said, "Holding companies, which are a representative sector with low PBRs, are expected to benefit from efforts to stimulate the domestic stock market." He analyzed, "The undervaluation of holding companies is mainly due to duplicate listings of subsidiaries, sluggish share prices during inheritance and succession processes, and passive cancellation of treasury shares. As policy initiatives are likely to reduce these discount factors, the PBR applied to holding companies is also expected to rise gradually."

However, as stock prices have surged rapidly on expectations, investors are advised to be cautious about chasing the rally. Eun Kyungwan, a researcher at Shinhan Investment Corp., said, "The sharp rise in holding company stocks is expected to enter a stabilization phase," emphasizing, "Rather than indiscriminately chasing the rally, it is time for selective investment based on the outlook for core businesses and the presence of intrinsic growth momentum."

Yang also noted, "Holding company stocks have risen across the board, but the very low proportion of holding companies in institutional investors' portfolios has led to a sudden concentration of demand." He added, "If the factors driving valuation re-rating persist, holding company stocks could continue to rise collectively in the future, but if the optimism fades, a process of distinguishing winners from losers will ultimately unfold."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.