Transaction Volume Up 23%, Sales Price Index Turns Upward After 2 Years

Monthly Rental Yield at 4.78%... Highest Since 2020, Attracting Investment Demand

Supply Plunges 78% in 2 Years... Soaring Demand Fuels Price Surge

Following the upward trend in Seoul apartments, the officetel market is also heating up. Since the beginning of this year, transaction volume has increased by double digits, and sales prices have rebounded after two years of decline. This is analyzed as a result of a surge in genuine demand from end-users seeking officetels instead of apartments, amid a severe shortage of housing supply in the Seoul metropolitan area.

Following Seoul apartments, the Seoul officetel market is also experiencing an upward trend in both transaction volume and prices. A bulletin board with officetel rental information is posted at a real estate agency in downtown Seoul. Photo by Yonhap News.

Following Seoul apartments, the Seoul officetel market is also experiencing an upward trend in both transaction volume and prices. A bulletin board with officetel rental information is posted at a real estate agency in downtown Seoul. Photo by Yonhap News.

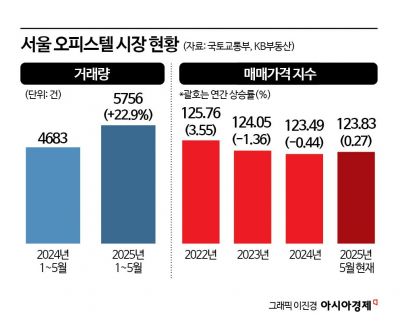

According to the actual transaction price system of the Ministry of Land, Infrastructure and Transport on June 10, the number of officetel transactions in Seoul from January to May this year reached 5,756, a 22.9% increase compared to the same period last year (4,683). As trading activity picked up, sales prices also began to rise. The Seoul officetel sales price index compiled by KB Real Estate has increased by 0.27% this year, currently standing at 123.83. While the increase is not large, it is significant in that it marks a reversal to an upward trend for the first time in about two years. In contrast, the nationwide average during the same period recorded a decline of -0.27%, with regions outside Seoul continuing to fall.

This index peaked at 125.76 in 2022, then declined for two consecutive years to 124.05 in 2023 and 123.49 in 2024, before turning upward again this year. This is attributed to both genuine demand from end-users seeking alternatives to apartments?whose prices have soared due to the severe shortage of housing supply in Seoul?and investment demand targeting higher monthly rental yields. Last month, the average rental yield for officetels in Seoul was 4.78%, the highest monthly figure since 2020. It has risen for 33 consecutive months since August 2022 (4.29%). The southwestern area, including Yeongdeungpo, Yangcheon, and Dongjak districts, recorded the highest increase this year with a 0.61% rise. This was followed by the northwestern area (0.24%) encompassing Mapo, Seodaemun, and Eunpyeong districts, the northeastern area (0.08%), and the southeastern area (0.06%). Only the central area recorded a decline, at -0.09%.

Some complexes have even surpassed the actual transaction prices recorded during the active officetel market of 2020-2021. In April, a 113-square-meter unit at 'Dogok Prugio' in Gangnam District was sold for 1.7 billion won, setting a new all-time high. This was a record price for the first time in four years since April 2021. There had been almost no transactions, but after several years, the record price was broken. In March, an 84-square-meter unit at 'Seocho Trafaliz' in Seocho District changed hands for 1.1 billion won, up 400 million won from the previous record, marking a new high after four years and four months. Not only in Gangnam, but also in other areas, mid- to large-sized officetel complexes with layouts similar to apartments are showing strong performance. Last month, a 137-square-meter unit at 'Hyundai Hyperion,' a representative residential officetel in Yangcheon District, was sold for 2.66 billion won, and an 82-square-meter unit at 'Mokdong Paragon' was sold for 1.46 billion won, both setting new record prices.

In contrast to the surging demand, supply is failing to keep up. The number of officetel units scheduled for occupancy in Seoul this year is 3,103, a 23.9% decrease from last year (4,077 units). Compared to 2023 (14,479 units), this is a dramatic 78.6% drop. This is due to successive delays in approvals and construction starts, as profitability has deteriorated because of rising construction and financing costs. The government is offering incentives, such as extending until 2027 the special provision that excludes residential officetels with a floor area of 60 square meters or less and an acquisition price of 600 million won or less (300 million won or less in non-metropolitan areas) from the housing count when calculating acquisition tax, comprehensive real estate tax, and capital gains tax. However, there are still concerns that recovery in supply remains limited.

Kim Saeryeon, a researcher at LS Securities, analyzed, "Nationwide, transactions for officetels have shrunk to the point where they have virtually stopped. This is due to the learning effect from the larger decline in asset value compared to apartments, reflecting the market's clear preference." Nevertheless, she added, "Seoul officetels are exhibiting exceptional trends thanks to location premiums and the inflow of alternative residential demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)