Deficit Transition Delayed to 2048, Fund Depletion Postponed to 2065

Need for Consideration of State Funding and Automatic Adjustment Mechanisms

Concerns Raised Over Declining Benefit-to-Contribution Ratio for Future Generations

The National Assembly Budget Office (NABO) has analyzed that, in relation to the National Pension reform agreed upon by the ruling and opposition parties in March, the timing of the transition to a fiscal deficit will be delayed by seven years and the depletion of the fund will be postponed by eight years. However, it was also pointed out that additional fiscal measures are still necessary.

On June 9, NABO released a report titled "Fiscal and Policy Impact Analysis of the 2025 National Pension Act Amendment," which examined the significance of this first pension reform in 18 years and the remaining challenges. Previously, on March 20, the political parties agreed to increase the current 9% National Pension contribution rate by 0.5 percentage points annually starting in 2026, reaching 13% by 2033. They also agreed to raise the nominal income replacement rate from the current 41.5% to 43%. In addition, the scope of military service credits, childbirth credits, and premium support for low-income regional subscribers was expanded. The state guarantee for pension benefits was also stipulated in the law.

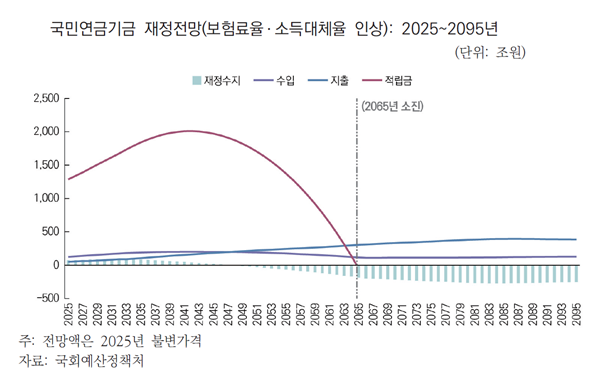

NABO projected that, as a result of this reform, the point at which expenditures exceed reserves will be delayed to 2048 (+7 years), and the complete depletion of accumulated reserves will occur in 2065 (+8 years). Thanks to the reform, the cumulative deficit projected for 2095, seventy years from now, is expected to reach 1,763 trillion won (in 2025 constant prices). This is similar to the government's projections. The government also forecasted the transition to deficit in 2048 (+7 years) and depletion in 2065 (+9 years).

While there are improvements in fiscal sustainability, some point out that fundamental solutions have not yet been achieved. Since the depletion of the fund is still expected in the mid-2060s and beyond, supplementary measures are deemed necessary.

In this context, discussions are underway regarding the introduction of automatic adjustment mechanisms as well as the injection of state funds. However, regarding the use of state funds, NABO noted, "There are differing opinions that, considering the principle of subscriber responsibility in social insurance and the need for state support to focus more on protecting vulnerable groups, as well as the ongoing fiscal deficit, these factors must be taken into account." On the automatic adjustment mechanism, NABO explained, "An automatic adjustment mechanism refers to automatically adjusting benefit levels or the eligibility age in response to changes in demographic structure, macroeconomic conditions, or the financial status of the pension fund. Many OECD member countries have introduced various forms of automatic adjustment mechanisms. The potential benefits and drawbacks of such mechanisms must be thoroughly discussed."

Meanwhile, the report also pointed out that the benefit-to-contribution ratio for future generations, often referred to as the next generation, will decline. For example, for those born in 1970, the benefit-to-contribution ratio will decrease from 2.93 to 2.90 due to this reform, while for those born in 2005, it will drop from 2.28 to 1.75. Regarding this, NABO explained, "If the low-contribution, high-benefit structure at the time of the National Pension's introduction was an inevitable choice to increase public acceptance, the post-reform decline in the benefit-to-contribution ratio can be understood as an improvement of the initial structure to make the system more sustainable. The effectiveness of the system is maintained, as the lifetime benefits still exceed the lifetime contributions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)