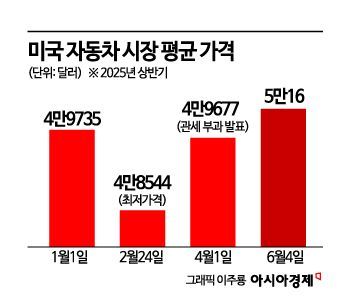

Average Sales Price Surpasses $50,000 in Just One Month

Dealer Incentives Also Reduced

Hyundai Motor Says "No Decision Yet on Price Increase"

After the U.S. government imposed tariffs on imported vehicles, automakers have been raising prices one after another. Although they initially maintained prices by increasing inventories, it is now being assessed that they have reached their limit. Hyundai Motor and Kia are still adhering to a price freeze policy, but if this trend continues to spread, they are expected to follow suit.

According to Automotive News on June 8 (local time), the average vehicle sales price in the U.S. as of June 4 exceeded $50,000, reaching $50,016 for the first time in a month.

The strong vehicle prices are largely due to a series of price hikes by manufacturers. According to the U.S. automotive evaluation platform Edmunds.com, Japanese automaker Subaru raised the average price across its entire lineup by 4.2% through May. Volvo, which produces only the EX90 model in the U.S., also plans to increase the price of its 2026 model year vehicles by about 4%. Volvo explained that this reflects "significant upgrades in vehicle technology across the entire lineup and current market conditions."

BMW has reportedly notified retailers that it will raise the prices of most 2026 model year vehicles by 1.9%, reflecting inflation and the introduction of new equipment. Mercedes-Benz announced that it will not increase prices for its 2025 model year vehicles, but price hikes of 3% to 5% are expected for 2026 model year vehicles. In particular, the company plans to apply even higher increases to its top-tier models.

Incentives provided by automakers to dealers have also been significantly reduced since the tariffs were imposed. According to JD Power, the average manufacturer incentive per vehicle last month was $2,563. This represents a decrease of $200 from the previous month and a decline of $143 compared to the same month last year.

The main reason for reducing incentives is to secure profitability in advance, anticipating a surge in demand from consumers seeking to purchase vehicles before prices rise due to tariffs. When dealer incentives, which directly impact consumers, are reduced, there is further motivation to raise vehicle prices.

As demand to purchase new vehicles before price hikes continues, automobile sales in the U.S. remain strong. Last month, seven major automakers?Hyundai Motor Group, Ford, Toyota, Honda, Subaru, Mazda, and Volvo?sold 3,855,207 vehicles in the U.S. from January to May. This represents a 6.9% increase compared to the same period last year.

However, the pace of sales growth appears to be slowing. U.S. auto market research firm Cox Automotive analyzed that "the surge in purchases seen in March and April slowed in May," estimating that "total sales in May increased by only 2.5% compared to the previous month."

An industry official stated, "It is impossible for companies to absorb all the tariffs, so clear price increases are expected to become evident within this month. If prices rise, vehicle sales in the U.S. are inevitably expected to decline."

Hyundai Motor and Kia are also under pressure to raise prices. Previously, Hyundai Motor President Jose Munoz said that prices would not be increased until June 2, but as the deadline has passed, it is expected to become increasingly difficult to maintain this stance. Hyundai Motor has previously stated that it will adjust its pricing strategy and incentive programs flexibly in response to changes in supply and demand and regulations.

A Hyundai Motor official said, "We have responded to declining demand by increasing incentives," adding, "However, no decision has been made yet regarding a price increase in the U.S."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)