KOSPI Recovers 2,800 Points After 10 Months

Samsung Electronics Up 2%, SK hynix Up Over 3%

Foreign Investors Drive Buying... Reflecting Hopes for New Government Policies

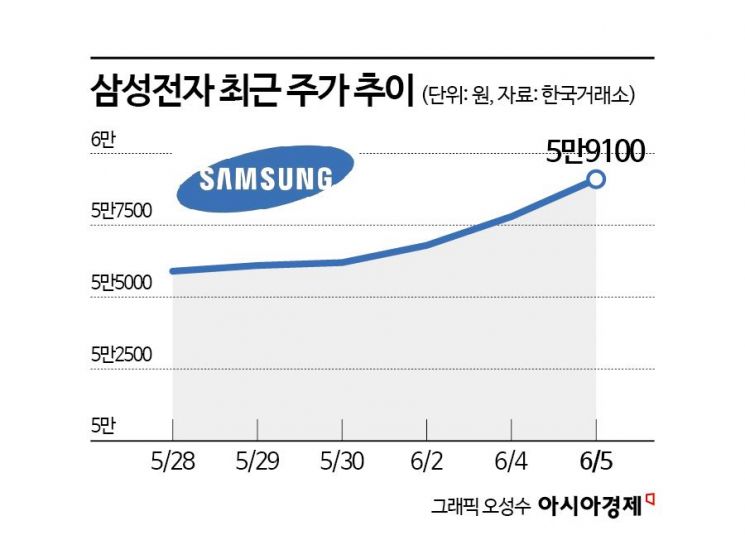

Thanks to the strong performance of semiconductor stocks, which are considered market leaders, the KOSPI has recovered the 2,800-point level for the first time in about ten months. Samsung Electronics has maintained an upward trend for six consecutive days recently, putting the company on the verge of reclaiming the "60,000 won" mark.

According to the Korea Exchange on June 9, Samsung Electronics has risen 5.16% so far this month. On June 5, the stock closed at 59,100 won, up 2.25%, coming very close to recovering the 60,000 won level. SK hynix has also posted strong gains for three consecutive days, regaining the 220,000 won mark. SK hynix closed at 224,500 won on June 5, up 3.22%.

Foreign investor buying has driven the strength in semiconductor stocks. So far this month, foreign investors have been net buyers of SK hynix to the tune of 691.8 billion won, making it their largest purchase. Samsung Electronics followed, with foreign investors net buying 453.1 billion won. In contrast, foreign investors had been heavy sellers of Samsung Electronics in previous months, with net sales of 1.2778 trillion won in May and 2.7762 trillion won in April, but this trend has reversed this month.

This is seen as reflecting expectations for new government policies. President Lee Jaemyung previously announced a plan to support the semiconductor industry as his first pledge after being nominated as the presidential candidate of the Democratic Party of Korea on April 28. At that time, President Lee stated, "We will make Korea the world's number one semiconductor nation," and pledged to quickly enact a special semiconductor law that would include subsidies and tax benefits for semiconductor companies.

Some analysts also note the need to pay attention to the recovery of Samsung Electronics' technological competitiveness. Park Yuak, a researcher at Kiwoom Securities, said, "Samsung Electronics has started to improve the yield of its 1cnm DRAM, which had previously faced difficulties, and mass production tests of HBM3e 12hi products for Nvidia and AMD are proceeding without major issues so far. Although it is still too early to draw conclusions, the company is clearly showing a different picture compared to when it received disappointing results in the past." He added, "Although the semiconductor industry is expected to face challenges in the second half of the year due to inventory adjustments, a slowdown in consumer demand, and adjustments in artificial intelligence (AI) capital expenditures (CAPEX), Samsung Electronics is likely to see its stock price differentiate itself thanks to its recovery in technological competitiveness."

The slowdown in the DRAM market in the second half of the year is expected to be short-lived. Seo Seungyeon, a researcher at DB Financial Investment, said, "Recently, DRAM prices have rebounded due to a combination of factors, including preemptive inventory buildup in response to tariff concerns, advance purchases due to reduced DDR4 production, and demand for HBM. The upward trend in DRAM prices is expected to continue through the third quarter due to concerns over tariffs and a shortage of DDR4 supply," adding, "From the fourth quarter of this year to the first quarter of next year, a high base effect from inventory buildup and seasonal off-peak demand are likely to lead to a temporary slowdown in the memory semiconductor market and a decline in prices. However, as the peak season resumes in the second quarter of next year, the downturn should be short-lived."

There are also forecasts that the rebound in NAND prices will continue. Kim Dongwon, a researcher at KB Securities, said, "In the second quarter, NAND prices rebounded due to a combination of factors, including preemptive buying in response to U.S. tariffs, Chinese government subsidies, and production cuts by manufacturers." He added, "In the third quarter, the full-scale launch of Nvidia's Blackwell new products and increased investment in AI servers will drive demand for enterprise solid-state drives (eSSD), and SSD prices are expected to rise an additional 5-10% in the third quarter." He continued, "In the second half of the year, reduced supply from production cuts and process transitions, combined with continued growth in AI-related demand, is expected to drive a rebound in eSSD prices, which should have a positive impact on the earnings of Samsung Electronics and SK hynix. Currently, the 12-month forward price-to-book ratios (PBR) for Samsung Electronics and SK hynix are 0.9 times and 1.32 times, respectively, indicating limited downside risk for their stock prices. Therefore, investors should focus on these stocks' potential for further gains in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)