Korea Federation of Banks Compiling Key Recommendations from the Banking Sector

Proposals to Enhance Banking Competitiveness Through Entry into New Businesses

Requests to Improve Supervisory Authorities' Sanctioning Methods Also Expected

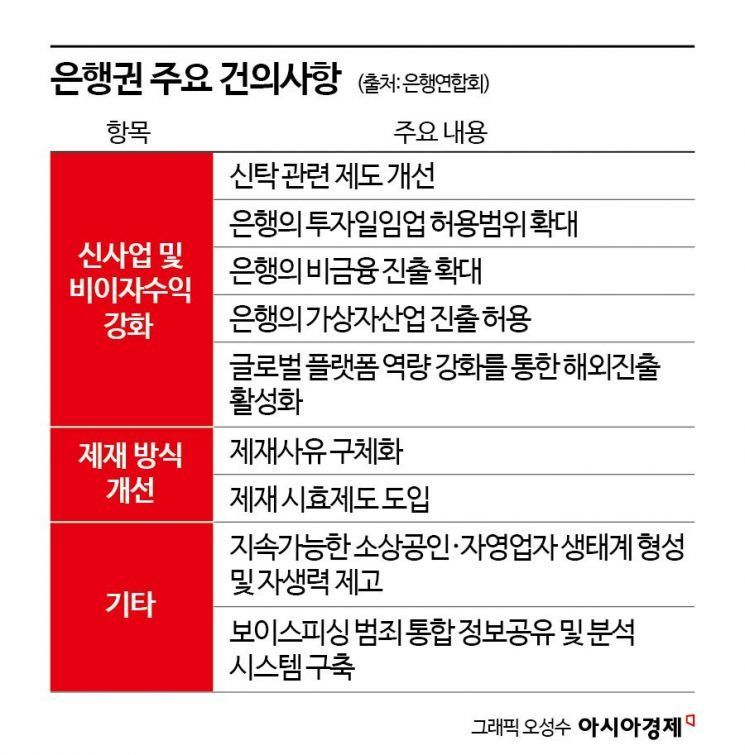

The banking sector is planning to request that the new government allow banks to enter the non-financial and virtual asset markets. They also intend to call for improvements to the investment advisory and trust systems. These measures are aimed at moving away from the interest income-centered business practices and increasing non-interest income to enhance the competitiveness of the banking industry. In addition to regulatory easing, proposals to improve the self-employed business ecosystem and to specify the grounds for bank sanctions in detail are also expected to be included in the recommendations to the new government.

According to the financial sector on June 9, the Korea Federation of Banks is currently compiling "key recommendations from the banking sector" that include these requests. At the end of last month, the federation collected policy suggestions for the new government through a meeting with vice presidents in charge of management strategy and planning at major banks.

First, the banking sector plans to ask the new government to broaden the path for banks to enter non-financial businesses and the virtual asset market. While big tech companies are able to freely attempt innovative services that combine finance and non-finance through relatively relaxed regulations, banks are effectively prohibited from entering other industries due to so-called "uneven playing field" regulations, raising concerns about fairness.

Currently, banks' ancillary businesses are limited to areas related to their core operations, such as lending and deposit-taking. Only a few exceptions, such as the budget phone business (KB Kookmin, Woori) and food ordering platforms (Shinhan Ddaenggyeoyo), are permitted through the regulatory sandbox under the Special Act on Financial Innovation Support.

To address this, the banking sector has recommended, "Allow a broader range of non-financial businesses, such as distribution, transportation, and travel, to be recognized as banks' ancillary businesses, and shift the regulatory framework for ancillary businesses and subsidiary ownership to a 'principle-based regulation' system."

The sector also plans to request that "virtual assets" be included in the scope of banks' business activities. Although domestic banks are already playing a role in fostering a sound market, such as by issuing real-name deposit and withdrawal accounts, virtual asset business is not included in the scope of banks' business under the Financial Business Act, resulting in many restrictions on their participation in the virtual asset industry.

The banking sector has stated, "Please improve the system so that banks, which have high credibility, accessibility, and consumer protection standards, can enter the virtual asset business."

In addition to expanding new business areas, the sector also plans to propose regulatory easing to strengthen non-interest income (fee income). This includes expanding the scope of permissible investment advisory business and improving trust-related systems. Unlike securities and asset management companies, which are allowed to fully engage in investment advisory business under current regulations, banks are only permitted to do so in a limited way for discretionary individual savings accounts (ISA), making it difficult to provide comprehensive one-stop asset management services. The banking sector intends to propose that, as in the United States and Canada, banks be allowed to fully engage in investment advisory business. If full permission is difficult, they suggest considering allowing investment advisory business for public funds first.

The sector also plans to call for improvements to the trust system. Unlike countries such as the United States and Japan, where trusts are widely used as a means of household asset management, in Korea, trusts have mainly developed for the purpose of selling financial products or as real estate trusts. The banking sector plans to request institutional improvements, such as expanding the range of assets eligible for trusts and easing restrictions on the outsourcing of essential trust-related operations, to respond to the increasing demand for asset management due to population aging.

Requests for improvements to the current sanctioning methods of financial authorities are also expected. The banking sector has stated, "While most financial business laws, such as the Capital Markets Act, specifically enumerate the grounds for sanctions, the Banking Act stipulates grounds for sanctions in a broad and non-specific way, unrelated to statutory obligations, making it difficult to predict what actions are subject to sanctions. Please enumerate the grounds for sanctions in detail, in relation to statutory obligations."

The sector has also called for the introduction of a statute of limitations for sanctions. The banking sector argued, "Since there is no statute of limitations for sanctions under the Banking Act and other financial business laws, it is difficult to ensure objectivity if materials and evidence are lost. There is also inefficiency as supervisory authorities expend resources proving the illegality or unfairness of old violations. To ensure legal stability, a period of exclusion, starting from the end date of the violation, should be established in financial business laws, as in the Administrative Basic Act."

In addition, the sector plans to recommend the formation of a sustainable ecosystem and enhancement of self-sufficiency for small business owners and the self-employed, the establishment of an integrated information sharing and analysis system for voice phishing crimes, and the promotion of overseas expansion by strengthening global platform capabilities.

A representative of the Korea Federation of Banks stated, "We are currently gathering additional opinions and plan to submit them in the future. Although the timing has not yet been determined, in past cases, the recommendations were submitted about a month after the new government was formed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.