Debt Accumulation... Robust Macroprudential Regulation and Bold Restructuring

Low Birthrate and Population Aging... Utilizing Idle Labor and Investing in Innovation-Oriented Education

Limits to Industrial Growth... Fostering Advanced Industries and Focusing on High Value-Added Service Exports

An analysis has emerged suggesting that Korea should learn from Japan's past experience of structural changes in debt, demographics, and technology during its period of low growth and low inflation, and embark on proactive structural reforms. The diagnosis is that Korea’s aging economic structure must be overhauled compared to its current economic level in order for the economy to regain vitality.

Before and after the collapse of its economic bubble, Japan faced structural changes in debt, demographics, and technology, which led to prolonged low growth and low inflation. The country was hit by a triple wave: debt accumulation from the asset market, population aging, and global horizontal division of labor. These structural problems could only be solved through structural reforms, but Japan instead relied on countercyclical policies as a supplementary measure. As a result, the government’s fiscal capacity was depleted, and the effectiveness of monetary policy was constrained for a long period.

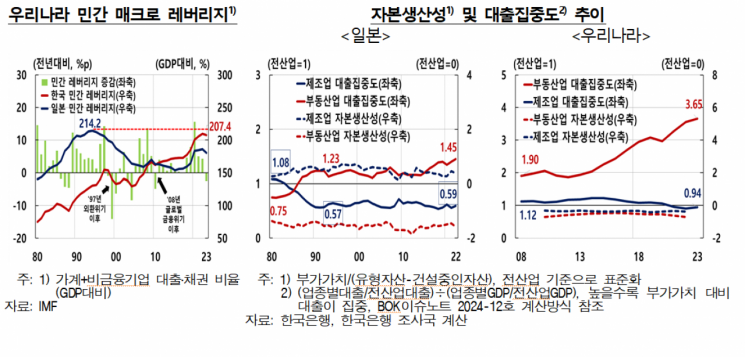

Korea’s current situation is not much different. As household debt from the real estate sector has accumulated, the private sector’s debt-to-GDP ratio reached 207.4% in 2023, approaching Japan’s bubble-era peak of 214.2% in 1994. The pace of population aging in Korea is even faster than in Japan. Since 2000, Korea has actively participated in the global horizontal division of labor and has grown through export-led growth to China and in IT, but the very foundation of this growth?global trade order and the special relationship with China?is now being shaken.

On June 5, Jang Taeyoon, Director at the Economic Research Department of the Bank of Korea, Kim Namjoo, Team Leader, and Son Yunseok, Director at the Daegu-Gyeongbuk Branch, published a 'BOK Issue Note?Lessons to Revisit from the Japanese Economy,' proposing key structural reform measures in five areas.

The best way to address debt accumulation from the real estate sector is to manage risks in a phased and preemptive manner. However, if debt has already turned sour, it must be restructured swiftly. Jang explained, “Around the bubble period, Japan saw a massive influx of funds into real estate, but macroprudential regulations were inadequate beforehand, and risk management was insufficient afterward. As a result, the non-performing loan problem spread to a banking crisis.” He pointed out that in Korea as well, even after experiencing the global financial crisis, the concentration of funds in real estate has continued without significant structural reforms.

Given these conditions, the analysis suggests that Korea should: operate precise macroprudential regulations; strengthen coordination with monetary policy; maintain a policy stance of managing household debt; and more strictly control the debt ratio through swift and bold restructuring. Jang noted, “It is fortunate that the private sector leverage ratio, which had only been rising, decreased from a quarterly average of 208.3% in 2023 to 202.4% in 2024 through policy coordination among authorities.”

Low birth rates and population aging are major factors behind Japan’s long-term economic stagnation. Japan’s working-age population began to decline in 1996, but conservative practices such as a preference for regular public recruitment and the concentration of childcare burdens on women made it difficult for idle labor to enter the workforce. Only after experiencing long-term stagnation and labor shortages from 2010 onward did Japan actively utilize women, the elderly, and foreign workers. Jang stated, “Korea should refer to major policy precedents and expand both the quantity and quality of its labor force by increasing the participation of idle labor?such as women with career interruptions, skilled retirees, and young people with interrupted work experience?and by strengthening innovation-oriented investment in education. There is also a need to consider more systematic and sustainable ways to utilize foreign labor.”

Korea and Japan are similar in that both achieved success through export-led growth centered on manufacturing. However, the strong experience of past success can become an obstacle to pursuing structural reforms when domestic and international environments change rapidly. Jang emphasized, “Above all, Korea must focus its capabilities on fostering advanced industries.” To this end, the government should prioritize securing talent in core technologies such as semiconductors and AI, and establish incentive structures not only to attract global talent but also to prevent talent outflow. He added, “Even before the recent trade conflicts, the share of goods trade in global trade was already declining, while the share of services trade was increasing. The government should support the growth of high value-added services?such as IT, healthcare, and cultural content?as core export industries through bold deregulation.”

Population aging, which increases rigid fiscal expenditures such as pensions and health insurance, is also a key factor rapidly depleting the government’s fiscal capacity. Since the 1990s, most of the increase in Japanese government debt has been due to pension and health insurance spending, and Korea has shown a similar trend since the 2010s. Jang stated, “Ensuring fiscal sustainability is more important than anything else. For example, after running a deficit to counteract economic downturns, a practice of restoring fiscal capacity through surpluses should become established.”

He stressed above all that monetary policy is a tool for countercyclical response, not for improving the economic structure. “Raising the potential growth rate is only possible through structural reforms,” he said. “Monetary policy should play only a supplementary role from a cyclical perspective.” He noted that, as traditional monetary policy reached its limits, Japan relied on various unconventional monetary policies, such as quantitative easing, purchases of risky assets, negative interest rates, and yield curve control. “In December last year, the Bank of Japan assessed that unconventional monetary policy had short-term effects in stimulating the economy but failed to restore growth potential and caused side effects such as market distortion. This is a lesson we must take to heart.”

It is estimated that if Japan had responded appropriately to demographic changes and had not experienced population decline from 2010 onward, its average annual economic growth rate from 2010 to 2024 would have been 0.6 percentage points higher, and the government debt-to-GDP ratio would have been 4.5 percentage points lower. Korea’s potential growth rate is also projected to fall to 0.6% in the late 2040s, but the analysis suggests that successful structural reforms could offset much of this decline. Jang emphasized, “We must learn from Japan’s past experience and innovate our economic structure through creative destruction.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.