13 Stores Owned by MDM and DL Group Face Lease Termination, Tenant Merchants at Risk of Losing Livelihoods

Homeplus Demands "Half-Price Rent" as a Hardline Move, Landlords Respond Firmly: "Unacceptable"

Outcome of Negotiations Before Court Rehabilitation Plan Submission Remains the Biggest Variable

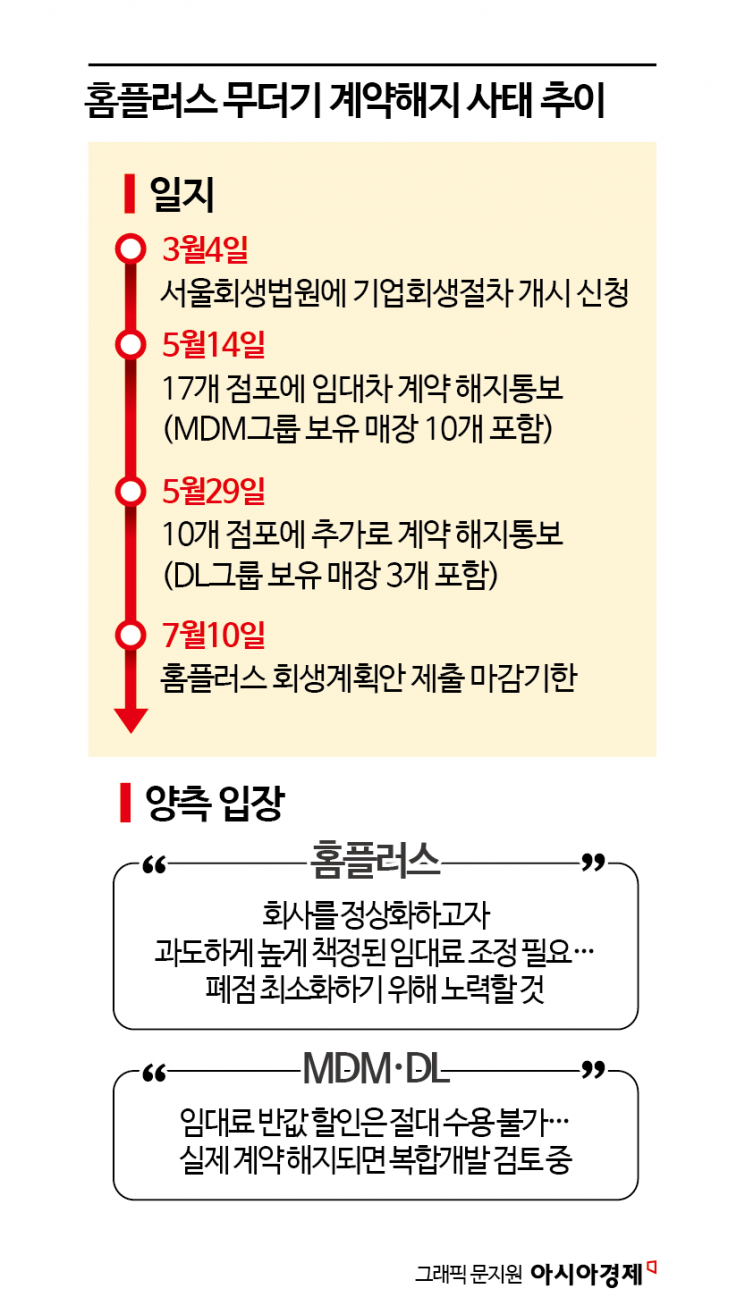

As negotiations over rent adjustments between Homeplus, which is currently undergoing corporate rehabilitation proceedings (court receivership), and MDM and DL Group have escalated into a standoff, there is a growing likelihood that at least 13 stores owned by these companies will be closed. Small business owners and tenant merchants operating in these locations now face the threat of losing their livelihoods.

According to the retail industry on June 10, Homeplus recently notified a total of 27 stores nationwide of lease contract terminations on two separate occasions, citing the Debtor Rehabilitation and Bankruptcy Act. The first notification included 10 stores owned by MDM Asset Management, an affiliate of MDM Group. These stores are Gayang, Siheung, Ilsan, Gyesan, Woncheon, Ansan Gojan, Cheonan, Jangnim, Dongchon, and Ulsan Buk-gu. In the second notification, three out of five stores owned by DL Group?Ulsan Nam-gu, Daejeon Munhwa, and Jeonju Wansan?were designated for contract termination.

Homeplus and the two companies have held multiple rounds of negotiations over rent adjustments but have yet to reach common ground. Homeplus has demanded a significant reduction in the lease period and a decrease in rent to about half of the current level. The industry interprets this as a 'brinkmanship' tactic. Analysts suggest that Homeplus is using the actual risk of store closures as a strategic card to strengthen its position in future negotiations, even at the cost of closing some locations. On the other hand, both companies maintain that they cannot accept the terms proposed by Homeplus. If the lease termination notifications for the 13 stores are carried out, Homeplus partner merchants operating in these locations are likely to be notified of contract termination without compensation or alternative store options.

If Homeplus withdraws, MDM Group and DL Group are more likely to pursue mixed-use redevelopment rather than seek new tenants. The existing stores are designed and structured exclusively for Homeplus, making it difficult to convert them into general commercial facilities. Profitability analyses by location also indicate that redevelopment is more advantageous than re-leasing. Both companies originally acquired these properties with long-term development in mind. In fact, DL Group’s Daejeon Munhwa store, which is among those notified of contract termination, has been selected for the 'Public Support Private Rental REITs Project,' giving concrete direction to its redevelopment.

An MDM Group representative explained, "Since we acquired the stores with long-term development in mind, the start of the project has simply been moved forward," adding, "We will transition to the asset development phase, even if it means absorbing operating losses." MDM Asset Management acquired the 10 stores in bulk in 2021 for approximately 790 billion KRW. If all 10 stores are vacated at once, the combined loss of rental income and financial costs such as interest is estimated to reach several tens of billions of KRW annually. While one year’s rent has been secured in the form of a deposit, the companies will need to cover costs with their own capital thereafter. Since Homeplus filed for corporate rehabilitation in March, MDM Asset Management has not received rent payments and has been using up the deposit. DL Group is in a similar situation.

The effective 'deadline' for negotiations is July 10, the court’s deadline for Homeplus to submit its rehabilitation plan. Of the 68 stores where Homeplus has been negotiating rent and contract terms, agreements have been reached for 41 locations. Homeplus stated, "We expect that rent and contract adjustments may be possible for about 7 out of the 27 stores that received lease termination notifications," adding, "We will do our utmost until the last moment to minimize store closures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.