Education Companies Restructure Amid Declining Birthrate and School-Age Population

From AI to Senior Education and Funeral Services in Search of Survival

Companies that have built decades of expertise in the education sector are increasingly making bold moves into “non-core” areas. Some firms that have focused on employment and certification training are transforming themselves into artificial intelligence (AI) companies, while others that specialized in early childhood and elementary education are entering the senior education market. The primary drivers behind these shifts are the inevitable changes in Korea’s demographic structure and the restructuring of its industrial landscape.

According to industry sources on June 5, Eduwill, a comprehensive education company, recently declared a major transformation into an “AI education company” and began reorganizing its structure. Well-known for its “civil service exam” brand image, the company is moving beyond adult-focused employment and certification training, restructuring its business portfolio with AI as a new growth engine.

To build an AI ecosystem, Eduwill has established an “AI Prompt Research Lab” internally and recruited Jung Jinil, CEO of Peopleware Education Consulting Group and an expert in the field, as the lab director. The lab plans to conduct employee training with the goal of increasing departmental productivity by five to ten times by the end of the year. Eduwill is also working to establish a subsidiary tentatively named “AI Platform Research Lab,” which will oversee AI technology and educational content development. A company representative stated, “We will fulfill our role as an AI company to lead the popularization of AI.”

This transformation is closely linked to the shrinking civil service exam market resulting from the decline in the school-age population. This year, the written test participation rate for the national level 9 civil service open recruitment exam hit a record low of 75.2%, and the average age of applicants has continued to rise, reaching 30.8 years. The competition ratio increased slightly to 24.3 to 1 from last year’s 21.8 to 1, but this small rebound is seen as insufficient to reverse the downward trend that has persisted for eight consecutive years since 2016, when the ratio was 53.8 to 1. The Ministry of Personnel Management has previously cited the decline in the school-age population as one of the causes for the falling competition ratio.

Other education companies are also making strategic changes in response to the decrease in the school-age population. Firms such as Woongjin, Daekyo, and Kyowon, which have focused on early childhood and elementary education, are now venturing into new businesses targeting seniors. They are diversifying their operations by developing educational content for seniors using their existing learning brand names, and by entering the funeral service market.

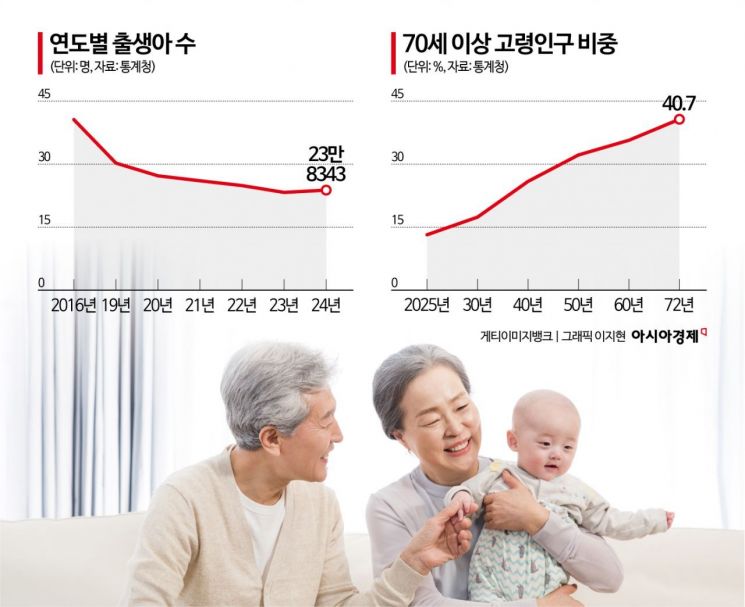

What these companies have in common is their effort to transform into “total life solution companies” that address the entire life cycle of their customers in response to demographic changes such as low birth rates and an aging population. According to Statistics Korea, the number of newborns in the country dropped from 406,243 in 2016 to 238,343 last year, nearly halving. Projections suggest that by 2072, people aged 70 and older will make up 40.7% of the total population. In 45 years, Korea will become a super-aged society where four out of every ten people are over 70 years old.

In line with this trend, Kyowon, which operates the learning brands “Kumon” and “Red Pen,” launched the “Kumon Active Life” learning package for seniors aged 50 and older last year. Daekyo, known for its “Noonnoppi” brand, established its subsidiary Daekyo New Life in 2022 to expand into senior care businesses such as long-term care insurance and cognitive enhancement programs. Earlier this year, the company also introduced a postpaid funeral service called “Nadawn Graduation Ceremony.” Woongjin went a step further by finalizing a massive deal to acquire Fried Life, the number one funeral service company in Korea, for 883 billion won. Woongjin plans to complete the acquisition by June 13 and maximize the synergy between the two companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.