Bank Consolidation Accelerates... 91 Branches Closed This Year

Most Bank-Owned Properties Are Being Sold

Calls to Utilize "Prime Locations" for Public Financial Services

Proposals for Financial Education Platforms and Centers for Small Business and Low-Income Finance

As domestic banks increasingly consolidate and close branches, there is growing debate over how best to utilize the resulting vacant properties.

Currently, most of these properties are being sold off, but there are also proposals to leverage their prime locations to enhance the public function of finance. Suggestions include transforming them into financial education platforms for the elderly who are not familiar with digital banking, or repurposing them as support centers for small business owners and low-income individuals, where in-person consultations remain crucial. Some argue that rather than making the consolidation process more difficult out of concern for financial accessibility, the focus should be on using these spaces to address financial blind spots.

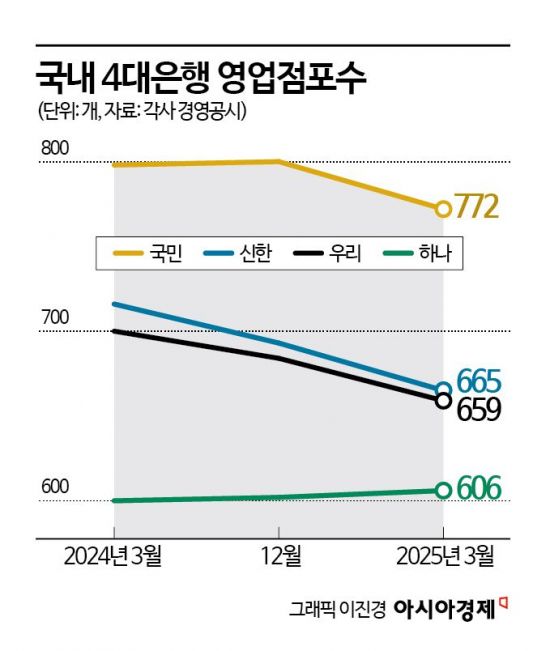

According to the financial sector on June 5, the four major banks (KB Kookmin, Shinhan, Hana, and Woori) closed a total of 91 branches in the first quarter of this year alone. Shinhan Bank closed the most with 35 branches, followed by KB Kookmin Bank and Woori Bank, which closed 28 and 26 branches, respectively. Hana Bank was reported to have closed two branches.

As the number of closed branches increases, the total number of domestic branches operated by the four major banks is rapidly declining. As of the first quarter of this year, there were 2,702 branches, a decrease of 77 compared to 2,779 in the fourth quarter of last year. Compared to one year ago, the number has dropped by 112. When including NH Nonghyup Bank to expand the count to the five major banks, the total comes to 3,776, meaning 150 branches have disappeared in the past year. As more customers avoid visiting branches due to the rise of non-face-to-face transactions, so-called "idle branches" have emerged, prompting banks to streamline their networks.

Most of the closed branches that are owned by the banks are being put up for sale. Recently, KB Kookmin Bank began the bidding process to sell 13 bank-owned branches that were closed over the past year. Woori Bank has also put 15 branches up for sale so far this year.

However, considering that most bank branches are located in areas with high foot traffic?so-called "prime locations"?some argue that alternative uses should be considered beyond simply selling them off. There are also concerns that branch closures worsen accessibility for financially marginalized groups, leading to proposals that these properties be used to expand the public function of finance.

Some banks are already exploring and implementing such ideas. Shinhan Bank, for example, has transformed a former branch into a financial education center called "Hagijae." Opened in April in Busan, Hagijae was created by remodeling a vacant branch left after consolidating locations in the Seomyeon area of Busan's old downtown. The bank is also considering opening unmanned artificial intelligence (AI) branches in areas where branches have previously been closed. KB Kookmin Bank is in discussions with the Small Enterprise and Market Service to use vacant real estate created by branch consolidations as consulting centers for small business owners.

There are also proposals to use these properties as support centers for small business owners, self-employed individuals, and low-income groups. A representative from the financial sector involved in policy-based financial support for low-income individuals stated, "For low-income finance, in-person consultations remain important because services are often linked to welfare, personal rehabilitation, or restart programs, but there is a shortage of service windows." "If the vacant real estate created by bank consolidations is used to enhance public service, it could become a sustainable and mutually beneficial financial solution," the representative added.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)