User Numbers Rise for Three Major Delivery Apps Even in May, the Off-Season

Baemin Reaches 22.4 Million, Coupang Eats Hits 11.11 Million

The food delivery app market is heating up due to Coupang Eats' aggressive pursuit and Baemin's (Baedal Minjok) offensive marketing to defend its market position. User numbers even increased in May, a period typically considered the off-season for delivery services. In response to Coupang Eats closing the gap, Baemin plans to continue investing in service differentiation throughout June.

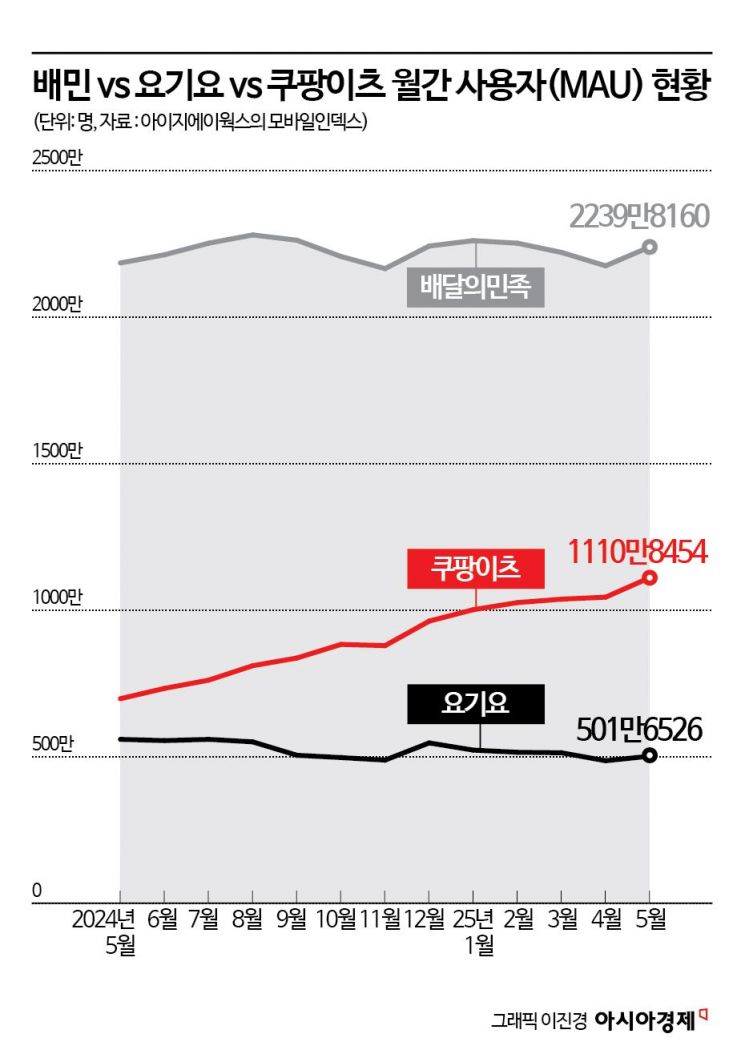

According to Mobile Index, a data platform by IGAWorks, on June 5, last month Baemin, Coupang Eats, and Yogiyo recorded monthly active users (MAU) of 22.4 million, 11.11 million, and 5.02 million, respectively. Compared to the previous month, user numbers increased by 3.0% for Baemin, 6.4% for Coupang Eats, and 3.2% for Yogiyo. May is generally considered a slow season with low delivery demand. Nevertheless, the increase in users is interpreted as a result of intensified marketing efforts by each company.

The unexpected marketing competition during the off-season is driven by Coupang Eats' rapid growth. Since surpassing 10 million users in January this year, Coupang Eats has continued its upward trajectory. Since January alone, 1.09 million new users have joined. Compared to the same period last year, the user base has grown by a remarkable 4.13 million, representing a 59.2% increase in scale.

The driving force behind Coupang Eats is the Coupang Wow membership, which boasts 15 million members. Coupang Eats has attracted users by offering various benefits such as free delivery and discounts to this customer base. The benefits tied to food delivery orders, combined with Rocket Delivery and OTT (Coupang Play), serve as incentives for Coupang users to subscribe to the Wow membership. Given that Coupang's MAU exceeds 30 million, the virtuous cycle of increasing Wow membership and expanding Coupang Eats users is expected to remain robust.

The company feeling the most pressure is Baemin, the market leader. Baemin's strategy to defend its position is to focus on "pickup" orders. By applying fees to pickup as well and promoting this service, Baemin believes it can secure new users who do not overlap with delivery customers. Since April, Baemin has been running a marketing promotion worth approximately 30 billion KRW to boost pickup orders. In June, the company plans to continue promotions offering discounts on pickup orders from popular franchise brands.

The "Hangureut" category, targeting solo diners, is another key strategy for Baemin. This category gathers food items suitable for single servings and removes the minimum order requirement. Baemin highlights that users can enjoy free delivery for small orders without meeting a minimum order amount. However, for delivery to occur despite low order values, Baemin needs to invest. Currently, the Hangureut category is available in Seoul, but starting June 12, Baemin plans to expand its operation to major regions nationwide, including the metropolitan area.

Industry analysis suggests that Coupang Eats' rapid growth is driving a virtuous cycle across the sector. However, there are concerns that intensifying competition could lead to a repeat of the past, with self-destructive price wars. An industry official stated, "For the development of the delivery platform ecosystem, companies should focus on diversifying their services rather than continuing loss-making competition through discount promotions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)