Individuals Net Purchased 33.9 Billion Won of Sangi Construction Last Month

Sangi Construction Shares Plunge, Leading to -57% Loss

After the 21st presidential election, most political theme stocks plummeted in the stock market. Shares related to former People Power Party candidate Kim Moonsoo, as well as some stocks linked to President Lee Jaemyung, also declined. Many individual investors who invested in political theme stocks were unable to exit in time and lost about half of their principal.

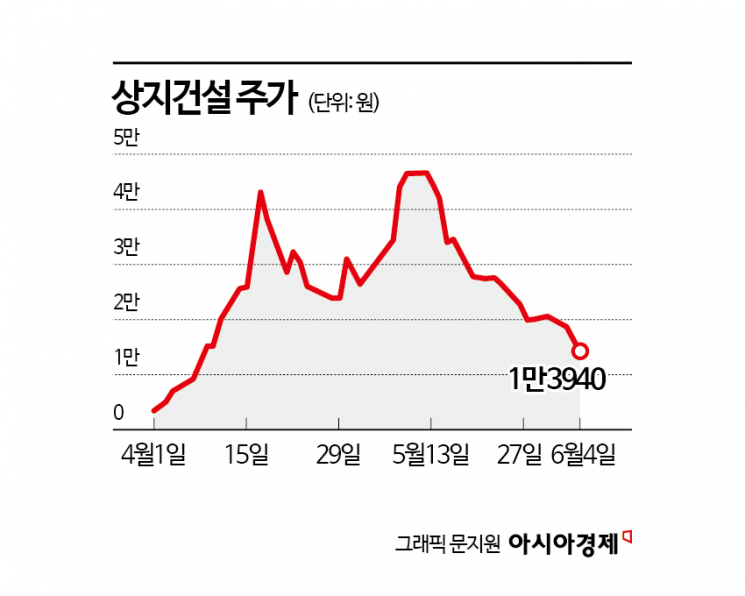

According to the financial investment industry on June 5, individual investors made net purchases of Sangi Construction shares worth 33.9 billion won from May 2 to May 30. The average purchase price per share was 32,709 won, more than twice as high as the previous day's closing price of 13,940 won. The average valuation loss rate for individual investors reached -57.4%.

The share price of Sangi Construction, which had remained around 3,000 won until the end of March this year, soared to 56,400 won on April 18. The stock surged after it became known that former outside director Lim Mooyoung joined President Lee Jaemyung's election camp. From April 2 to April 17, the stock hit the upper price limit ten times. In just 13 trading days, the share price rose by 1,680%. Although Sangi Construction showed the strongest upward trend among political theme stocks, its share price retreated last month. On April 4, after the presidential election ended, the stock plunged by 24%, and individual investors are currently recording large losses.

Investors in Orient Precision are in a similar situation. Last month, individuals purchased Orient Precision shares worth 29.5 billion won. The average valuation loss rate stands at -44%. Individuals who bought Hyungji Global shares are recording an average valuation loss rate of -46%. The share price of Pyeonghwa Holdings, considered a Kim Moonsoo-related stock, also plummeted. Individuals bought Pyeonghwa Holdings shares worth 3.7 billion won last month, but their accounts have been cut in half.

An official from the financial investment industry said, "Some political theme stocks surged in a short period, attracting individual investors who wanted to achieve high returns in a brief time," and added, "Only a very small number of individual investors make profits from political theme stocks that appear during every presidential election."

On this day, the KOSPI and KOSDAQ indices rose by 2.7% and 1.3%, respectively. As political uncertainty eased six months after the 12·3 Martial Law Incident, investor sentiment is growing in anticipation of a full-fledged rebound in the domestic stock market. On the other hand, concerns about 'sell-on-news' are increasing for political theme stocks due to the fading of related issues. This is why Sangi Construction, Dongshin Construction, Hyungji I&C, Atec, Hyungji Global, and Orient Precision, among others, plummeted in the domestic stock market the previous day.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)