If Birth Rate Recovers to OECD Average,

Elderly Employment Expands, and Productivity Growth Rises by 0.5%p,

Structural Reform Could Raise Growth Rate and Real Interest Rate

by an Average of 1% Point Annually from 2025 to 2070

The Bank of Korea has analyzed that if South Korea, which has entered a super-aged society, undertakes structural reforms in the areas of population and productivity, it could raise both the real interest rate and the economic growth rate by an average of 1 percentage point annually from this year through 2070. Structural reform is expected not only to alleviate concerns over low growth, but also to expand the flexibility of monetary policy operations, which is a core function of the Bank of Korea. In a situation where President Lee Jaemyung has emphasized his commitment to "reviving the economy" through emergency economic measures as his first priority upon taking office, the Bank of Korea's call for structural reform to restore growth carries significant implications.

Structural Reform to Raise Growth Rate and Real Interest Rate by 1% Point Annually from 2025 to 2070

According to the in-depth mid- to long-term study, "Changes in Monetary Policy Conditions and Implications Due to Super-Aging," published on June 4 by Lee Jaewon, Director of the Bank of Korea Economic Research Institute, and Hwang Indo, Head of the Monetary and Financial Research Division, if the birth rate gradually recovers to the OECD average level (1.58), employment among the elderly expands, and productivity growth rises by 0.5 percentage points as a result of structural reform, both the real interest rate and the growth rate would remain about 1 percentage point higher on average annually from 2025 to 2070.

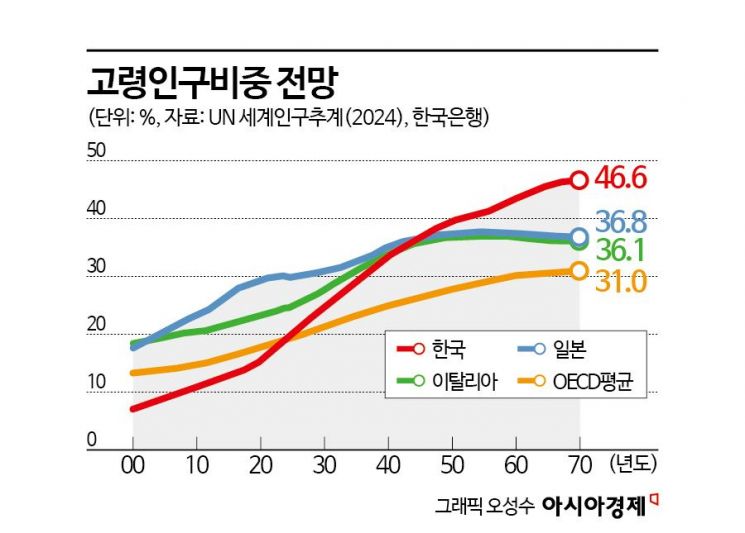

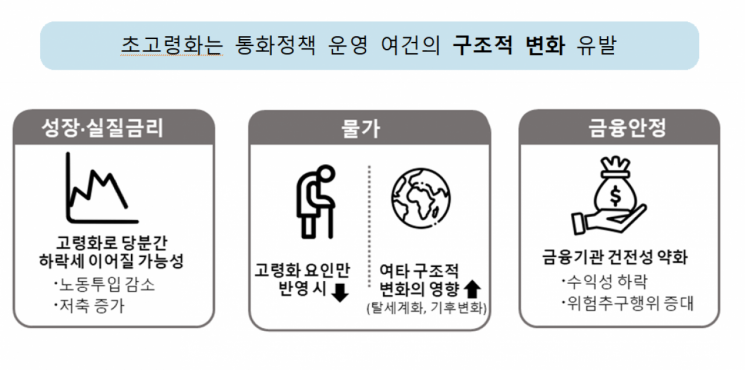

As of the end of last year, the proportion of South Korea's population aged 65 and over exceeded 20 percent, marking its entry into a super-aged society. By 2045, South Korea is projected to have the highest proportion of elderly population among OECD countries. Hwang stated, "Aging has been analyzed to bring about structural changes in the conditions for monetary policy operation, such as slowing growth, declining real interest rates, and deteriorating soundness of financial institutions," adding, "A decline in real interest rates narrows the scope for interest rate policy. If both growth momentum and the foundation for financial stability weaken simultaneously, conflicts among policy objectives may intensify."

Analysis using an open economy life-cycle model showed that aging lowers the growth rate by reducing the labor force, while also decreasing real interest rates through slowing investment and increasing savings. For example, if the birth rate and life expectancy had remained at 1991 levels (1.71 and 72.2 years, respectively), the equilibrium real interest rate in 2024 would have been about 1.4 percentage points higher than it is now. Scenario analysis reflecting future population projections also found that aging will continue to exert downward pressure on both the growth rate and real interest rates.

Inflation is expected to decline slightly. Hwang explained, "Aging is projected to exert an average downward pressure of 0.15 percentage points per year on South Korea's inflation rate between 2025 and 2070," but pointed out, "However, there are also structural factors exerting upward pressure on inflation, such as deglobalization, supply chain restructuring, and climate change, so the long-term direction of inflation remains highly uncertain."

The foundation for financial stability is also expected to weaken. An analysis of 27 years of panel data from 7,148 banks in OECD member countries showed that aging reduced capital adequacy ratios and increased the risk of bank defaults. This is due to deteriorating profitability and the resulting pursuit of high-risk, high-return business opportunities. The negative impact was particularly pronounced in financial institutions with a lending structure centered on real estate.

Responding to Structural Changes from Aging with Real Sector and Financial Structural Reform... How to Proceed

The report emphasized that structural changes resulting from aging should be addressed not with short-term measures, but with structural reforms that strengthen the fundamentals of the real and financial sectors. Hwang stated, "If the trend of low growth persists, social demands for accommodative monetary policy may increase," but also pointed out, "Short-term policies such as aggregate demand management are limited in their effectiveness against low growth caused by structural factors." On the contrary, such measures may cause side effects, including financial imbalances.

To address the reduction in labor supply due to aging, the report highlighted the need to expand women's participation in economic activity and support continued employment for the elderly. Hwang diagnosed, "Conditions for youth employment, housing, and child-rearing must be substantially improved to promote recovery in the birth rate," and added, "To enhance productivity across the economy, it is necessary to promote technological innovation and improve the efficiency of resource allocation." In the financial sector, given that the negative impact of aging is particularly significant in institutions with a lending structure centered on real estate, the report analyzed that dependence on real estate finance should be gradually reduced. Considering the sensitivity of the financial market structure to external price variables, it also emphasized the need to expand the demand base for the Korean won and enhance the stability and resilience of the foreign exchange market. Hwang predicted, "Such structural reforms will raise real interest rates and growth rates, thereby expanding the scope for monetary policy and strengthening the foundation for financial stability."

The report also argued that efforts to enhance the effectiveness of monetary policy under changed conditions should proceed in parallel. Hwang noted, "The environment for open market operations should be continuously improved in line with policy changes due to aging, and policy communication should be refined to effectively manage market expectations." He added, "The effectiveness of policy should be enhanced through appropriate coordination between monetary policy and macroprudential policy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)