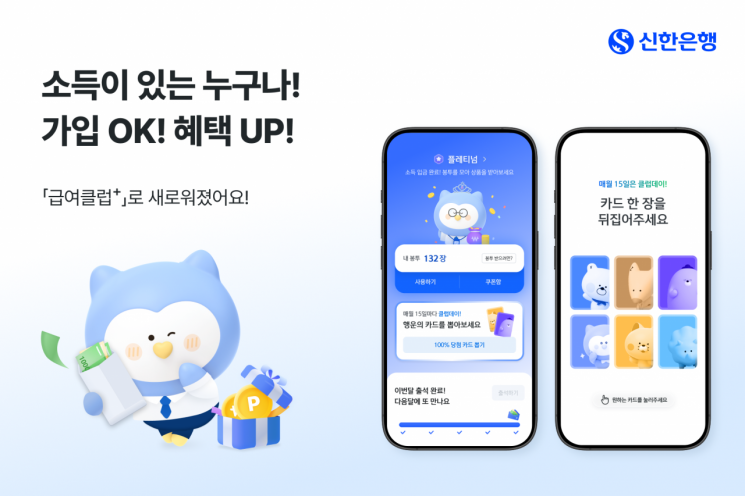

Shinhan Bank announced on June 4 that it has revamped its digital membership service platform for income transfer customers, 'Geubyeo Club,' and relaunched it as 'Geubyeo Club+'.

Geubyeo Club is a membership service exclusively for salary customers, first introduced by Shinhan Bank in the financial sector in 2019. It has offered various benefits to a wide range of income transfer customers, including pension recipients, sole proprietors, and freelancers, such as 'Monthly Salary Envelope' (random points awarded each month) and 'Golden Envelope' (raffle tickets for customers who complete missions).

Through this revamp, Shinhan Bank has expanded the benefits. Customers who transfer an income of at least 500,000 KRW per month will receive a random number of points ranging from 1 to 100, and the accumulated 'Monthly Salary Envelopes' can be exchanged for various prizes. In addition, a new tier system has been introduced to reward customers for the continuity of their income transfers and for engaging in financial product transactions. Platinum, the highest tier, offers opportunities to enter raffles for a 100,000 KRW Naver Pay point voucher (5 winners each month) or a 1,000,000 KRW Korean Air gift card (1 winner each month).

In addition, the bank plans to increase the perceived value of benefits by operating attendance missions and a 'Club Day' event with a 100% chance of winning on the 15th of every month.

A Shinhan Bank representative stated, "This revamp was designed to allow anyone to join and receive greater benefits, in line with the changing trends of diversified income types," and added, "We will continue to dedicate ourselves to providing new customer experiences that enhance the convenience and enjoyment of financial life for income transfer customers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)