Competition Heats Up as Mounjaro and Hanmi Challenge Wegovy's Dominance in Obesity Drug Market

The domestic obesity treatment market is once again experiencing significant changes. In the second half of this year, the U.S. pharmaceutical company Eli Lilly is expected to launch its new drug, Mounjaro, in Korea. This will create a direct competitive landscape with Novo Nordisk's Wegovy, which has so far maintained a dominant position. If Hanmi Pharmaceutical launches its own obesity drug, the domestic market is expected to be reshaped into a three-way competition between global big pharma and local pharmaceutical companies.

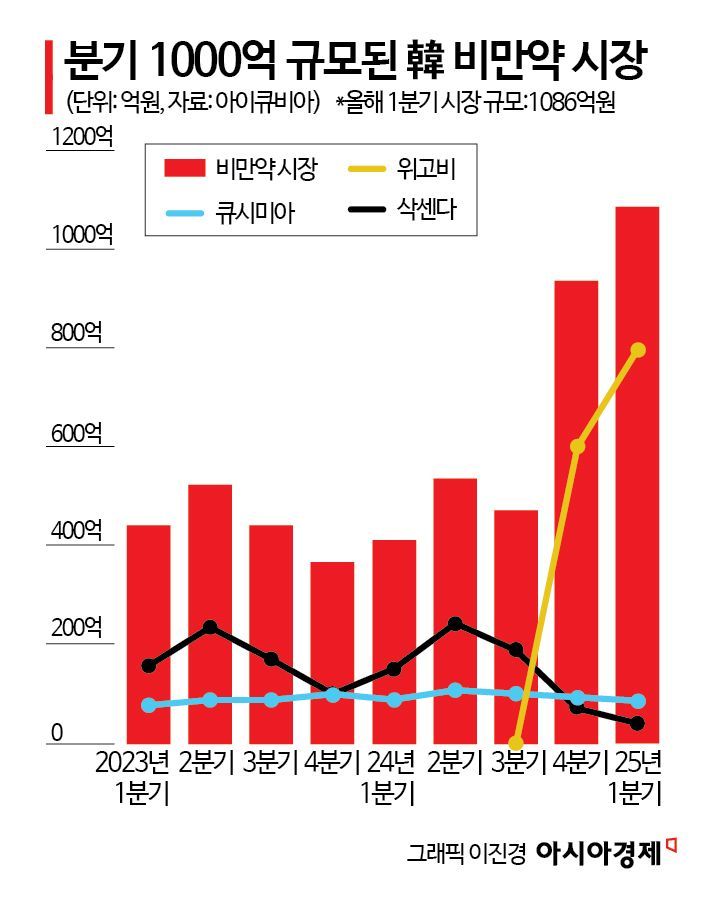

According to the pharmaceutical research institute IQVIA on June 4, Wegovy held a 73.2% market share in the domestic obesity drug market in the first quarter of this year. The size of the obesity drug market increased by 162.3%, from 41.4 billion won in the first quarter of last year to 108.6 billion won in the first quarter of this year, surpassing 100 billion won for the first time in a single quarter.

Wegovy, an injectable GLP-1 (glucagon-like peptide-1) receptor agonist for obesity treatment, quickly expanded its prescriptions after its launch in Korea in 2023. Wegovy produces effects similar to the 'GLP-1' hormone, which regulates appetite and digestive processes in the body. This hormone is naturally released when we eat and regulates overall metabolism in the brain, stomach, and pancreas, which makes the drug highly effective and long-lasting.

If Eli Lilly's Mounjaro enters the domestic market, the situation could change rapidly. Mounjaro is a new dual-acting obesity drug that stimulates both GLP-1 and GIP (glucose-dependent insulinotropic polypeptide) receptors. The GIP receptor plays a key role in promoting insulin secretion and regulating fat metabolism. Clinical results have shown that Mounjaro delivers even stronger weight loss effects than Wegovy, and it is rapidly expanding its market share in the United States. In Korea, Eli Lilly applied for domestic sales approval for both the Mounjaro vial and quick pen formulations to the Ministry of Food and Drug Safety last year, and approval is likely within this year.

Recently, Lilly presented research results showing that Mounjaro produced superior weight loss effects compared to Novo Nordisk's Wegovy. According to clinical studies, the group treated with Mounjaro experienced an average weight loss of 22.8 kg at week 72, while the group treated with semaglutide (the active ingredient in Wegovy) saw an average loss of 15.0 kg. After 72 weeks of treatment with both drugs, patients who received Mounjaro lost over 8 kg more on average than those who received Wegovy.

Korean pharmaceutical company Hanmi Pharmaceutical is also at the center of this market shift. Hanmi plans to launch 'Efeglenatide,' a GLP-1 analogue based on its sustained-release drug delivery platform 'LAPSCOVERY,' in the second half of next year. It is evaluated as having differentiated competitiveness by enabling long-term use while reducing gastrointestinal side effects. The domestic phase 3 clinical trial of Efeglenatide, which is currently underway, is expected to be completed within this year.

As competition in the GLP-1 obesity drug segment intensifies, the prices of obesity drugs are also dropping significantly. When Wegovy was first launched, the monthly price exceeded $1,350 (about 1.85 million won), but this year it has dropped to $499 (about 680,000 won). An industry official stated, "Domestic pharmaceutical companies, including Hanmi Pharmaceutical and HK Innoen, are accelerating the development of oral and combination drugs to keep up with the new obesity drug trends. Companies with price competitiveness and strong production and supply capabilities are expected to take the lead in the market going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)