Reducing Financial Burden for Vulnerable Groups Under the Lee Jae Myung Administration

Strengthening Asset Growth for Young People and Enhancing Financial Consumer Protection Expected

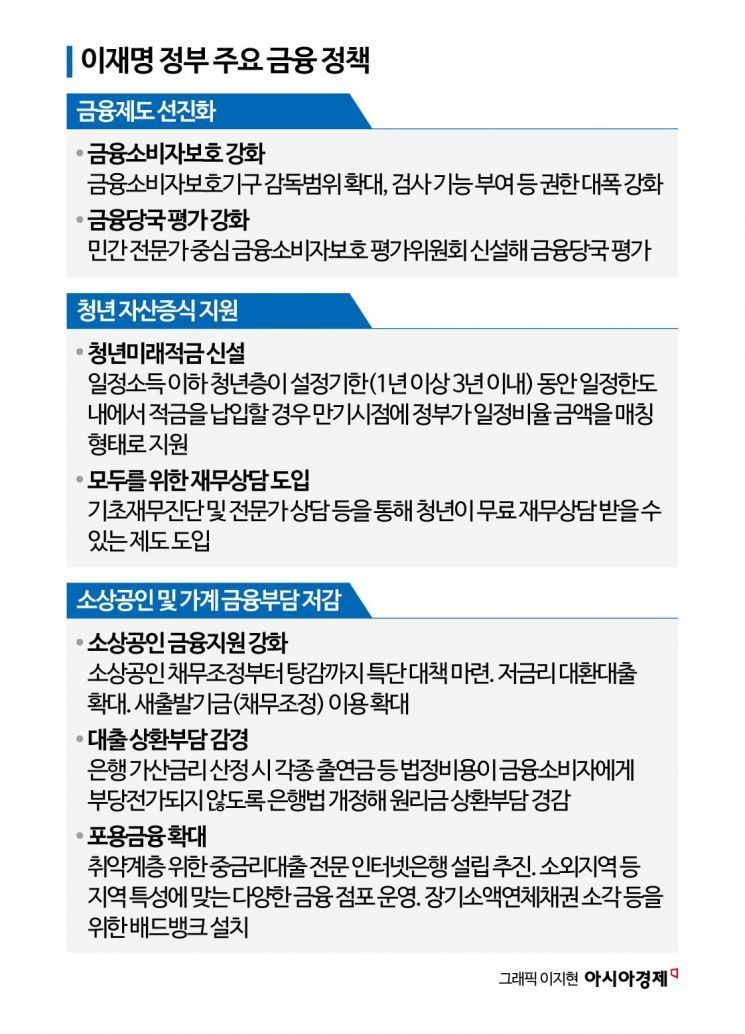

The financial policies of the Lee Jae Myung administration focus on reducing the financial burden and increasing the assets of vulnerable groups, such as the self-employed, young people, and low-income households, as well as the majority of the public. There is also attention on separating the policy and supervisory functions of financial authorities, and significantly strengthening consumer protection functions.

Reducing Financial Burden for Ordinary Citizens by Lowering Bank Interest Rates

According to the Democratic Party of Korea on June 4, President Lee Jae Myung is pursuing plans to lower bank interest rates to reduce the financial burden on citizens. The administration plans to revise the Banking Act to ensure that various statutory costs, such as contributions, are not unfairly passed on to financial consumers when banks calculate their additional interest rates, thereby alleviating the burden of principal and interest repayments.

The additional interest rate refers to the risk-weighted rate added by banks to the benchmark (base) rate when setting lending rates. The method for calculating additional interest rates varies by bank and is treated as a business secret. If, as President Lee has pledged, banks are prevented from passing statutory costs onto consumers when calculating additional interest rates, it is expected that borrowers will see a reduction in their interest payments. President Lee also plans to restructure the burden-sharing system for the education tax included in additional interest rates by banks, further lowering interest costs for the public.

Support for the self-employed and small business owners, who have faced difficulties from COVID-19 to periods of martial law, will also be greatly expanded. To this end, the administration is promoting the establishment of an internet bank specializing in mid-interest rate loans for financially vulnerable groups, such as small business owners and ordinary citizens. The lending review system will be enhanced by utilizing artificial intelligence (AI) and fintech (finance + technology) techniques to improve the mid-interest rate loan process. The proportion of mandatory loans to mid- and low-credit borrowers by existing internet banks will also be increased. Measures to promote refinancing loans for small business owners and the self-employed are also being prepared. Refinancing loans refer to borrowing from a financial institution to repay other loans or overdue payments, preventing individuals from becoming credit delinquents.

A bad bank will be established to write off long-term small overdue debts. Small business owners who meet certain criteria will also be eligible for debt write-offs. A large-scale temporary fund will be created to facilitate the write-off of bad debts held by private financial companies. It is expected that the administration will introduce bold support measures at the level of debt forgiveness, rather than simple debt adjustment.

President Lee Jae Myung and his wife Kim Hye Kyung are leaving after visiting the Central Party Office in Yeouido, Seoul on June 4, 2025. Photo by Kim Hyun Min

President Lee Jae Myung and his wife Kim Hye Kyung are leaving after visiting the Central Party Office in Yeouido, Seoul on June 4, 2025. Photo by Kim Hyun Min

Strengthening Supervisory Authorities to Enhance Financial Consumer Protection

Financial consumer protection will also be strengthened. President Lee has pledged to significantly enhance the functions and independence of financial consumer protection organizations by expanding the supervisory scope of authorities and granting them inspection powers. There are also plans to establish a Financial Consumer Evaluation Committee composed mainly of private experts to evaluate financial authorities.

In this process, there is also the possibility of restructuring the Financial Services Commission and strengthening the role of the Financial Supervisory Service. During his candidacy, President Lee stated, "The Financial Services Commission is currently handling both supervisory and policy tasks, so it seems necessary to separate and reorganize these functions." One scenario being discussed involves transferring the overall financial policy function and state-owned financial enterprises from the Financial Services Commission to the Ministry of Economy and Finance, and establishing a new Financial Supervisory Commission to be responsible for prudential supervision, relevant laws, and the licensing and mergers of financial institutions.

To eradicate financial crimes causing property damage to an unspecified number of people, a Multiple Victim Financial Crime Prevention Act will be enacted. President Lee has also pledged to make the confiscation of criminal proceeds mandatory for multiple-victim crimes affecting ordinary citizens, such as voice phishing and large-scale fraud. The reward for reporting illegal private lending will be doubled.

To guarantee the rights of insurance policyholders, the administration will require insurance companies to pay the full amount of insurance claims to policyholders first when claims are filed. If there is an amount to be refunded the following year, the insurance company will settle directly with the National Health Insurance Service. A new option for selective riders in indemnity insurance will also be introduced, allowing policyholders to exclude unnecessary medical items from coverage and thus reduce their premiums. The administration will continue its policy of stabilizing total household debt. To achieve this, regular meetings between relevant agencies will be held to ensure that real estate price stabilization and financial system stability measures are balanced.

The administration will also support asset growth for young people. President Lee has pledged to introduce financial counseling for all young people, aiming to help them establish a foundation for stable financial lives through basic financial diagnosis and expert consultation. A new Youth Future Savings program will be introduced, where the government will match up to 25% of the amount saved by young people with incomes below a certain threshold who make regular deposits for more than one year and less than three years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)