"AI-driven productivity improvements vary depending on labor market characteristics"

"AI expansion centered on the consumer goods industry increases economic returns... Should be prioritized in policy"

Inflation impact depends on whether 'AI productivity shocks' are anticipated

"AI contributes to productivity improvements, but its impact varies by country. The Bank of Korea is considering how much money it should invest in AI."

Lee Changyong, Governor of the Bank of Korea, made these remarks during a session on "The Impact of AI on Output and Inflation" at the second day of the "2025 BOK International Conference" held at the Bank of Korea in Jung-gu, Seoul, on June 3. Governor Lee stated, "In the cases of Korea and Japan, the labor markets are rigid. AI will likely be utilized more by the younger generation, and wages also vary by age group," adding, "Because of these concerns, central banks face significant challenges in determining the appropriate scale of investment in AI."

In response, Leonardo Gambacorta, Head of the Emerging Markets Department at the Bank for International Settlements (BIS) and a session presenter, said, "While the scale of investment is up to the judgment of each central bank, in terms of approach, it is important to protect information from big tech companies and to develop in-house solutions," emphasizing, "Significant investment should be made in the field of robotics." He further added, "Some solutions can utilize large corporate cloud services, but others should be developed domestically in Korea, making a hybrid solution necessary."

Lee Changyong, Governor of the Bank of Korea, is attending the 2025 BOK International Conference held at the Bank of Korea in Jung-gu, Seoul on the 2nd, listening to a presentation. Photo by Yonhap News

Lee Changyong, Governor of the Bank of Korea, is attending the 2025 BOK International Conference held at the Bank of Korea in Jung-gu, Seoul on the 2nd, listening to a presentation. Photo by Yonhap News

During his session presentation, Gambacorta highlighted, "The spread of AI centered on the consumer goods industry will yield higher economic returns compared to other industries," stressing, "This should be prioritized in policy formulation."

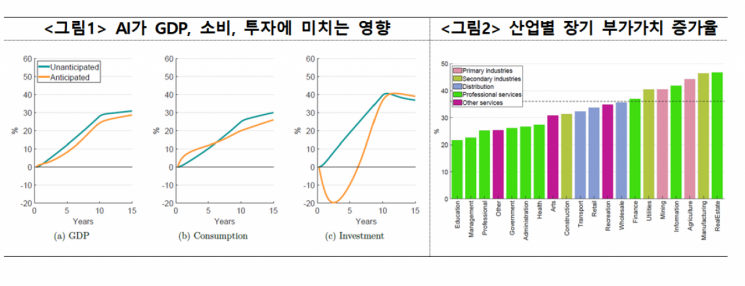

Gambacorta explained, "Labor mobility across industries is relatively rigid, so productivity improvements from AI will lead to long-term increases in real wages. As a result, labor-intensive industries will see limited production growth due to increased production costs, compared to capital-intensive industries." When AI is concentrated in the consumer goods industry, labor shifts to the capital goods industry, triggering a chain reaction that increases output and significantly boosts overall economic productivity. In contrast, when AI is focused only on the capital goods industry, the responses in total output and inflation are found to be minimal.

Gambacorta emphasized that while the spread of AI will increase gross domestic product (GDP), consumption, and investment over the long term, its impact on inflation depends on whether economic agents anticipate "future productivity improvements from AI." Accordingly, he analyzed that central banks need to consider the short-term inflation shocks and the differing effects across industries, depending on whether economic agents expect future productivity gains. He explained that if households and businesses do not anticipate future productivity improvements from AI, there will be short-term disinflation, followed by a shift to an inflationary phase as aggregate demand rises. However, if future productivity gains are expected, inflationary pressures will emerge from the outset.

Gambacorta stated, "AI adoption has increased both GDP (by approximately 35%) and consumption in both the short and long term through productivity improvements." However, he explained that in the short term, under the expectation scenario, households anticipating future income growth led to a sharp initial increase in consumption. Investment also rises in the long term, but in the short term, under the expectation scenario, companies predicting future productivity gains delayed investment, resulting in a steep initial decline. As a result, capital accumulation was delayed, and the short-term GDP increase was more limited compared to the non-expectation scenario.

Regarding inflation, in the non-expectation scenario, the productivity shock expands supply capacity, causing short-term disinflation, but is followed by a gradual increase in demand, leading to an inflationary phase. In the expectation scenario, consumption expands immediately, resulting in inflationary pressures from the start. Policy interest rates respond to the inflation path: in the non-expectation scenario, rates fall in the short term and then rebound, while in the expectation scenario, rates rise immediately and remain elevated for an extended period.

Gambacorta emphasized, "While AI adoption can have positive macroeconomic spillover effects such as enhancing growth and investment over the long term, it is necessary to consider the short-term inflation shocks and heterogeneous effects across industries, depending on whether economic agents anticipate future productivity improvements."

He explained, "Policies that promote AI adoption can help stabilize prices in the short term and control inflation in the long term," adding, "AI also has growth potential that can offset long-term demand contraction caused by population aging, reshoring, and supply chain restructuring."

Previously, Marco Del Negro, Economic Research Advisor at the Federal Reserve Bank of New York, stated in a session on "Does the Green Transition Cause Inflation?" that "significant economic contraction will be necessary to curb inflation resulting from carbon taxes, and that cost must be borne." He added, "Central bank policymakers must consider the trade-off between controlling inflation caused by the green transition and achieving potential growth rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)