Expectations for Realization of Governance Reform Policies

Activist Funds Expected to Expand Their Activities

With the inauguration of President Lee Jaemyung, there is growing attention on whether the new administration will actively pursue governance improvement policies. In particular, if issues discussed during the presidential campaign?such as amendments to the Commercial Act, mandatory cancellation of treasury shares, and stricter requirements for tender offers?are actually legislated, analysts predict that the scope of activities for activist funds and alliances of minority shareholders demanding 'enhancement of corporate value' will expand further.

According to the investment banking (IB) industry on June 4, President Lee is expected to begin in earnest the process of amending the Commercial Act and reforming corporate governance upon his inauguration on this day.

Previously, President Lee pledged several measures to revitalize the stock market and improve corporate governance, including: ▲ introducing a duty of loyalty to shareholders under the Commercial Act ▲ activating cumulative voting ▲ expanding separate election of audit committee members ▲ introducing a one-strike-out system for unfair practices ▲ mandating the cancellation of treasury shares ▲ eradicating private benefits for controlling shareholders ▲ and inclusion in the Morgan Stanley Capital International (MSCI) Developed Markets Index.

"Directors' Duty of Loyalty to Shareholders, Expanded Protection of Shareholder Rights"

The securities industry expects that 'corporate governance improvement policies' will become a key capital market policy for the new administration. Of particular note is the proposed amendment to the Commercial Act regarding directors' duty of loyalty to shareholders. If the target of the duty of loyalty is changed from 'the company' to 'the company and its shareholders,' the board of directors, which has so far been responsible only to the company, will also have to consider the interests of shareholders.This would provide activist funds and others with a stronger legal basis when pressuring corporate management.

Regulations related to treasury shares are also a major focus for activist funds. Lee Kyungyeon, a researcher at Daishin Securities, analyzed, "With the implementation of the 'treasury share report' disclosure obligation from this year, transparency in treasury share management has been greatly enhanced," adding, "Companies with a low controlling shareholder stake and a high proportion of treasury shares may become targets for activist funds."

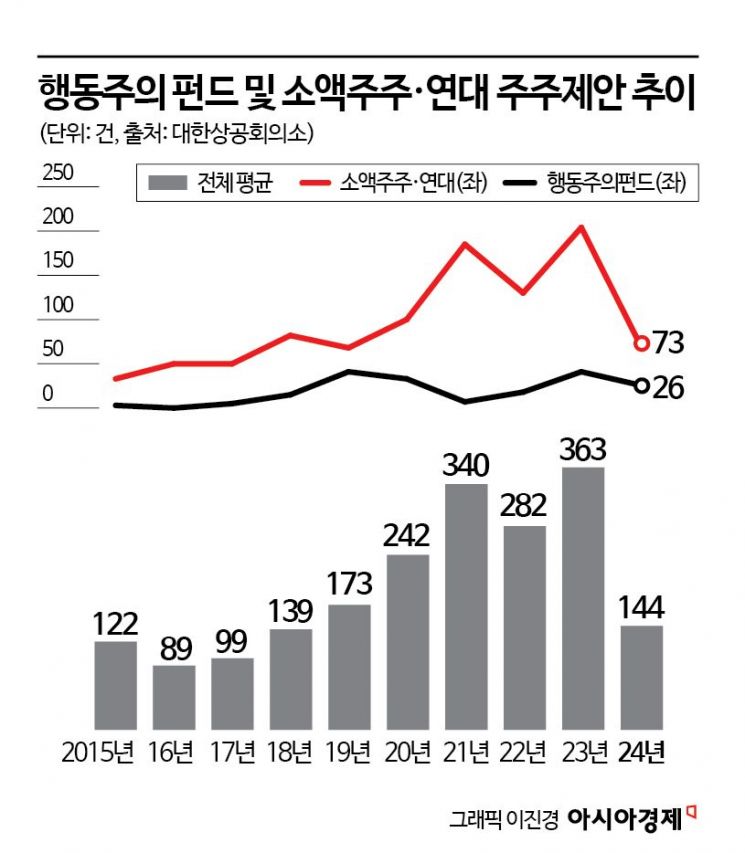

In fact, signs of governance changes in the domestic capital market have continued to expand. According to an analysis by the Korea Chamber of Commerce and Industry of shareholder proposals at regular and extraordinary general meetings of 412 companies over the past 10 years, the total number of shareholder proposals increased from 122 in 2015 to 144 last year. Regarding the decrease from 363 proposals in 2023 to last year's figure, a representative of the Chamber explained, "The reasons are the activation of communication between shareholders and management, as well as companies' proactive responses to the value-up policy of the Yoon Sukyeol administration."

"Activist Funds to Target Companies with Less Than 30% Controlling Shareholder Ownership"

Companies are already preparing for the possibility of strengthened disclosure and mandatory cancellation of treasury shares. A representative case is Telcoware, which is pursuing delisting through a tender offer. The company holds a high proportion of treasury shares at 44.1%, and it is reported that concerns over a sharp decline in the controlling shareholder's stake and management rights instability in the event of full cancellation prompted this response.

Researcher Lee Kyungyeon explained, "Such strategic choices by companies are also observed in the Japanese market," adding, "The Japanese government is demanding capital efficiency measures such as increased dividends and cancellation of treasury shares from undervalued companies with a price-to-book ratio (PBR) below 1, and as a result, there has been an increase in management buyouts (MBOs) leading to delistings." An MBO refers to corporate management buying company shares from shareholders, usually with the aim of delisting.

Lee Sunghoon, a researcher at Kiwoom Securities, stated, "If the Commercial Act is amended, there will be an increase in hostile mergers and acquisitions (M&A) and shareholder proposals by activist funds targeting companies where the controlling shareholder's stake is less than 30%, which are vulnerable to management rights defense." He continued, "Traditionally, holding companies have used treasury shares as a means to strengthen control. If mandatory cancellation of treasury shares is implemented to enhance shareholder returns, holding companies with a high proportion of treasury shares are likely to further expand shareholder returns."

The head of a domestic activist fund commented, "The issue is not the repurchase of treasury shares itself, but the purpose and method of their use," adding, "They should be used as a means to enhance shareholder value, not as a tool for management rights defense. If the new government's policies move in this direction, activist strategies will also evolve accordingly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)