Looking at the New Administration's Real Estate Policy

Leaving Housing Price Formation to the Market

Government to Refrain from Direct Intervention

Market Polarization Expected to Intensify

The overall direction of President Lee Jaemyung's real estate policy has been established, but it lacks specificity. Some describe this as a form of "strategic neglect." This approach is seen as a lesson learned from the Moon Jaein administration, which rolled out a series of comprehensive real estate measures in an effort to eliminate "speculative demand." The market is now focused on the possibility that President Lee may employ a different strategy from that of the traditional Democratic Party.

View of apartments and other buildings from Namsan in Seoul on the 4th, as the new government takes office. Photo by Yonhap News

View of apartments and other buildings from Namsan in Seoul on the 4th, as the new government takes office. Photo by Yonhap News

On the other hand, this strategic choice has led to criticism that President Lee's real estate policy is somewhat vague and theoretical. As Choi Eunyoung, Director of the Korea Urban Research Institute, put it, "Problems such as jeonse fraud and poor housing conditions are concrete, but the pledges are abstract." This is why there are calls for President Lee, who must fill a policy vacuum without a transition committee, to focus more on policy specificity.

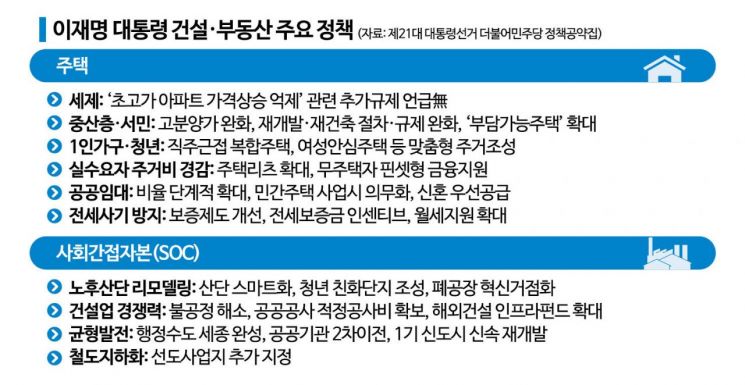

According to the Democratic Party's presidential campaign pledge booklet released on the 4th, the top priority of real estate policy is not "housing prices" but "housing supply." The booklet states, "The focus will shift from curbing price increases in ultra-high-priced apartments to a housing policy centered on supplying homes for the middle and low-income classes." This is interpreted as the government leaving price formation to the market and not directly intervening to control prices, which differs from the policy direction of previous Democratic Party administrations.

President Lee has also made remarks acknowledging housing as an investment asset. On May 28, during an appearance on MBC's "Kwon Soonpyo's News High Kick," he said, "I will not control housing prices through taxation," and explained, "The reason housing prices are rising is because homes serve as investment assets, and in Korea, housing is virtually the only investment option available."

However, there are concerns that focusing solely on housing supply will intensify market polarization and increase calls for solutions. Park Sera, a researcher at Shin Young Securities, observed, "Housing policy is becoming more passive than in the past," and predicted, "Deliberate exclusion of real estate market policies will deepen polarization and widen the asset gap."

President Lee has also proposed easing floor area ratios and building coverage ratios for reconstruction and redevelopment projects, provided that public interest is strengthened. However, it is expected that the benefits will be concentrated in certain complexes and large construction companies. Park noted, "Projects are being promoted mainly in major redevelopment areas such as Yeouido, Mokdong, and Apgujeong, which can withstand soaring construction costs and financial interest burdens," and analyzed, "This is likely to benefit large construction firms."

The rental housing market is also shifting toward dominance by large-scale operators. Park explained, "The market is being reorganized around corporate and institutional capital, which represents the extreme end of polarization," and added, "With global institutions making full-scale investments in Korea's rental housing market, the corporate rental housing sector is now emerging." Although President Lee has specified that he will increase public rental housing for young people, Park pointed out that it remains to be seen how effective this will be amid the ongoing restructuring of the rental market.

Both inside and outside government ministries, there is keen interest in how balanced regional development will be pursued. The Democratic Party has openly emphasized relocating the presidential office and the National Assembly to Sejong. In addition, a second-phase roadmap for relocating public institutions to the provinces has been drafted. Park predicted, "Infrastructure investment could stimulate local real estate markets and also contribute to a recovery in the construction industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.