Global Financial Institutions Rapidly Expanding AI Adoption

AI Brings Greater Convenience, But Also Heightened Risks

Countries Strengthen AI Management and Supervision

As artificial intelligence (AI) is rapidly being adopted across the financial sector, including banks, concerns are growing about the associated risks, leading to calls for stronger management and supervision.

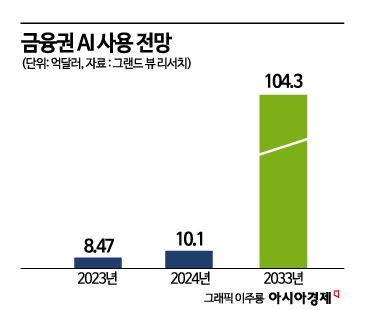

Financial Sector AI Market Expected to Grow More Than Tenfold in 10 Years

According to the Capital Market Research Institute and the International Finance Center on June 2, global financial institutions are now widely utilizing AI across various areas, including customer service, financial transactions, and internal operations management and supervision.

Market research firm Grand View Research reports that the global generative AI market in the financial sector grew from $847.5 million in 2023 to over $1 billion in 2024, and is projected to continue expanding to $10.433 billion by 2033. Financial institutions use AI most frequently for customer communication, followed by algorithmic trading, robo-advisors, supervision, and transaction processing.

Domestic banks in Korea are also steadily increasing their use of AI. Commercial banks have moved beyond basic AI chatbot consultation services and have begun deploying AI bankers to handle a range of banking services, including investment product sales, account deposits and withdrawals, and certificate issuance. There is also a growing trend toward AI-powered unmanned branches that operate without staff.

AI adoption is also advancing rapidly in overseas financial sectors. All of the top 10 commercial banks in the United States are operating AI chatbots as a form of customer service. They are focusing on providing more sophisticated and conversational chatbot services using generative AI. In China, since last year, about 30 major banks have introduced DeepSeek AI technology to improve internal operational efficiency, reduce costs, and enhance the quality of customer service.

Global investment banks (IBs) are actively leveraging AI for algorithmic trading, investment decision-making, and order execution. AI is also being used extensively in loan screening to reduce employee workloads and support more accurate credit risk assessments for borrowers.

Concerns Grow Over Erosion of Trust in Financial Markets as AI Use Expands

However, as the use of AI in the financial sector expands rapidly, the associated risk factors are becoming more prominent. Deepfakes, hacking, and misinformation enabled by AI can pose security threats and undermine trust in financial markets. As financial companies increasingly rely on external technologies rather than developing AI in-house, there is a growing risk of concentration among a small number of suppliers, which could heighten financial instability. There is also the potential for financial firms to suffer losses and reputational damage due to AI model performance degradation or erroneous outcomes.

In response, financial authorities in various countries are working to establish and strengthen regulatory frameworks to address the risks associated with increased AI adoption. The U.S. Financial Stability Oversight Council (FSOC) is conducting research, noting that specialized analysis may be required to evaluate the accuracy of generative AI, which differs from traditional approaches. The UK Financial Conduct Authority (FCA) has established an AI laboratory and is engaging financial firms and stakeholders in discussions on AI regulation. Europe, Japan, Singapore, Australia, and Canada are also preparing specialized guidelines that reflect the unique and high-risk nature of AI.

In Korea, the Financial Services Commission announced measures to support the use of generative AI in the financial sector at the end of last year, aiming to identify and address issues arising from the expansion of AI use. Financial authorities plan to develop guidelines to address the ambiguity of AI-related regulations.

Hong Jiyeon, a senior researcher at the Capital Market Research Institute, stated, "As AI spreads throughout the financial sector, major countries overseas are responding by supplementing existing financial regulations with AI-specific guidelines and principles, and by strengthening monitoring capabilities. In Korea as well, efforts are underway to build AI platforms for the financial sector, provide specialized financial data, and revise relevant guidelines. These measures are necessary to resolve uncertainties associated with the use of AI in finance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)