Apartments with High Jeonse Ratio...

Rising Share of Monthly Rent for Small Units

"Changing Perception of Monthly Rent Gradually Spreads to the Apartment Market"

There is a growing preference for monthly rent over jeonse (lump-sum deposit lease) in Seoul's small apartment market. In the wake of widespread jeonse fraud, tenants are increasingly avoiding jeonse contracts, with the advantage of not having large sums of money tied up also drawing attention.

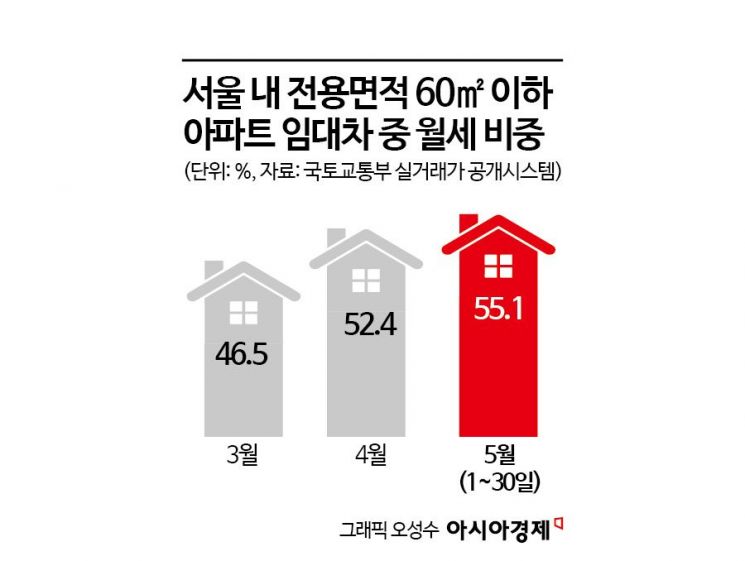

According to the Ministry of Land, Infrastructure and Transport's actual transaction price disclosure system, the proportion of monthly rent transactions among leases for small apartments (exclusive area of 60 square meters or less) in Seoul from May 1 to 30 was 55.1%. This is an increase of 5.9 percentage points from 52.4% in April, indicating a continued rise in the share of monthly rent contracts. Except for March, the proportion of monthly rent this year has been higher than during the same period last year.

Traditionally, jeonse has been the preferred option in the apartment rental market. There has been a strong perception that, despite requiring a large lump-sum deposit, jeonse is more affordable than paying monthly rent. In reality, it is possible to find housing at a lower cost through jeonse loans compared to monthly rent. For apartments, the jeonse price as a proportion of the sale price is relatively lower than for other types of housing such as officetels, which has contributed to the perception that the risk of not recovering the deposit or falling victim to fraud is lower.

However, this conventional wisdom has been upended by the rise in jeonse fraud. There is now a perception that it is safer to pay rent monthly rather than handing over a large deposit to the landlord. Many people are also choosing to invest the money they would have used for a jeonse deposit elsewhere. The gradual increase in jeonse prices has also played a role. According to data from the Korea Real Estate Board, the jeonse price index for Seoul apartments rose by 1.15% last year and by 0.11% from January to April this year. In comparison, the apartment sale price index decreased by 0.2% last year and increased by 0.33% from January to April this year, indicating that jeonse prices have risen more sharply than sale prices.

This trend is most pronounced in the small apartment market. In April, the proportion of monthly rent contracts for small apartments exceeded 50%, while for all apartments, the figure was 42.5%.

Kwon Youngsun, head of the Real Estate Investment Advisory Center at Shinhan Bank, explained, "It cannot be said that there is no risk of jeonse fraud or deposit non-return even with apartments. With the sharp increase in sale prices, it has become more difficult to secure a home by putting down a deposit through a jeonse contract, so more people are questioning the need to insist on jeonse." He added, "This shift in perception toward monthly rent is gradually spreading from other housing types such as villas to the apartment market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.