Pet Industry Spending Trends Analyzed by KB Kookmin Card

Number of Veterinary Clinics Reaches 17,000...

Consumer Spending Concentrated at Top Clinics

Spending on pet-related businesses using credit cards has increased by about 30% over the past three years. It was found that three-quarters of this spending was used for veterinary expenses.

KB Kookmin Card announced on June 1 that it had analyzed payment data from 2021 to 2024 to identify consumer trends in the pet industry. The analysis covered 24.85 million payment transactions from 3.54 million consumers who had used services such as veterinary clinics and specialty pet stores during this period.

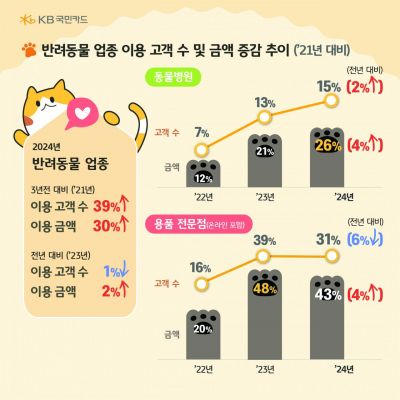

Last year, the number of customers using pet-related businesses increased by 39% compared to 2021, and the total amount spent rose by 30%. Although the number of customers decreased by 1% compared to the previous year, the amount spent increased by 2%. This indicates that the average spending per person has increased.

In 2024, 75% of spending in the pet industry was on veterinary expenses. This was three times higher than the share spent at specialty pet stores (25%).

The number of customers using veterinary clinics increased by 2% compared to the previous year, and the amount spent rose by 4%. The number of customers purchasing pet supplies decreased by 6%, but the amount spent increased by 4%. This suggests that a trend toward high-quality and premium-focused consumption is spreading.

Looking at pet industry customers by age group last year, those in their 30s accounted for 23%, those in their 20s and 40s each accounted for 22%, and those in their 50s accounted for 20%. The rate of increase in spending was highest among those in their 60s (60%), followed by those in their 50s (39%) and those in their 30s (31%).

Among customers aged 60 and older, spending on pet supplies increased by 77%, and spending at veterinary clinics rose by 57%. This suggests that older adults are increasingly viewing pets as life companions and are actively spending on them.

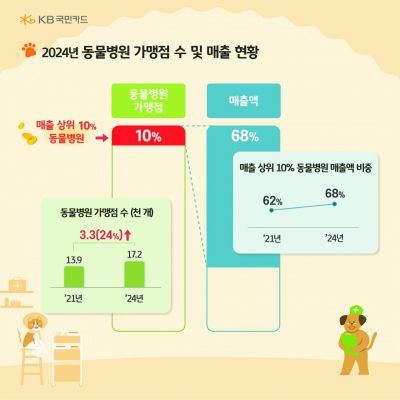

The number of veterinary clinic merchants increased from about 13,900 at the end of 2021 to about 17,200 at the end of last year, an increase of about 3,300 (24%).

The share of the top 10% of veterinary clinics by sales also rose from 62% in 2021 to 68% in 2024. This indicates that consumer spending is increasingly concentrated at major veterinary clinics.

Last year, 64% of pet supply purchases were made online. Online sales increased by 53% compared to three years ago. The offline share was 36%, with spending up by 27%.

Looking at online pet supply sales, revenue from cat-related products increased by 81% compared to three years ago, showing a higher growth rate than dog products (49%). Among cat products, sales of food and treats increased by 106%, and general supplies rose by 62%.

A KB Kookmin Card representative said, "We have confirmed changes in pet-related consumer lifestyles, such as increased spending by older adults and a shift toward online consumption," adding, "We will continue to analyze the consumption patterns of various customer groups based on data and provide differentiated benefits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)