Stocks of Major Financial Holding Companies Hit Record Highs Day After Day

Driven by Improved Earnings, Expectations for New Government's Market Stimulus, and Value-Up Initiatives

CEOs' Direct Participation in IR Activities Actively Boosts Share Prices

The stocks of financial holding companies, regarded as top performers in value-up (corporate value enhancement), have simultaneously reached record highs. The rise in share prices is attributed to improved first-quarter earnings, expectations for stock market-boosting measures by the new government, and the stabilization of exchange rates. Analysts also point to increased investor confidence, driven by financial group chairmen taking the lead in value-up initiatives, such as personally participating in investor relations (IR) activities.

(From left) Yang Jonghee, Chairman of KB Financial Group; Jin Okdong, Chairman of Shinhan Financial Group; Ham Youngjoo, Chairman of Hana Financial Group; Lim Jongryong, Chairman of Woori Financial Group

(From left) Yang Jonghee, Chairman of KB Financial Group; Jin Okdong, Chairman of Shinhan Financial Group; Ham Youngjoo, Chairman of Hana Financial Group; Lim Jongryong, Chairman of Woori Financial Group

Shares of the Four Major Financial Holding Companies Continue to Climb

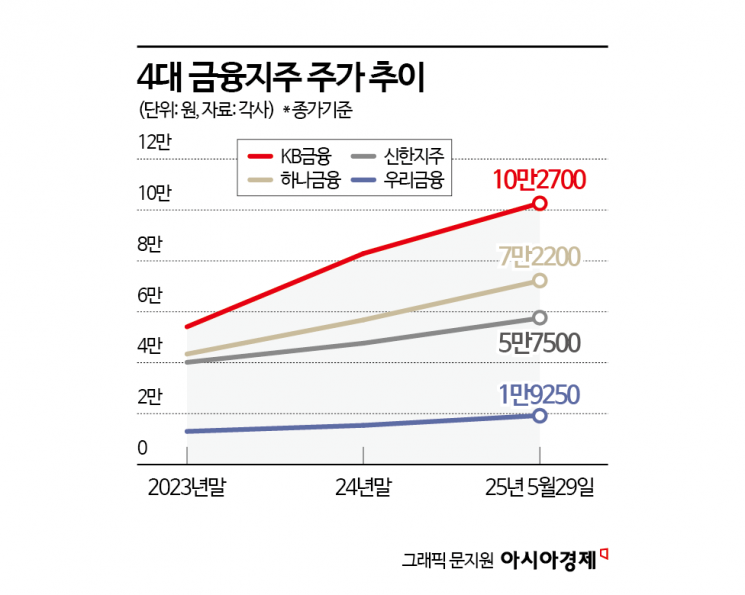

According to the financial investment industry on May 30, all four major financial holding companies?KB Financial Group, Hana Financial Group, Shinhan Financial Group, and Woori Financial Group?recorded their highest share prices of the year in the domestic stock market the previous day. Notably, KB Financial Group, Hana Financial Group, and Shinhan Financial Group reached all-time closing highs.

The rise in financial holding company stocks is seen as the result of a combination of factors: improved earnings this year, the new government's commitment to supporting stock prices, and each company's strengthened value-up policies.

The combined net profit of the four major financial groups in the first quarter of this year was KRW 4.9289 trillion, the highest ever for a first quarter. This figure represents a 16.8% increase compared to the first quarter of last year. Based on these improved results, each company implemented even more proactive value-up policies.

When announcing its first-quarter results, KB Financial Group raised its cash dividend target for the year above its initial goal and also announced plans to repurchase and cancel KRW 300 billion worth of treasury shares. Since last year, Yang Jonghee, Chairman of KB Financial Group, has personally attended overseas IR events to demonstrate the sincerity of the group's value-up policies to foreign investors. At this year's general shareholders’ meeting, he also expressed a strong commitment to strengthening these policies. Thanks to these efforts, KB Financial Group received the Deputy Prime Minister’s Award at the 'Value-Up Excellence Awards' hosted by the Korea Exchange on May 27. In addition, KB Financial Group's market capitalization surpassed KRW 40 trillion, making it the fifth largest among all listed companies in Korea.

Hana Financial Group has also demonstrated a strong commitment to value-up. In February, Ham Youngjoo, Chairman of Hana Financial Group, became the first CEO among domestic financial holding companies to release a video interview expressing his determination to pursue value-up. He stated, "By strengthening our value-up policies, we will raise our price-to-book ratio (PBR) to 1 and recover our undervalued share price."

The CEOs of Woori Financial Group and Shinhan Financial Group are also firmly committed to value-up. Last week, Lim Jongryong, Chairman of Woori Financial Group, visited Indonesia and Hong Kong to meet major foreign investors and personally present the company's vision and shareholder return policies. This was the first time Chairman Lim has participated in overseas IR activities since his inauguration in 2023. Jin Okdong, Chairman of Shinhan Financial Group, also conducted IR activities in the UK, Germany, and Poland from May 18 to 24. During this trip, Chairman Jin discussed potential cooperation with global investment bank Goldman Sachs in areas such as corporate finance and asset management.

Rising Expectations for New Government's Stock Market Stimulus Policies, Including Separate Taxation of Dividend Income

Expectations for the new government's stock market stimulus policies have also played a significant role. Lee Jaemyung, the Democratic Party candidate, has promised active stock market revitalization policies, including amending the Commercial Act to codify directors' duty of loyalty, separate taxation of dividend income, and treasury share cancellation. All of these policies are related to corporate value-up. Kim Moonsu, the People Power Party candidate, has also proposed several stock market support measures, such as separate taxation of dividend income and tax benefits for long-term stockholders. These policies have had a positive effect on the share prices of financial holding companies, which are fundamentally high-dividend stocks.

An official in the banking sector stated, "The policy of separate taxation of dividend income will benefit financial holding company stocks, which are high-dividend stocks," and added, "Expectations for the new government's policies are already partially reflected in share prices."

The stabilization of the won-dollar exchange rate, which had surged since the end of last year, is also positive for financial holding company stocks. When the exchange rate rises sharply, banks' risk-weighted assets (RWA) increase, which negatively affects both soundness indicators and earnings. The won-dollar exchange rate, which at one point approached KRW 1,500, has recently fallen to the upper KRW 1,300 range.

Choi Jungwook, a researcher at Hana Securities, explained, "A stronger won leads to a decrease in RWA, making it possible for the common equity tier 1 (CET1) ratio to rise significantly. This is positive for shareholder returns and net profit improvement." He added, "Even though the share prices of bank stocks have risen by more than 50% since 2024, the current average PBR of banks is only 0.45. If the trend of meaningful expansion in shareholder returns continues, share prices could rise further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)