Expanding Lifestyle-Oriented Services

Aiming to Boost App Stickiness

"We Will Evolve into a Lifetime Financial Platform"

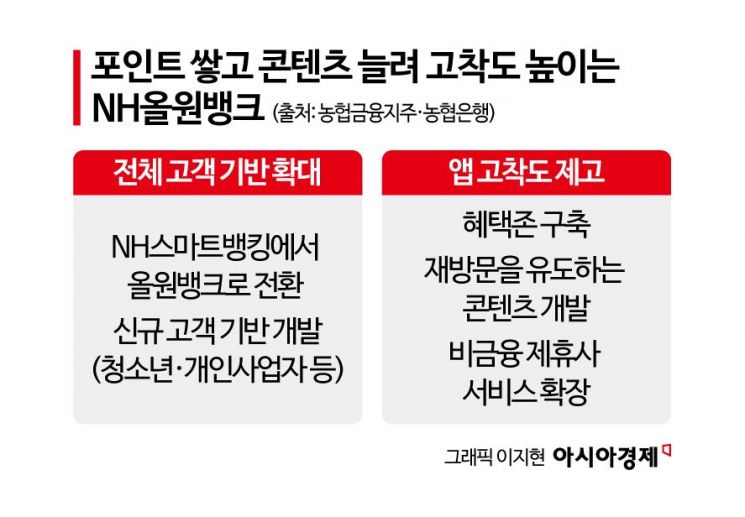

As NH Nonghyup Bank's application (app) 'NH All One Bank' is transforming into a super app for Nonghyup Financial Group, this year's super app development strategy has been revealed as 'Daily Finance,' with a focus on expanding lifestyle-oriented services. The main objective is to broaden the base of new customers and maximize the time customers spend within the app.

According to the financial sector on May 30, Nonghyup Financial Group recently announced this direction in its '2024 Annual Report.' To realize daily finance within All One Bank, the group will first expand its overall customer base. There are also plans to guide users of another banking app, NH Smart Banking, to All One Bank. Additionally, the bank aims to establish a new customer base among groups such as teenagers and sole proprietors. A key example is the launch of a new mortgage loan comparison service on May 13, which expanded the eligible customer group to include sole proprietors.

Last year, All One Bank introduced a dedicated service called 'Teens' to help teenage customers develop healthy financial habits. Inspired by the popularity of 'Tongkku,' a feature for decorating paper bankbooks, the bank also launched the 'Record Bankbook' service. Customers can select an account to use as a record bankbook, enter a schedule and savings amount, and deposits and records are then made automatically.

Measures are also being put in place to increase app stickiness (an indicator of how frequently or consistently users engage with the app). Specifically, the bank plans to create a 'Benefits Zone' to increase lifestyle benefits, produce content that encourages repeat visits, and expand partnerships with non-financial service providers.

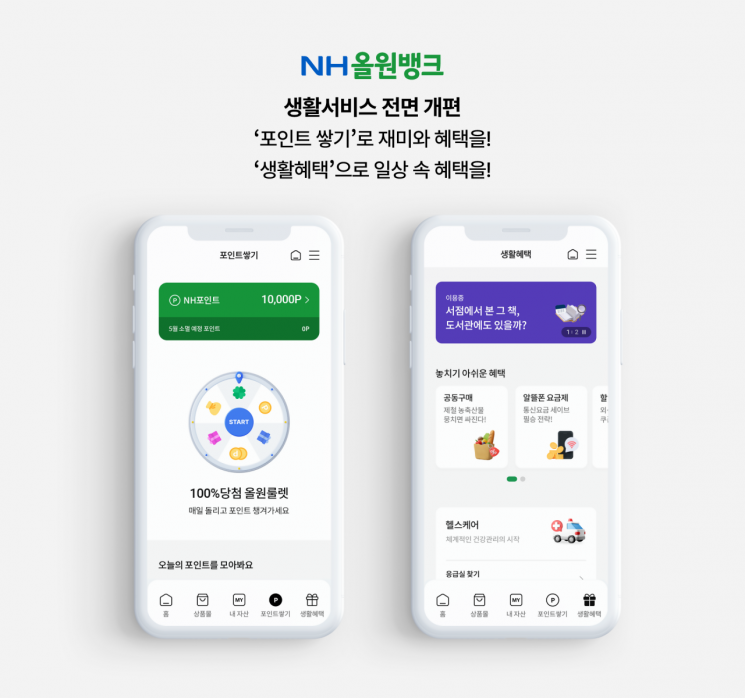

In line with this strategy, on May 28, NH All One Bank revamped its lifestyle services, adding new menus for 'Point Accumulation' and 'Life Benefits' within the NH Points rewards content. Previously, the app's bottom menu had four sections: Home·Product Mall·My Data·Life+. After the revamp, these changed to Home·Product Mall·My Assets·Point Accumulation·Life Benefits. Content related to point accumulation, which was previously found within Life+, is now accessible directly from the main screen at any time.

A key example of content designed to encourage repeat visits is the 'Book Connection Service,' launched on May 26. Without requiring separate membership registration or a library card, users can easily check the borrowing status and return dates for books at 2,751 libraries nationwide, as well as access a book search function. Nonghyup Bank explained that real estate, healthcare, and mobility-related services have also been added to the Life Benefits tab, further expanding lifestyle-oriented features. The bank is also offering a group purchasing service for agricultural and livestock products, reflecting Nonghyup's identity.

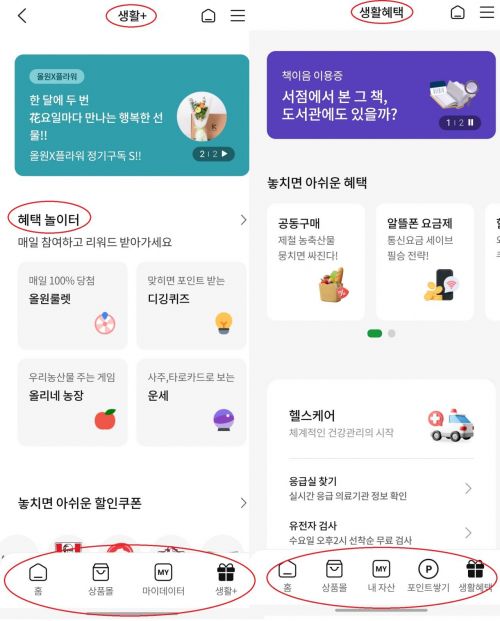

Before the revamp on the 28th, the NH All One Bank screen (left) featured tabs labeled 'Home·Product Mall·My Data·Life+'. After the revamp, the screen (right) changed to 'Home·Product Mall·My Assets·Point Accumulation·Life Benefits'. The Benefits Playground section was also separated into its own 'Point Accumulation' tab, and 'Life+' was renamed to 'Life Benefits'. Screenshot from NH All One Bank

Before the revamp on the 28th, the NH All One Bank screen (left) featured tabs labeled 'Home·Product Mall·My Data·Life+'. After the revamp, the screen (right) changed to 'Home·Product Mall·My Assets·Point Accumulation·Life Benefits'. The Benefits Playground section was also separated into its own 'Point Accumulation' tab, and 'Life+' was renamed to 'Life Benefits'. Screenshot from NH All One Bank

The app also provides a comprehensive range of services related to financial products. Earlier this year, the bank began offering 'Full Banking' services, enabling customers to handle all banking tasks without visiting a branch. Users can now view key information from NH Investment & Securities, NH Card, NH Life Insurance, NH Property Insurance, NH Capital, and NH Savings Bank?all affiliates of Nonghyup Financial Group?at a glance.

Nonghyup Financial Group and Nonghyup Bank plan to develop All One Bank into a 'lifetime financial platform' that goes beyond traditional finance to cover all stages of life, including marriage, travel, housing, and health. A Nonghyup Financial Group representative emphasized, "Next year, we will further increase profitability and assets and maximize customer value," adding that the bank will continue to advance more personalized target marketing (marketing that clearly defines and targets specific customer groups).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.