Common Equity Tier 1 Capital Ratio of Banks Reaches 13.2% in Q1

Up 0.13 Percentage Points from Previous Quarter

BIS Capital Adequacy Improves as Exchange Rate Surge Subsides

In the first quarter of this year, the capital adequacy ratio of domestic banks, as measured by the Basel Committee on Banking Supervision (BIS) standard, improved. The BIS capital ratio, which had declined at the end of last year due to a surge in the won-dollar exchange rate following the declaration of martial law, has returned to normal levels this year.

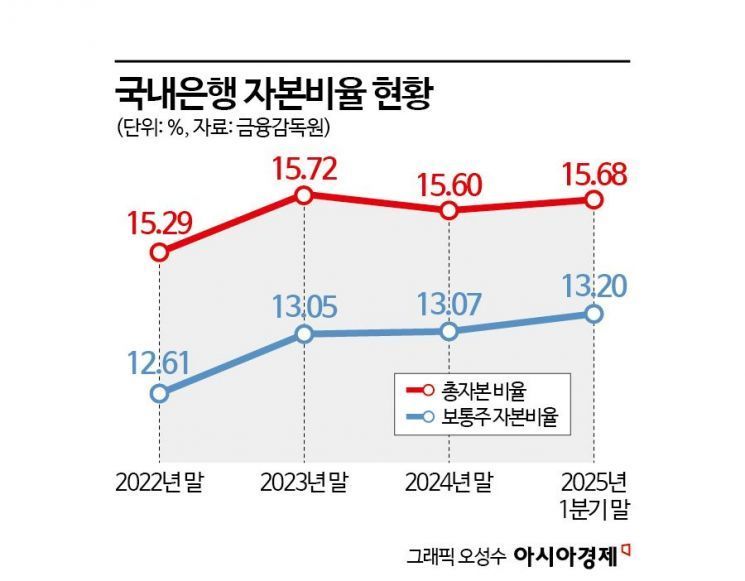

According to the "Status of BIS Capital Ratios of Bank Holding Companies and Banks as of the End of March (Provisional)" released by the Financial Supervisory Service on the 29th, the common equity tier 1 (CET1) capital ratio of domestic banks at the end of the first quarter stood at 13.2%, up 0.13 percentage points from the previous quarter. The tier 1 capital ratio at the end of the first quarter was 14.53%, an increase of 0.14 percentage points from the previous quarter, while the total capital ratio rose by 0.08 percentage points to 15.68%.

The BIS capital ratio is a core indicator of a bank's financial soundness, representing the ratio of equity capital to total assets (weighted by risk). Regulatory requirements set by supervisory authorities are 8.0% for the common equity tier 1 capital ratio, 9.5% for the tier 1 capital ratio, and 11.5% for the total capital ratio.

At the end of the fourth quarter last year, the common equity tier 1 capital ratio of domestic banks fell sharply by 0.26 percentage points to 13.07% compared to the previous quarter, due to an increase in risk-weighted assets (RWA) following a surge in the won-dollar exchange rate after the declaration of martial law. During the same period, the total capital ratio dropped by 0.24 percentage points to 15.60% from the previous quarter, and the tier 1 capital ratio decreased by 0.28 percentage points to 14.37%. However, as the situation surrounding martial law stabilized in the first quarter of this year, the upward trend in the exchange rate halted and bank performance improved, leading to a rise in capital ratios.

The Financial Supervisory Service assessed that, as of the first quarter, all domestic banks achieved a sound level that significantly exceeded the capital regulatory ratios. By individual bank, KB, Citi, SC, and Kakao were evaluated as highly stable, with total capital ratios exceeding 16%. However, BNK's ratio was somewhat lower, at under 14%.

In terms of the common equity tier 1 capital ratio, Citi, SC, Kakao, and Toss all posted ratios above 14%, indicating strong performance. KB, Hana, Shinhan, Export-Import, Korea Development, and K banks recorded relatively high levels, with ratios above 13%. IBK Industrial Bank, on the other hand, was relatively lower, with a ratio in the 11% range.

A Financial Supervisory Service official stated, "As of the end of March, all domestic banks maintained capital ratios above the regulatory requirements, indicating a sound level," but added, "Since domestic economic recovery is delayed and uncertainties remain over U.S. tariff policies, both domestic and external risk factors persist. Therefore, we will continue to monitor bank capital ratios and related indicators to ensure sufficient loss-absorbing capacity is maintained."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)