Secondary Financial Sector: "We May Lose Loan Customers to Internet Banks with Lower Rates"

Internet Banks: "Mandatory Lending Ratio for Mid- and Low-Credit Borrowers Is Too High"

As presidential candidates pledged to increase mid-interest rate loans at internet banks, both the secondary financial sector and internet banks have voiced strong opposition. The secondary financial sector expressed concerns that it is inevitable for customers seeking unsecured loans and card loans to be drawn to internet banks, which offer lower interest rates. Internet banks argued that even the current mandatory lending ratio of 30% to mid- and low-credit borrowers is burdensome, and raising this requirement further would inevitably increase their operational burden.

Lee Jae-myung, the Democratic Party presidential candidate, appeals for support at a campaign rally held at Gyeyang Station Square in Incheon on May 21, 2025. Photo by Kim Hyunmin

Lee Jae-myung, the Democratic Party presidential candidate, appeals for support at a campaign rally held at Gyeyang Station Square in Incheon on May 21, 2025. Photo by Kim Hyunmin

According to political and financial industry sources on May 29, the Democratic Party of Korea stated in its recently released policy manifesto, "The Real Korea Starts Now," that it will "promote the establishment of an internet bank specializing in mid-interest rate loans for financially vulnerable groups such as low-income individuals and small business owners," and that it will "simultaneously raise the mandatory lending ratio for mid- and low-credit borrowers at existing internet banks." The People Power Party also wrote in its policy platform, "A New Korea with the People," that it will "establish a state-run bank specializing in small business owners and integrate and coordinate functions for inclusive finance." While the People Power Party did not specifically pledge to raise the mandatory lending ratio for mid- and low-credit borrowers at internet banks, it did clarify, like the Democratic Party, that it intends to promote policies to boost mid-interest rate loans at internet banks.

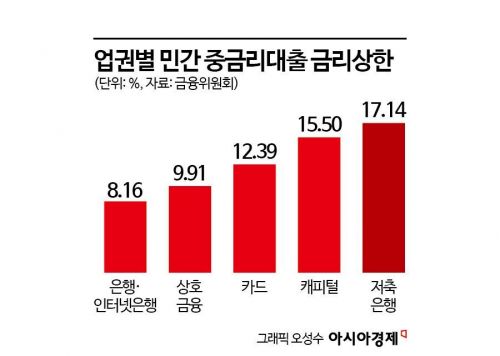

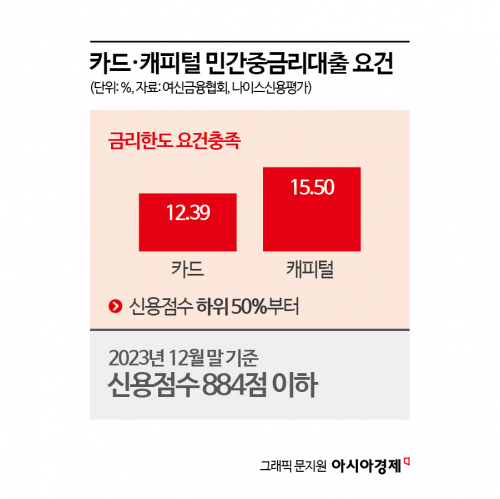

The financial industry criticized these pledges as typical populist policies, warning that they could deal a major blow to the business of both the secondary financial sector and internet banks. Secondary financial institutions such as card companies, capital firms, savings banks, and mutual finance institutions complained that they could lose customers in the personal credit loan and card loan segments to internet banks, which offer lower loan rates. According to the Financial Services Commission, the upper limit for private sector mid-interest rate loans in the first half of the year was 8.16% for internet banks, 9.91% for mutual finance, 12.39% for cards, 15.50% for capital firms, and 17.14% for savings banks. According to the Korea Federation of Banks and the Credit Finance Association, the requirements for mid-interest rate loans include industry-specific interest rate caps and being in the bottom 50% of credit scores. NICE Credit Rating reported that as of the end of 2023, a credit score of 884 or below falls within the bottom 50%.

A senior official at a card company said, "As presidential candidates are all promising to expand mid-interest rate loans, there is concern that customers seeking card loans and personal credit loans may be lost to internet banks," adding, "There is a high likelihood that customers will move to internet banks, where loan rates are about two-thirds those of card companies."

Another card company official commented, "While we need to see how much overlap there is between mid-interest rate loan customers at internet banks and those at card companies, given the clear policy trend among presidential candidates to expand mid-interest rate loans, competition among card companies for credit loan performance is bound to intensify."

Capital firms, savings banks, and mutual finance institutions showed similar reactions. However, in the case of capital firms, those focused mainly on new and used car loans, such as Hyundai Capital and KB Capital, are expected to be relatively less affected.

An official at a capital firm noted, "If internet banks become more active in offering unsecured loans to mid- and low-credit borrowers, not only will capital firms engaged in unsecured lending face increased competition, but competition within the secondary financial sector as a whole will also intensify," adding, "In particular, the savings bank sector, which relies heavily on unsecured loans, could be hit hard in terms of business operations."

However, the primary financial sector, including banks and internet banks, expects that policies to expand mid-interest rate loans will not significantly disrupt the business of the secondary financial sector. This is based on the judgment that the customer base for mid- and low-credit borrowers at internet banks does not overlap significantly with that of the secondary financial sector. The requirements for mid-interest rate loans specify only interest rate caps and credit scores, and do not include details such as employment status, age, or residence. Even if the credit scores of internet bank customers and secondary financial sector customers are similar at 884 or below, differences in employment status, age, and residence suggest that the customer bases will not overlap substantially.

On the contrary, the internet banking industry pointed out that the Democratic Party's pledge to raise the mandatory lending ratio for mid- and low-credit borrowers would negatively impact their business. An internet bank official said, "It is difficult to verify personal details of customers, but there are not many customers with such low credit that they have been pushed to card loans and private lenders who would then seek mid-interest rate loans from internet banks," adding, "The presidential candidates' pledges to expand mid-interest rate loans will be a much greater burden on internet banks' lending operations than on the secondary financial sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.