Delinquency Rates Rise Across Insurance, Credit Card, Savings Bank, and Mutual Finance Sectors

Vulnerable Borrowers Turn to Secondary Financial Institutions Amid Economic Downturn

High Number of Loss-Making Firms in Savings Banks and Mutual Finance Increases Insolvency Risk

The soundness of loans in the secondary financial sector has become a major concern. Due to the economic downturn, the number of borrowers unable to repay their debts has increased across the entire secondary financial sector?including insurance companies, credit card companies, savings banks, and mutual finance institutions?raising the risk of insolvency.

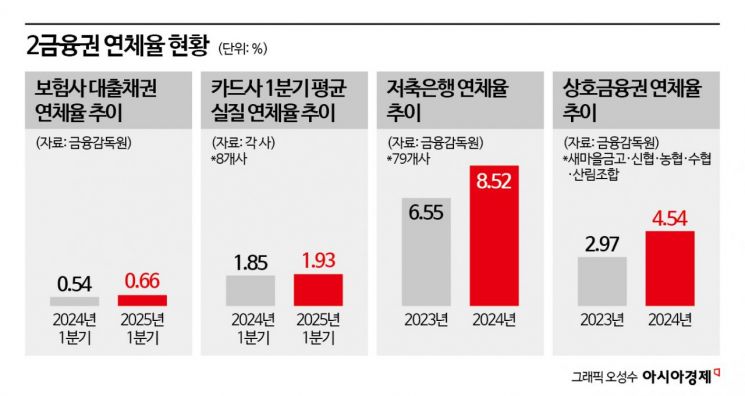

According to the financial industry on May 29, the outstanding loan balance of insurance companies in the first quarter of this year was 267.8 trillion won. The delinquency rate was 0.66%, up 0.12 percentage points compared to the same period last year. The delinquency rate refers to the proportion of loans overdue by more than one month out of the total loan balance. This means insurance companies were unable to collect about 1.8 trillion won on time.

The delinquency rate for insurance companies is more severe in household loans than in corporate loans. In the first quarter, the delinquency rate for household loans rose by 0.19 percentage points year-on-year to 0.79%, while the corporate loan delinquency rate increased by only 0.09 percentage points to 0.6%. Among household loans, mortgage loans rose by 0.02 percentage points compared to a year ago, while insurance contract loans and unsecured loans?often used as emergency funds by ordinary people?surged by 1.02 percentage points.

The risk of rising delinquency rates is also spreading in the credit card sector. The actual delinquency rate for the eight major domestic standalone credit card companies (excluding NH Nonghyup Card) in the first quarter was 1.93%, up 0.08 percentage points from 1.85% in the same period last year. The actual delinquency rate includes the proportion of loans overdue by more than one month, including card loan refinancing receivables. The increase in delinquency rates in the credit card sector is attributed to the growing share of card loans and cash advances, which are mainly used by people in urgent need of funds. In fact, as of the first quarter, the balance of personal credit card loans at the eight credit card companies was 10.4186 trillion won, up 0.25% from the same period last year. During the same period, cash advances increased by 4.26% to 13.1807 trillion won.

As more borrowers are unable to repay after using card loans and similar products, the proportion of refinancing loans has also been increasing recently. Refinancing loans refer to so-called 'card revolving', where borrowers who cannot repay their card loans take out new loans from the card company to pay off the old ones. According to the Credit Finance Association, as of last month, the outstanding balance of refinancing loans at the eight credit card companies stood at 1.4146 trillion won, up 5.7% from the previous month. An increase in refinancing loans ultimately leads to a vicious cycle of rising delinquency rates for credit card companies.

The situation is no different in the savings bank sector. As of the end of last year, the delinquency rate for Korea's 79 savings banks was 8.52%, up 1.97 percentage points from the previous year. This is the highest level since the end of 2015 (9.2%). The delinquency rate for real estate project financing (PF), where the liquidation of insolvent business sites has been delayed, remains high at over 7%, and recently, delinquency rates for individual business owners and household loans have also been on the rise. Given that the savings bank industry recorded losses for two consecutive years last year, the risk of insolvency due to rising delinquency rates is greater than in other sectors.

The mutual finance sector (Saemaeul Geumgo, credit unions, Nonghyup, Suhyup, and forestry cooperatives) is also seeing a clear rise in delinquency rates. As of the end of last year, the delinquency rate for mutual finance institutions was 4.54%, up 1.57 percentage points from the previous year. With about 34% (1,168 out of 3,484) of mutual finance cooperatives and credit unions nationwide posting losses last year, the burden of rising delinquency rates is significant. The aftermath of aggressively expanding real estate PF during the real estate boom in 2021 is still being felt.

Borrowers typically turn to the secondary financial sector, where interest rates are higher than in the primary sector, because their income is unstable or their credit rating is low. The rise in delinquency rates in the secondary financial sector means that the risk of insolvency among vulnerable borrowers is greater than in the primary sector. When delinquency rates rise, loan loss provisions increase, which leads to reduced profits, a deterioration in capital adequacy ratios, and a downgrade in credit ratings. Kim Sangbong, a professor of economics at Hansung University, said, "The main reason is that the secondary financial sector has been lending aggressively despite the poor economic conditions," adding, "Financial authorities need to play a role in tightening lending, especially in cases where borrowers are unable to repay principal and interest."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)