Stricter Rental Guarantee Standards ... Preventing Inflated Appraisals

Preventing Disputes Over Excessive Restoration Costs at Move-Out ... Measures for False Reporting and Sub-Registration

In the future, if you purchase a non-apartment property such as a villa, multiplex house, or officetel and register it with the government as a rental property for six years, you will be eligible for tax benefits. Registered properties will be exempt from the comprehensive real estate holding tax, and capital gains tax and corporate tax will also be reduced.

The Ministry of Land, Infrastructure and Transport announced on May 28 that it will fully implement the "Six-Year Short-Term Registered Rental Housing System" starting from June 4. Even individuals who already own one home can receive the "single household, single home" special provision if they purchase a villa or similar property and register it for short-term rental.

This system revives the short-term rental program, which was abolished in 2020 due to controversy over tax avoidance by multiple homeowners, by changing the rental requirement to six years (previously four years) and excluding apartments. At the same time, the government has revised the rental guarantee standards to reduce concerns about rental deposit fraud.

Lee Kibong, Director of Housing Welfare Policy at the Ministry of Land, Infrastructure and Transport, explained that the introduction of the short-term registered rental system "creates conditions to revitalize the supply of non-apartment private rental housing, which serves as a housing ladder for ordinary people." This system was prepared as part of the revision of subordinate regulations following the amendment of the "Private Rental Housing Act" in December last year. It includes amendments to the enforcement decree, enforcement rules, and the public notice on the "Application Ratio of Officially Announced Price and Standard Market Price."

Once the system is implemented, if villas or multiplex houses are registered as rental businesses with the government, they will be eligible for tax benefits such as exemption from comprehensive real estate holding tax aggregation and exclusion from increased capital gains tax and corporate tax rates. However, to receive these benefits, the property price must be below a set threshold. For newly built properties, the officially announced price must be 600 million won or less; for purchased properties, the limit is 400 million won or less in the Seoul metropolitan area (200 million won or less in non-metropolitan areas). Corporate tax benefits apply only to newly constructed properties.

Additionally, if a property registered for short-term (six-year) rental is later converted to long-term rental (such as ten years), the initial six years will also be recognized, allowing for a seamless transition without any loss of benefits.

Stricter Rental Guarantee Standards ... Preventing Inflated Appraisals

The government will block "inflated appraisal values," a method frequently abused in rental deposit fraud, and revise the standards for joining rental deposit guarantee insurance. The new policy will completely block the previous appraisal method, in which rental business operators manipulated market prices by commissioning their own appraisals, and will also lower the application ratio of officially announced prices, which some have criticized as excessive.

Currently, when joining rental guarantee insurance, rental business operators could choose among the appraised value, the officially announced price multiplied by the application ratio, or the guarantee company's standard price as the property value. However, some operators pressured appraisers to inflate the valuation, then used that figure as the basis for setting excessive rental deposits, which became a channel for rental deposit fraud.

To address this, the government will introduce the "HUG-Recognized Appraised Value" system, under which only guarantee institutions (such as HUG), not rental business operators, can directly commission appraisals. From now on, the principle will be to apply the officially announced price or the guarantee company's own standard price first. If the rental business operator objects, only then will the guarantee institution commission an appraisal from a designated appraisal agency, and the amount determined will be recognized as the property value. This fundamentally eliminates any opportunity for the operator to intervene in the appraisal process.

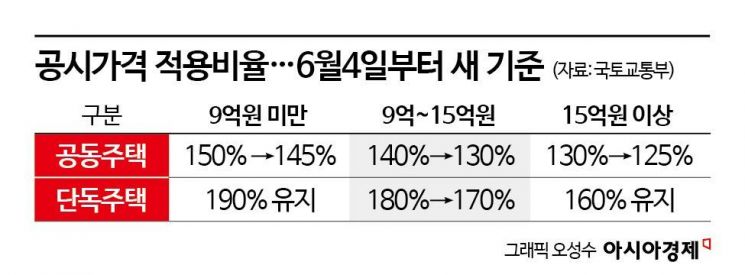

Along with this, the "application ratio," which is multiplied by the officially announced price to determine the property value, will be lowered in certain segments. The purpose is to adjust excessively high ratios in some segments, taking into account the actualization rate of official prices, to better reflect real deposit levels.

For multi-unit housing, the ratio will be reduced across all price segments: under 900 million won, from 150% to 145%; between 900 million and 1.5 billion won, from 140% to 130%; and over 1.5 billion won, from 130% to 125%. For single-family homes, only the 900 million to 1.5 billion won segment will be reduced from 180% to 170%, while the under 900 million won (190%) and over 1.5 billion won (160%) segments will remain unchanged.

Preventing Disputes Over Excessive Restoration Costs at Move-Out ... Measures for False Reporting and Sub-Registration

Improvements will also be implemented to prevent disputes arising from excessive restoration cost demands when tenants move out. Previously, landlords often demanded excessive payments from tenants upon move-out, claiming issues such as "cracks in the wall" or "the flooring needs to be replaced."

Now, the enforcement rules require that, at move-out, the landlord and tenant jointly inspect the condition of the facilities, and that repair costs be calculated based on actual expenses incurred. Based on these standards, the Ministry of Land, Infrastructure and Transport will begin a research project next month to prepare detailed guidelines, with the goal of completing them by the first half of next year.

To prevent false reporting of lease contracts, local government officials have been granted the authority to verify actual transaction reports and rental deposit guarantee information.

If a private rental registration has ended, local governments will now be able to apply for the cancellation of the "rental housing sub-registration" remaining on the certified copy of the real estate register on behalf of the parties. This measure is intended to reduce inconvenience for both tenants and landlords.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)