Five Key Trends Identified:

Strengthening Digital and B2B Capabilities Essential

Samjong KPMG has identified key trends that should be referenced to establish a growth foundation for the insurance industry where sustainability and innovation coexist amid a rapidly changing financial environment. The company particularly emphasized the need to overcome limitations by learning from the Japanese example.

On May 28, Samjong KPMG released a report titled "Insurance Reboot (Re:Boot): What Is the Future Business Direction of the Insurance Industry?" outlining these insights.

The report examined the future that the Korean insurance industry will face by analyzing the case of Japan, which has already experienced an aging society and population decline. Japan entered an aging society in 1994 and subsequently underwent large-scale restructuring, with seven insurance companies either going bankrupt or merging. Korea is aging even faster than Japan, so domestic insurers are facing similar challenges.

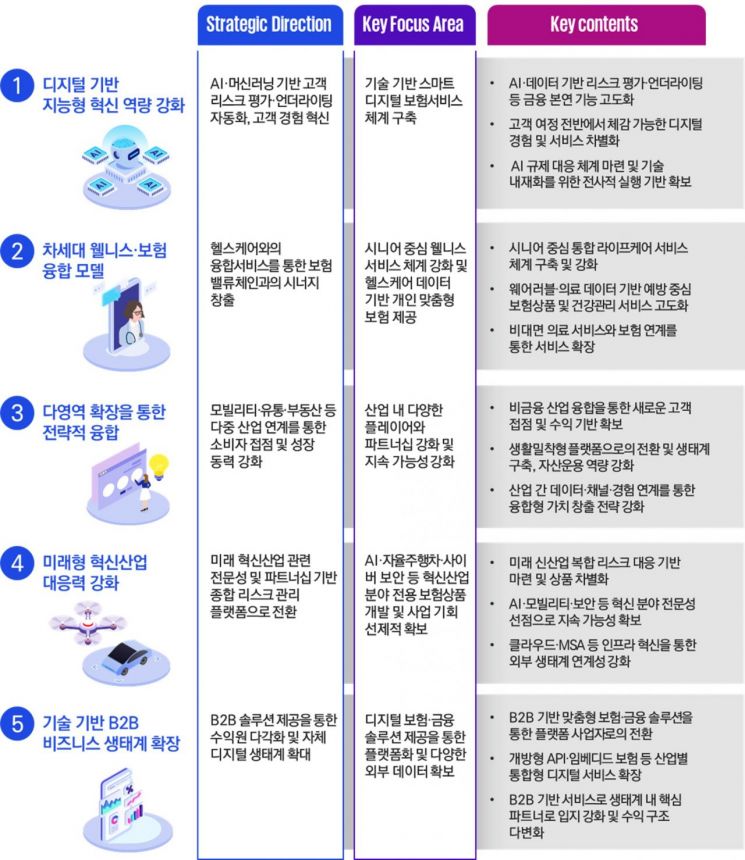

The report outlined five key future trends: ▲strengthening digital-based intelligent innovation capabilities; ▲developing next-generation wellness-insurance convergence models; ▲strategic convergence through expansion into multiple domains; ▲enhancing the ability to respond to future-oriented innovative industries; and ▲expanding technology-based B2B business ecosystems.

Overseas insurers are automating core processes such as insurance claims, underwriting, and fraud detection by utilizing artificial intelligence (AI), the Internet of Things (IoT), and big data. Customer service is being advanced through AI chatbots and digital portals. Real-time risk management systems powered by digital technology are accelerating the transition from traditional post-event response models to prevention-focused insurance models.

The report also noted that the role of insurance is evolving beyond simple coverage to become a partner in everyday health management. Insurers are collaborating with healthcare companies, hospitals, and wearable device manufacturers to collect real-time health data, which is then used to design customized insurance products and provide reward-based health management services. In particular, there is active development of insurance products tailored to aging societies.

The report also highlighted the importance of strategic convergence with various non-financial industries such as mobility, travel, and retail. Insurers are seeking to evolve their revenue models into lifestyle-oriented platforms by increasing touchpoints within customers' daily lives.

There is also growing demand for new types of insurance driven by the advancement of cutting-edge industries such as cybersecurity, future mobility, and AI. By collaborating with technology companies in each sector, insurers are able to precisely analyze complex risks and proactively respond to changes by developing customized products that reflect these risks.

As a result, insurers are expanding their business into B2B-centered ecosystems targeting corporate clients in each industry. B2B products such as embedded insurance and insurance-as-a-service are transforming the role of insurers into integrated digital partners.

Jo Jangkyun, Executive Director at Samjong KPMG, stated, "The domestic insurance industry urgently needs to establish sustainable growth strategies in response to structural changes in the external environment, such as low growth, low birth rates, and an aging population." He emphasized, "It is essential to secure new competitiveness and redesign the industry's overall sustainability through digital-based structural innovation and linkage with external ecosystems."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.