CBSI for All Industries Rises to 90.7, Up 2.8 Points from Previous Month

Largest Increase Since Lifting of COVID-19 Emergency Status

Manufacturing Sector Recovers on US-China Tariff Suspension

Non-Manufacturing Sectors Including Real Estate and Transportation Also Improve

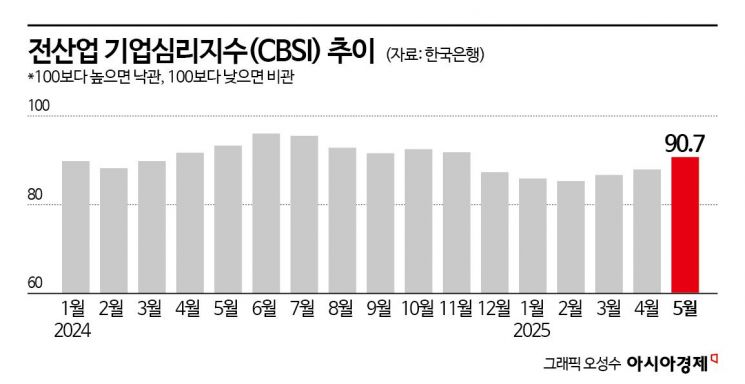

As business sentiment has continued to improve for three consecutive months, the Business Survey Index (CBSI) for all industries in May surpassed the 90-point mark. The improvement in the manufacturing sector was attributed to factors such as the temporary suspension of U.S. tariffs, while the non-manufacturing sector, including real estate and transportation, also saw improvements due to scheduled property sales and an increase in cargo volume. However, the index still remains well below the baseline of 100 and has not yet recovered to the level seen before the December 12·3 martial law incident last year, leading experts to caution that it remains to be seen whether a full-fledged recovery will materialize.

According to the "May Business Survey Results and Economic Sentiment Index (ESI)" released by the Bank of Korea on the 28th, the CBSI for all industries this month stood at 90.7, up 2.8 points from the previous month. This is the largest monthly increase since May 2023, when the COVID-19 emergency status was lifted and the index rose by 4.4 points. However, the index has not yet returned to the pre-crisis level seen before the sharp deterioration in business sentiment caused by the December 12·3 martial law incident and other events at the end of last year (91.8 in November 2024). The CBSI is a business sentiment indicator calculated using key indices from the Business Survey Index (BSI). A reading above 100 indicates that companies are more optimistic about the economic situation than in the past, while a reading below 100 indicates a more pessimistic outlook.

Lee Hyeyoung, head of the Economic Sentiment Survey Team at the Bank of Korea's Economic Statistics Department 1, stated, "Although the CBSI for all industries has risen for three consecutive months, it still remains below the long-term average, so it is difficult to say that the situation is optimistic." She added, "The tariff suspension that had a positive impact on manufacturing this month is a short-term benefit, and this month's export performance?excluding semiconductors and ships?has generally been sluggish, so it remains to be seen whether the improvement will continue."

This month, the manufacturing CBSI rose 1.6 points from the previous month to 94.7, marking its highest level since July 2023 (96.0). Manufacturing performance improved mainly in petroleum refining and coke, non-metallic minerals, and chemicals and chemical products. Petroleum refining and coke benefited from improved refining margins due to falling oil prices, which resulted from increased production by OPEC+ (the alliance of major oil-producing countries including OPEC and Russia). Non-metallic minerals saw improvements in business conditions, especially among cement and concrete companies, as construction activity picked up. Chemicals and chemical products showed an improving trend due to increased exports to China following the 90-day U.S.-China tariff suspension and expectations of improved profits due to falling oil prices.

The non-manufacturing CBSI also rose by 3.6 points to 88.1. Like the all-industry CBSI, this was the largest increase since May 2023 (up 6.0 points). Non-manufacturing performance improved mainly in real estate, transportation and warehousing, and professional, scientific, and technical services. The real estate sector showed improvement due to an increase in lease contracts and scheduled property sales. Transportation and warehousing benefited from increased cargo volume from China to the Americas, resulting from the 90-day U.S.-China tariff suspension, and from higher freight rates. The professional, scientific, and technical services sector saw better conditions, especially among companies involved in semiconductor equipment and plant design services. However, Lee pointed out, "In the case of construction, the improvement was due to seasonal factors as spring construction activity progressed, but the overall business conditions are still well below the long-term average, so it is difficult to say that the sector is doing well."

Many companies expect business conditions to improve in both manufacturing and non-manufacturing sectors next month. The June CBSI outlook for manufacturing was 93.1, up 3.1 points from the previous month, while the outlook for non-manufacturing was 87.1, up 3.3 points. The manufacturing outlook for June is expected to improve mainly in electronics, visual and communications equipment, chemicals and chemical products, non-metallic minerals, and petroleum refining and coke. The non-manufacturing outlook is expected to see a recovery mainly in construction, professional, scientific and technical services, and information and communications.

The Economic Sentiment Index (ESI), which combines the Business Survey Index (BSI) and the Consumer Sentiment Index (CSI), rose 4.7 points from the previous month to 92.2. The cyclical component, which removes seasonal factors, stood at 88.1, down 0.2 points from the previous month.

This survey was conducted from May 13 to May 20, targeting 3,524 corporate entities nationwide. Of these, 1,852 were manufacturing companies and 1,445 were non-manufacturing companies, with a total of 3,297 companies responding (93.6%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.