Growth Rate Significantly Downgraded This Year

Economic Slowdown Inevitable Due to Worsening Domestic and External Conditions

Bank of Korea Should Cut Base Rate Quickly and Seek Policy Alternatives

The Korea Institute of Finance has expressed concerns that the country's economic situation could deteriorate further and argued that the Bank of Korea should expedite a policy rate cut. The institute also pointed out that, in addition to lowering the base rate, the Bank of Korea should consider a range of policy alternatives, such as temporarily expanding financial support for export-oriented companies.

According to the Korea Institute of Finance's report, "2025 Revised Economic Outlook and Policy Implications," released on May 28, the nation's real gross domestic product (GDP) growth rate for this year is expected to remain at just 0.8% due to heightened domestic and external uncertainties and sluggish domestic demand. This figure is a downward revision of 1.2 percentage points from the 2.0% forecast presented by the institute at the end of last year.

South Korea's real GDP growth rate recorded marginal quarter-on-quarter growth of 0.1% or less for four consecutive quarters, from the second quarter of 2024 through the first quarter of this year. Domestically, private sector momentum has weakened significantly, with declines in private consumption and construction investment. Externally, deteriorating conditions have led to a slowdown in exports, resulting in an overall loss of growth momentum and the expectation that economic sluggishness will persist for the time being.

Economic slowdown inevitable due to worsening domestic and external conditions... Rate cuts needed swiftly

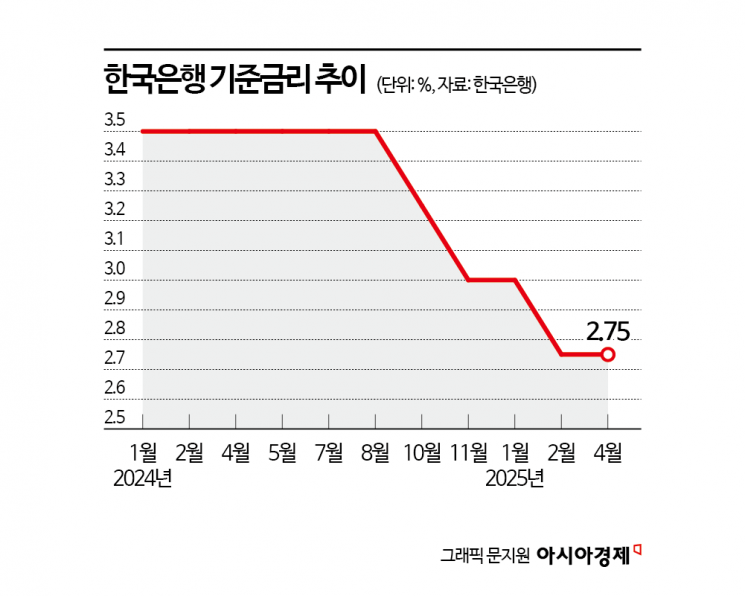

The institute emphasized that, given the increased downside risks to the economy, proactive policy responses from both the Bank of Korea and the government are essential. In particular, it assessed that the Bank of Korea's monetary policy should adopt a more accommodative stance for the time being, as inflationary pressures are not currently high and concerns about economic slowdown are mounting. This is interpreted as a call for the Bank of Korea to move quickly with a base rate cut to respond promptly to the economic downturn. The Bank of Korea cut the base rate once in February, and the market expects another rate cut at the Monetary Policy Board meeting scheduled for May 29.

However, the institute analyzed that a base rate cut by the Bank of Korea could further widen the interest rate gap with the United States and increase volatility in the won-dollar exchange rate, suggesting that there may be limits to stimulating the economy through rate cuts alone.

Accordingly, it advised that a variety of policy alternatives should be explored, such as measures to directly expand credit supply to financial institutions. For example, it suggested that the Bank of Korea should consider temporarily increasing financial support for small and medium-sized export companies during periods of economic vulnerability by utilizing its Bank Intermediated Lending Support Facility.

The institute also assessed that the government's fiscal policy should respond to the economic downturn by providing targeted support to vulnerable groups, taking into account the practical constraint of maintaining medium- to long-term fiscal soundness. It added that it is necessary to strengthen trade finance and emergency liquidity support for export companies and industries affected by worsening trade conditions, and to minimize job losses by providing employment retention subsidies.

The institute argued that efforts toward structural reform should also continue to strengthen the economy's fundamentals and raise its potential growth rate over the longer term. Kim Hyuntae, a research fellow at the Korea Institute of Finance, stated, "It is necessary to boldly ease regulations that hinder business restructuring and innovation by Korean companies, and to comprehensively design tax incentives and investment promotion measures for new growth sectors."

He added, "To address the medium- to long-term trend of declining labor supply, society must reach consensus on measures such as extending the retirement age and reforming the wage determination system, and labor productivity should be enhanced through automation and digitalization of production processes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)