Petrochemical Slump Shakes Energy Demand

Raw Material Consumption Plunges 7.9% Despite Falling Oil Prices

Annual Demand Outlook Faces Downward Pressure... "A Structural Issue"

In the first quarter of this year, domestic oil consumption in South Korea was found to be even lower than in the first quarter of 2020, when the COVID-19 pandemic began. Analysts attribute this mainly to the petrochemical industry, which relies on oil as a raw material, remaining mired in a slump.

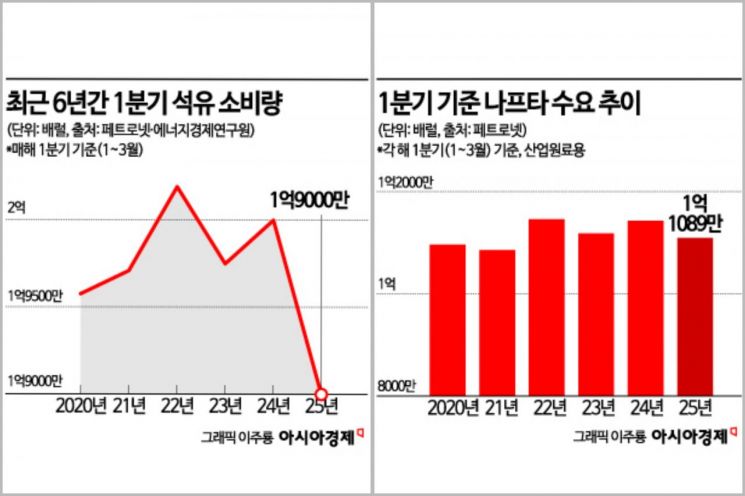

According to the May issue of the "Energy Brief" report published by the Korea Energy Economics Institute on the 27th, domestic oil consumption in the first quarter of this year was tallied at 190 million barrels. This provisional figure, calculated after removing duplicate naphtha volumes, represents a 5.1% decrease compared to the same period last year (200.21 million barrels). It is also lower than the first quarter of 2020 (195 million barrels), when demand plummeted sharply due to the spread of COVID-19. Since 2020, oil consumption has fluctuated, with a slight rebound of just over 1 percentage point in the first quarter of last year, but it has returned to a sharp decline this quarter.

The decrease in oil consumption indicates sluggish production in the domestic petrochemical industry. Industrial oil demand fell by 7.6% year-on-year, with demand for feedstock such as naphtha dropping by 7.9%. Consumption of liquefied petroleum gas (LPG), which is sensitive to petrochemical demand, also declined by 3.0%, reflecting an overall contraction across the industry. As of February, production of basic petrochemical feedstocks plunged by 5.4%, and naphtha consumption by 8.5%. A representative from the chemical industry explained, "The inventory burden has increased throughout the supply chain, from raw materials to downstream products," adding, "Even if plant operating rates are reduced, it is difficult to resolve the situation without a recovery in demand."

Naphtha is a key raw material that supports a wide range of general-purpose products such as synthetic resins. A decline in its consumption affects the entire structure of the domestic petrochemical industry. A contraction in intermediate goods consumption has a greater impact on the industry overall than a decrease in final consumption. Chemical products are closely linked to major industries such as steel, electronics, and construction, so a decline in oil product consumption is interpreted as a sign of a broader economic downturn. When downstream demand industries delay new product development or investments, demand for raw materials also plummets.

Industry experts view this trend not as a simple economic cycle, but as a clear example of the structural vulnerabilities in the domestic petrochemical sector. Multiple factors are at play, including the rise in China's petrochemical self-sufficiency rate, a slowdown in global demand, and a contraction in downstream industries such as steel and cement. The decline in international oil prices has also failed to spur a recovery in consumption. In the first quarter of this year, the average price of Dubai crude oil was $76.9 per barrel, 5.4% lower than the same period last year. A representative from a foreign chemical company commented, "In the past, the industry followed a two- to three-year business cycle, but now even that pattern no longer exists," adding, "This should be seen as a structural issue."

The domestic economic downturn also contributed to the reduction in oil consumption. Despite a record cold snap in February that caused heating degree days in the first quarter to increase by 9.9% year-on-year, oil consumption in the building sector still declined. Heating degree days are an indicator of how much the daily average temperature falls below a reference temperature (usually 18 degrees Celsius) and are used to estimate heating demand. In addition to the shift from oil to alternative fuels such as electricity or city gas, weakened consumer sentiment due to the economic situation is also believed to have played a role.

Although there were some declines in the transportation and building sectors, the decreases were relatively modest. Oil consumption for transportation fell by 0.3% year-on-year, while the building sector saw a 2.5% decrease.

The outlook for annual oil demand also remains bleak. As of the second half of last year, domestic oil demand for 2025 was projected at 788 million barrels, but Kim Sungkyun, the research fellow who authored the report, believes that actual demand is likely to fall short of this figure, given the current consumption trends and downward revisions to economic growth forecasts.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)