Exchange Rate Hits 7-Month Low

Hyundai Motor's Net Profit Drops by 160 Billion Won for Every 5% Decline in Exchange Rate

The domestic automobile industry, which benefited significantly from a high exchange rate last year, is now facing headwinds as the won-dollar exchange rate has recently plummeted. In addition, exports remain sluggish due to U.S. import tariffs on automobiles, making it inevitable that profitability will deteriorate for some time.

According to industry sources on the 27th, the recent decline in the won-dollar exchange rate to the 1,360 won level has raised concerns that automakers could face net profit losses amounting to several hundred billion won.

On the 26th, when the KOSPI index recovered the 2600 level early in the session and the domestic stock market started with a simultaneous rise, dealers were working in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. On the same day, the won-dollar exchange rate started trading at 1369.6 won, down 6.6 won from the previous trading day. 2025.5.26. Photo by Kang Jinhyung

On the 26th, when the KOSPI index recovered the 2600 level early in the session and the domestic stock market started with a simultaneous rise, dealers were working in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. On the same day, the won-dollar exchange rate started trading at 1369.6 won, down 6.6 won from the previous trading day. 2025.5.26. Photo by Kang Jinhyung

In the first quarter, the average won-dollar exchange rate was 1,453 won, up 9.4% from the same period last year. However, in the second quarter, it has been on a downward trend, falling to 1,365 won as of the close on the 26th. This represents a 6% drop compared to the previous quarter's average.

According to Hyundai Motor's first quarter report, a 5% drop in the won-dollar exchange rate would result in a decrease of approximately 159.5 billion won in pre-tax net profit. For Kia, a 10% drop in the exchange rate would reduce net profit by 132.8 billion won. Given the recent fluctuations in the exchange rate, it is estimated that net profit in the second quarter could fall by more than 60 billion won compared to the first quarter.

KG Mobility is also expected to see an impact of 8.4 billion won on net profit for every 10% decline in the exchange rate.

From the second quarter, the automobile industry has seen a clear decline in automobile exports. According to the Ministry of Trade, Industry and Energy, from the 1st to the 20th of this month, passenger car exports amounted to $3.08 billion, down 6.3% from the same period last year. Exports of auto parts also plunged 10.7% year-on-year to just $901 million.

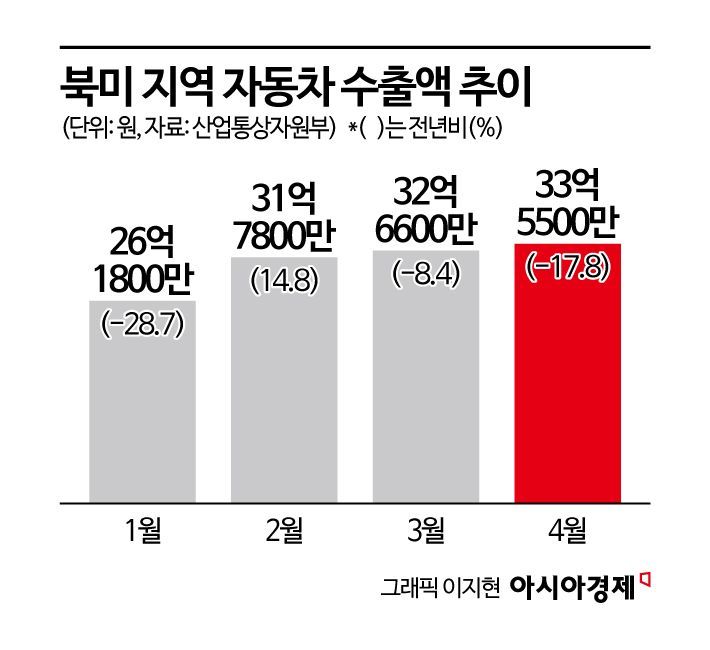

The main reason for the sluggish automobile exports is the contraction of exports to North America, the industry's key market. Since April 2, the U.S. government has imposed a 25% itemized tariff on foreign automobiles, which has dampened local sales.

As a result, automobile exports to the U.S. in March stood at $2.78 billion, down 10.8% from the same month last year. In April, exports fell by 19.6% to $2.89 billion. Hyundai Motor's exports to the U.S. last month also dropped to 51,148 units, a 20.0% decrease compared to the same month last year (63,939 units).

In this situation, the sharp fluctuations in the exchange rate are adding to the challenges. Since automobiles have a high export ratio, a rise in the exchange rate increases sales and operating profit when converted into won, while a decline in the exchange rate has the opposite effect. Last year, Hyundai Motor estimated that the high exchange rate contributed approximately 2.059 trillion won to sales and 601 billion won to operating profit.

The automobile industry believes that U.S. automobile export performance in May will be a key indicator for future trends. An official from a finished vehicle manufacturer said, "Due to uncertainties related to tariffs, there are now factors causing price fluctuations, so we are concerned that local sales in the U.S. will remain subdued for the time being." The official added, "Most automakers have decided to freeze local sales prices for one to two months, but from this month, the impact of consumer spending downturn is likely to be reflected in sales volume."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.