Japan and the EU Provide Tens of Trillions of Won in Semiconductor Support through Policy Finance

South Korea Plans to Establish a 50 Trillion Won Advanced Strategic Industry Fund for Support

There has been a call to supply high-risk capital through policy financial institutions, similar to Japan or the European Union (EU), in order to foster South Korea's semiconductor industry over the medium and long term as it faces a crisis.

According to the report "Status of Semiconductor Industry Support Systems in Major Countries" published by the KDB Future Strategy Research Institute of Korea Development Bank on May 26, South Korea has a competitive edge in memory semiconductors. However, it remains highly dependent on foreign countries for materials, parts, and equipment (so-called "Sobu-jang"), and its lack of capabilities in areas such as foundry and other system semiconductors is considered a weakness. In the case of system semiconductors, South Korea's global market share is only 3.3%, and its weak competitiveness in semiconductor materials, parts, and equipment leaves it constantly exposed to supply chain risks.

The institute emphasized that, for South Korea to ensure the continued growth of its semiconductor industry, government, businesses, and academia must be organically connected to present a medium- to long-term roadmap. It particularly argued that strengthening semiconductor competitiveness requires large-scale capital, and that policy financial institutions should be actively utilized in parallel with fiscal policies. The analysis suggests that fiscal policy and policy finance, based on risk-taking strategies, can play a role in encouraging private investment and thereby create a leverage effect (multiplier effect) in the semiconductor industry.

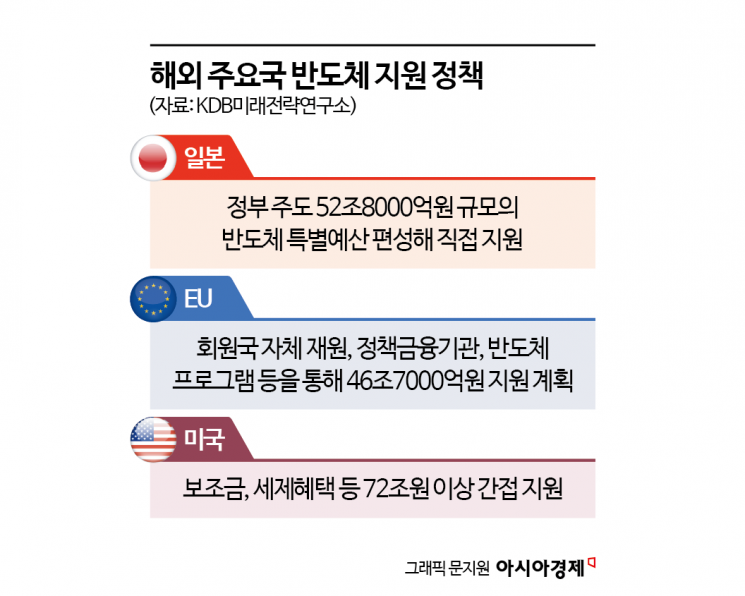

In this context, the institute suggested that South Korea should look to Japan and the EU, which provide financial support mainly through indirect finance (banks), rather than the United States, whose semiconductor support system focuses on subsidies and tax incentives.

Japan, for example, has allocated a special semiconductor budget of 5.5 trillion yen (52.8 trillion won) led by the government to invest in advanced semiconductor production facilities and support the development of manufacturing technologies. The Japanese government (Ministry of Economy, Trade and Industry) allocates the semiconductor fund budget to the New Energy and Industrial Technology Development Organization (NEDO), which then uses the funds to support semiconductor companies. Through this method, Japan has provided large-scale subsidies to advanced semiconductor companies such as TSMC, Kioxia, Micron, Rohm, and Toshiba. In addition to direct support, the Japanese government is also actively supporting policy funds through tax credits and long-term, low-interest loans from policy financial institutions.

In the case of the EU, it plans to provide approximately 30 billion euros (46.7 trillion won) to semiconductor-related industries through member states' own resources, policy financial institutions, and semiconductor programs. In addition, under the European Chips Act, the EU will directly support the semiconductor industry with 3.3 billion euros (5.14 trillion won) by 2027. In contrast, the United States does not have a nationwide policy financial institution, and supports its semiconductor industry mainly through fiscal measures such as subsidies and tax incentives.

In South Korea, the government, led by the Financial Services Commission and the Ministry of Economy and Finance, has established a plan to create a 50 trillion won advanced strategic industry fund at Korea Development Bank to foster future industries such as semiconductors, secondary batteries, bio, artificial intelligence, and robotics. However, as this requires approval from the National Assembly, including amendments to the Korea Development Bank Act, the concrete timeline and funding arrangements have yet to gain momentum.

Lee Ki-eun, a senior researcher at the KDB Future Strategy Research Institute, emphasized, "Since our country has a financial system centered on indirect finance (banks) like Japan and the EU, it is necessary to actively utilize policy financial institutions in parallel with fiscal policies." Lee added, "Given South Korea's fiscal constraints, which make it less free to inject fiscal resources compared to major countries, supplying high-risk and patient capital through policy financial institutions, as seen in Japan and the EU, will play an effective role in providing funding for the semiconductor ecosystem."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)