1,079 Real Estate Purchases by Chinese Buyers in April... First Four-Digit Figure in Six Months

75% Concentrated in the Seoul Metropolitan Area... 10 Billion KRW Home in Seongbuk-dong Also Acquired

Tax and Loan Regulations Remain a "Blind Spot"... Ongoing Debate Over "Reverse Discrimination" Against Koreans

Chinese buyers are once again turning their attention to real estate in South Korea. After a slowdown in the second half of last year, the number of purchases by Chinese nationals has surpassed 1,000 again in just six months. The concentration in the Seoul metropolitan area, including Seoul, Incheon, and Gyeonggi Province, is particularly notable, with even cases of luxury homes worth over 10 billion KRW being purchased entirely in cash.

"Welcome Back, Dage"?Chinese Purchases Exceed 1,000 in Six Months

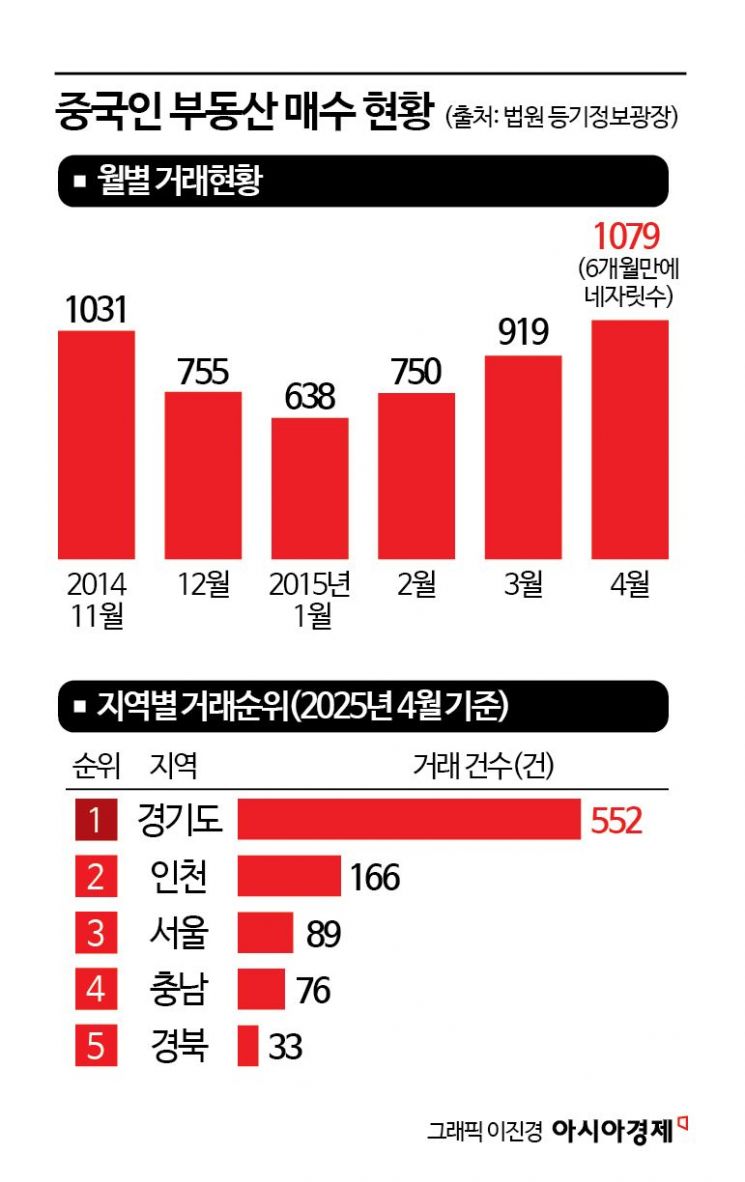

According to the status of "buyers who applied for ownership transfer registration by sale" at the Court Registration Information Plaza as of the 25th, the number of real estate purchases (including collective buildings, land, and buildings) by Chinese nationals last month was recorded at 1,079. This is the first time since October last year (1,031 cases) that the figure has surpassed 1,000 again. The number of purchases by Chinese buyers declined for three consecutive months after November last year?1,031 in November, 755 in December, and 638 in January of this year?but has increased for three consecutive months since then, with 750 in February, 919 in March, and 1,079 last month. Looking at the monthly figures overall, the only time there were more transactions than last month was in April of last year, with 1,111 cases.

By region, Gyeonggi Province recorded the highest number last month with 552 cases. Incheon (166 cases) and Seoul (89 cases) followed. The combined total for these three regions was 807, meaning about 75% of all purchases were concentrated in the metropolitan area. Outside the metropolitan area, Chinese purchases were also significant in South Chungcheong Province (76 cases), North Gyeongsang Province (33 cases), South Gyeongsang Province (32 cases), North Chungcheong Province (30 cases), and Ulsan (27 cases), indicating a focus on the Gyeongsang and Chungcheong regions.

There was even a case of a full-cash transaction exceeding 10 billion KRW in an area known for high-end residences. A 33-year-old Chinese national purchased a large detached house located in Seongbuk-dong, Seongbuk-gu, Seoul?spanning one basement floor and two above-ground floors, with a land area of 1,098 square meters and a total floor area of 760 square meters?for 11,968,940,000 KRW in March, completing the registration transfer last month. As no mortgage was registered on the property, it is presumed to have been an all-cash transaction. So far this year, there have been a total of three transactions involving detached or multi-family homes exceeding 10 billion KRW, with the Seongbuk-dong case being the only one where the buyer was an individual; the other two involved corporate buyers.

Chinese nationals are the overwhelmingly dominant group among foreign real estate investors. Last year, the total number of real estate purchases by all foreigners was 17,489, with Chinese nationals accounting for 11,352, or 64.9%. On an annual basis, the number fell from 13,416 in 2020 to 9,629 in 2022, but rebounded for two consecutive years, reaching 10,157 in 2023 and 11,352 last year.

Loans and Regulations: A "Blind Spot"?Ongoing Debate Over Reverse Discrimination Against Koreans

As Chinese investment in Korean real estate continues steadily, concerns about "reverse discrimination" against Korean nationals have been raised. Foreigners can secure funding through their own country's financial institutions, meaning that Korean lending regulations (such as LTV and DSR) are effectively not applied to them. In addition, it is difficult for the government to track the actual number of homes owned by foreigners, making it practically impossible to impose higher acquisition or capital gains taxes on multiple-property owners. While Koreans are subject to strict loan and tax regulations, foreigners continue to trade freely outside these restrictions.

Currently, there are virtually no special regulations on the acquisition and ownership of real estate by foreigners in Korea. With the exception of certain designated areas such as military facility protection zones, foreigners can freely trade domestic real estate. The Ministry of Land, Infrastructure and Transport operates a "designated trustee system," which requires foreigners without a Korean address or residence to appoint a Korean trustee when purchasing land or housing, and also requires long-term foreign residents to provide a certificate of foreigner registration. These measures are more supplementary safeguards to prevent side effects rather than actual regulations.

In contrast to Korea, many countries restrict foreign real estate investment in various ways. In Ontario, Canada, a 15% speculation tax was imposed on foreign buyers purchasing homes for non-residential purposes in 2017, which was raised to 20% in 2022. In the United States, some states restrict foreign ownership of farmland or prohibit acquisitions in certain areas for security reasons, while the United Kingdom imposes a 2 percentage point higher acquisition tax on foreigners. China also strictly limits foreign real estate purchases, allowing residential property acquisitions only for those who have resided in the country for more than one year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)