Nara Sella, Korea's First Listed Wine Importer,

Turns Last Year's 3.5 Billion KRW Loss into Profit in Q1

Focuses on Structural Improvements for Profitability

Demand Recovering, but High Exchange Rates Remain a Burden

Wine importers that struggled with poor performance last year have managed to rebound this year by focusing on improving profitability. Nara Sella, the only publicly listed wine importer in Korea, turned a profit in the first quarter by concentrating on cost efficiency, and plans to continue this trend of improved performance through a low-cost approach and a demand-tailored portfolio strategy. The alcoholic beverage industry anticipates that wine demand has bottomed out and will gradually recover, but sluggish domestic consumption and high exchange rates are expected to remain as burdens.

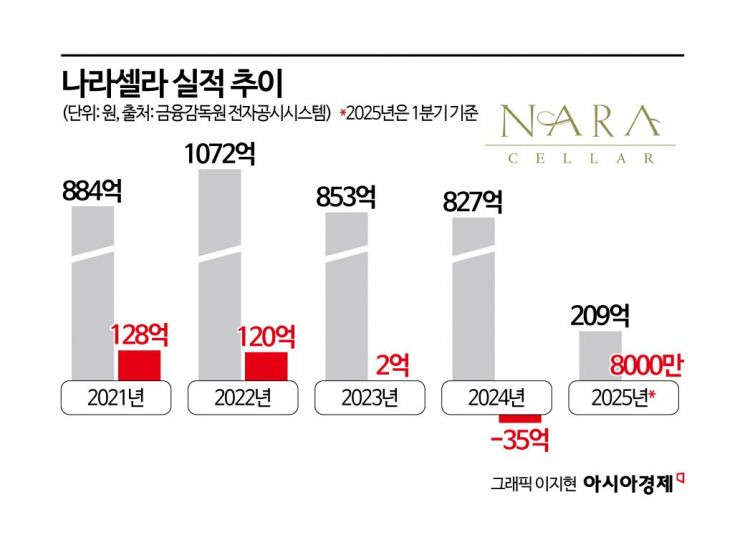

According to the Financial Supervisory Service's electronic disclosure system on May 26, Nara Sella's sales in the first quarter of this year amounted to 20.9 billion KRW, a decrease of 12.4% compared to the same period last year. However, the company recorded an operating profit of 81 million KRW, successfully turning a profit.

Nara Sella became the first Korean wine importer to be listed on the KOSDAQ market in June 2023, but turned to a loss last year, just one year after its IPO. Sales reached 82.7 billion KRW, down 3.1% year-on-year, and the company posted an operating loss of 3.4 billion KRW. During this period, liabilities also increased. Short-term borrowings rose by 61.6% from 10.9 billion KRW in 2023 to 17.7 billion KRW last year, resulting in the debt ratio increasing by 15.4 percentage points from 87.4% in 2023 to 102.8% last year.

Nara Sella's poor performance last year was largely due to a decline in wine demand caused by weakened consumer spending amid the economic downturn, which negatively impacted the imported liquor industry. The market shrank as wine demand among consumers in their 20s and 30s, who had driven consumption after the COVID-19 pandemic, decreased. The impact felt even greater due to the high growth experienced up until 2022. In addition, the high exchange rate was another burden. Given the nature of the business, which involves importing wine from overseas and distributing it domestically, an increase in the exchange rate directly leads to higher costs.

This year, the domestic wine industry has also set its sights on improving profitability. Rather than simply pursuing quantitative growth by expanding sales, companies are focusing on structural improvements centered on profitability through cost management. At least in the first quarter, there are signs of a turnaround. Although sales declined, efforts to cut costs helped the companies escape losses. Nara Sella plans to improve the efficiency of selling and administrative expenses this year, aiming to reduce them by about 20% compared to last year. In fact, selling and administrative expenses in the first quarter were reduced by 15.4%, from 11.1 billion KRW last year to 9.4 billion KRW this year.

Shinsegae L&B, the industry's leading company, is also making a turnaround in the first quarter by reducing costs. Shinsegae L&B maintained sales of 40.8 billion KRW in the first quarter, the same as last year, but turned a quarterly net loss of 1 billion KRW into a profit of 400 million KRW. CEO Ma Kihwan, who took office last October, has made profitability improvement through cost reduction and business efficiency his top priority this year. To strengthen the profitability of the specialized liquor distribution channel 'Wine & More,' the company is discontinuing underperforming brands to reduce the number of products offered.

Nara Sella plans to implement a tailored strategy to meet consumer demand, in addition to cost efficiency, as the domestic wine market is showing a trend toward polarization between low-priced and premium segments. For low-priced wine demand, the company intends to develop wines for distribution and increase product exposure by expanding sales channels. In particular, the company is responding to rising demand for white and sparkling wines by increasing its offerings in these categories. In March, Nara Sella launched the Prosecco 'Toresslla,' and next month, it plans to introduce a new Cava brand and New Zealand wines.

For premium demand, the company will respond by strengthening its portfolio, including old vintage and limited edition wines. Nara Sella is known for its strength in importing Napa Valley wines from the United States, with American wines accounting for 43% of sales in the first quarter. However, since last year, the company has introduced more than 20 new brands, including 'Domaine Perrot Minot' and 'Maison Thiriet,' and this year it is further strengthening its European wine lineup for portfolio balance by launching premium Italian Brunello di Montalcino wine 'Stella di Campalto.'

A Nara Sella representative said, "We plan to strengthen profitability and brand power by reducing commissions incurred during distribution by increasing direct supply to on-trade channels such as retail, hotels, and restaurants. We also aim to respond quickly and flexibly to market changes by forming close partnerships through direct communication with stores."

The industry believes that the decline in wine demand has hit bottom and will gradually shift to an upward trend. In fact, according to the Korea Customs Service, as of April this year, cumulative domestic wine imports reached 18,423 tons, up 15.5% from the same period last year (15,944 tons), marking the first increase in four years. However, as consumer sentiment remains uncertain and high exchange rates for the euro and dollar continue to drive up wine procurement costs, significant improvement is expected to be difficult.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)