Japanese 30-Year Government Bond Yield Hits Highest Level Since 2000

UK and German 30-Year Yields Also Remain High

Japan Considers Consumption Tax Cut... Europe Faces Increased Defense Spending Burden

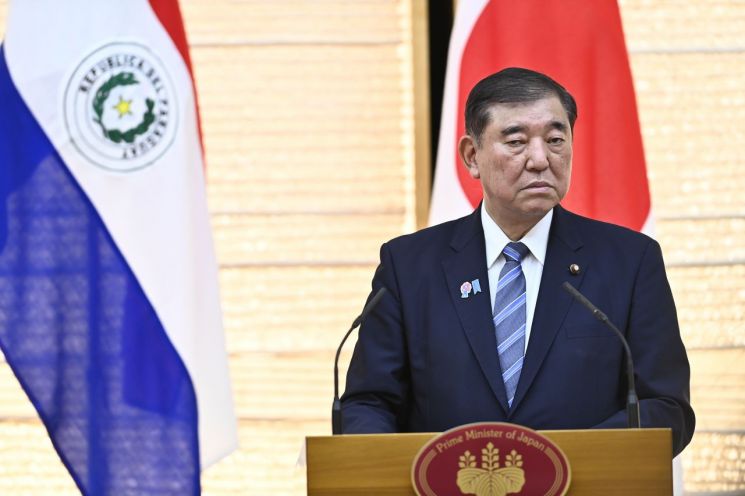

Japanese Prime Minister Shigeru Ishiba is attending a press conference on the 21st. According to US CNBC, as of 9:32 AM on the 22nd, the yield on Japan's 30-year government bonds is 3.169%, up 0.025 percentage points from the previous day. Photo by EPA Yonhap News

Japanese Prime Minister Shigeru Ishiba is attending a press conference on the 21st. According to US CNBC, as of 9:32 AM on the 22nd, the yield on Japan's 30-year government bonds is 3.169%, up 0.025 percentage points from the previous day. Photo by EPA Yonhap News

In the bond markets of Japan and Europe, yields on ultra-long-term government bonds with maturities of 30 years or more are rising rapidly. This indicates a decline in government bond prices. The main reason for this trend is growing concerns that US President Donald Trump's tariff policies could fuel inflation. Additionally, worries over fiscal deficits caused by Japan's consumption tax reduction policy and Europe's increased defense spending policies are also cited as major factors driving the sharp rise in government bond yields.

According to US CNBC, as of 9:32 AM on the 22nd, the yield on Japan's 30-year government bonds stands at 3.169%, up 0.025 percentage points from the previous day. On the previous day (the 21st), the yield soared to 3.1872%, reaching the highest level since the issuance of 30-year government bonds began in 2000. At the same time, the yield on the UK's 30-year bonds was 5.519%, and Germany's 30-year bonds were trading at 3.165%. Because ultra-long-term bonds have low trading volumes, market sentiment is reflected more sensitively, making these yields a clear indicator of investor anxiety.

Japanese newspaper Nikkei pointed out that this surge in long-term bond yields is due to inflation concerns. As major US economic indicators, such as employment data, have proven more robust than expected, the prevailing outlook is that the US Federal Reserve (Fed) will not rush to cut interest rates.

Since it has become difficult for central banks around the world to lower interest rates, yields are likely to remain high. Higher government bond yields mean that bond prices are lower. In a situation where future bond prices are expected to be low, investment incentives inevitably decrease.

Concerns over fiscal deterioration due to tax cuts and fiscal expansion policies being pursued by various countries are also identified as a primary reason for the surge in government bond yields. In Japan, ahead of this summer's House of Councillors election, there are concerns that the push for a consumption tax cut could further widen the fiscal deficit. If the consumption tax reduction is actually implemented, it is projected that tax revenue could decrease by as much as 10 trillion yen (approximately 97 trillion won).

Poor demand in the auction for 20-year government bonds conducted by Japan's Ministry of Finance on the 20th also led to a decline in market confidence. Naoya Hasegawa, chief bond strategist at Okasan Securities, told Reuters, "For demand for ultra-long-term government bonds to recover, a clear signal is needed that the volume of newly issued bonds will be reduced."

Europe is also facing fiscal burdens due to increased defense spending. Earlier this month, the European Union (EU) announced that it would mobilize at least 800 billion euros (approximately 1,238 trillion won) to encourage increased defense spending among its 27 member states.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)