Strengthening Competitiveness Through the Separation of CDMO and Biosimilar Businesses

On May 22, Samsung Biologics announced through a public disclosure that it will establish 'Samsung Epys Holdings' via a simple physical division, completely separating its CDMO (Contract Development and Manufacturing Organization) business from its biosimilar business.

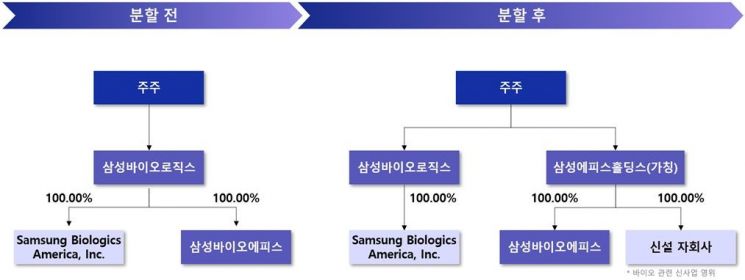

Through this split, Samsung Biologics will become a pure-play CDMO company. The newly established Samsung Epys Holdings, which will operate as a pure holding company, plans to make Samsung Bioepis, a biosimilar (biopharmaceutical generic) company, its wholly owned subsidiary in the future.

Samsung Biologics Governance Structure Before and After the Split. Data Provided by Samsung Biologics

Samsung Biologics Governance Structure Before and After the Split. Data Provided by Samsung Biologics

The reason Samsung Biologics is pursuing this business split is to fully separate its CMO business from its biosimilar business, thereby addressing potential concerns from CDMO clients about the company operating competing businesses. The company also expects that this move will alleviate concerns for investors who have had to invest in two businesses with different revenue generation models at the same time.

Samsung Biologics and Samsung Epys Holdings plan to further strengthen their independent decision-making systems through this split, thereby enhancing the competitiveness of each business and working to increase both corporate and shareholder value.

Samsung Biologics decided on the split in order to proactively eliminate risk factors arising from the coexistence of the bio CDMO and biosimilar businesses, especially as external policy uncertainties, such as changes in the international trade environment and drug price reductions, have increased rapidly in recent times.

Samsung Epys Holdings to Incorporate Samsung Bioepis and Relist After Establishment

Samsung Epys Holdings will be established by splitting off the business division that has been responsible for managing subsidiaries and new investments within Samsung Biologics. Kim Kyungah, CEO of Samsung Bioepis, is expected to concurrently serve as CEO of Samsung Epys Holdings.

The split will be finalized following a series of procedures, including the submission of a securities report on July 29 and a shareholders' meeting for split approval on September 16. Samsung Epys Holdings is scheduled to be founded on October 1, at which point it will complete the split by incorporating Samsung Bioepis as a 100% subsidiary. Subsequently, on October 29, the relisting of the surviving company Samsung Biologics and the new listing of Samsung Epys Holdings will take place.

This corporate split will be carried out as a physical division, in which shareholders will receive shares in the existing and new companies in proportion to their ownership. Existing shareholders of Samsung Biologics will be allotted shares in Samsung Biologics and Samsung Epys Holdings at a ratio of 0.6503913 to 0.3496087. The split ratio was determined based on the current book value of net assets.

Trading of Samsung Biologics shares will be temporarily suspended from September 29, the day before the record date for new share allocation, until October 28, the day before the relisting and new listing.

Faster and More Flexible Decision-Making... Aiming to Become a Global Top Bio Company

Through this split, Samsung Biologics and Samsung Epys Holdings will be able to make prompt and specialized decisions tailored to the characteristics and strategies of each business division, enabling them to pursue their businesses more quickly and flexibly.

As a pure-play CDMO company, Samsung Biologics plans to continue its growth strategy aimed at becoming a 'global top-tier CDMO.' Based on its 'three-pillar growth strategy' of expanding production capacity, diversifying its portfolio, and increasing its global footprint, the company will strengthen its CDMO capabilities and further expand investments in new business areas such as antibody-drug conjugates (ADC), adeno-associated viruses (AAV), and pre-filled syringes (PFS).

Samsung Epys Holdings has presented a growth strategy to secure a portfolio of more than 20 biosimilar products in order to develop Samsung Bioepis into the 'world's number one biosimilar company.' The company also plans to continue discovering and investing in next-generation technology fields for future growth, such as building new modality development platforms.

John Rim, CEO of Samsung Biologics, stated, "We decided on this split to proactively and swiftly respond to rapid changes in the global environment and to enable both companies to secure unrivaled competitiveness in their respective businesses through focus and selection," adding, "This will serve as an opportunity for both companies to accelerate growth and become global top-tier bio companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)